Home furnishing retailer Bed Bath & Beyond (NASDAQ: BBBY) reported a net loss for the third quarter of 2019, contrary to expectations for earnings. The bottom-line was hurt by a 9% decline in revenues. The management withdrew its full-year guidance and revealed plans for a strategic revision of the business.

On an adjusted basis, the company reported a loss of $0.38 per share, compared to earnings of $0.02 per share in the third quarter of 2018. analysts were expecting a profit for the most recent quarter. Net loss, on a reported basis, was $38.55 million or $0.31 per share, compared to a profit of $24.35 million or $0.18 per share last year.

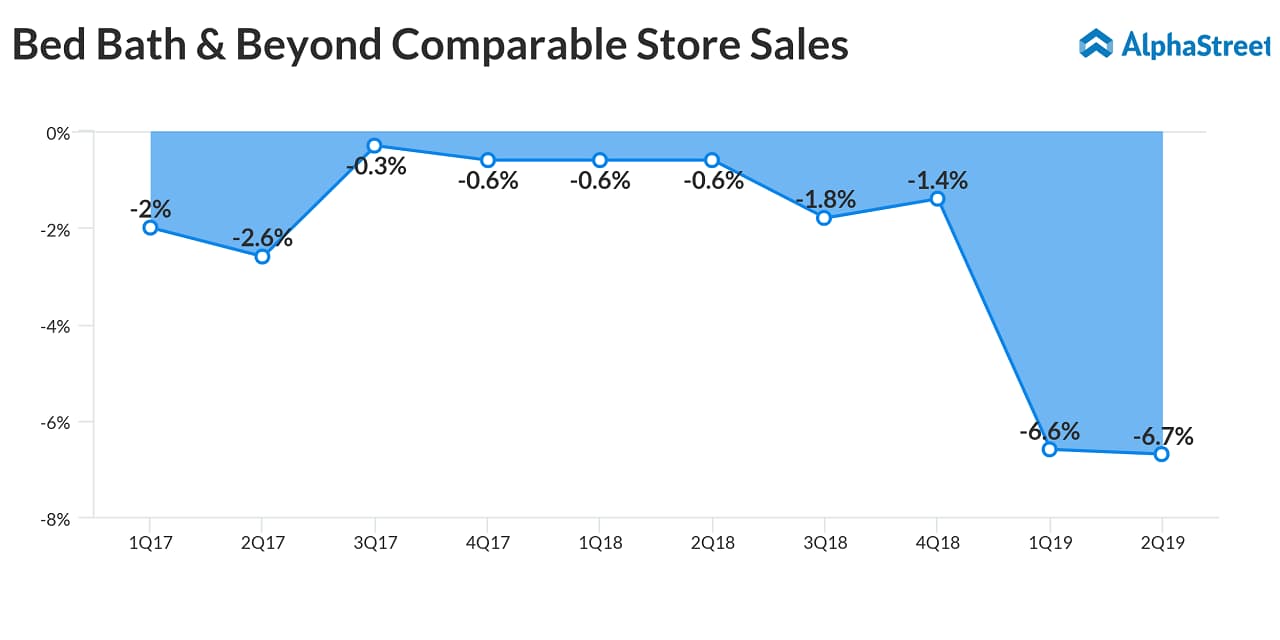

The unimpressive bottom-line performance reflects a 9% fall in revenues to $2.76 billion. The top-line also missed Wall Street’s prediction. Comparable sales were down 8.3%. The performance was negatively impacted by the calendar shift of the Thanksgiving holiday this year, which resulted in one less week of sales compared to last year.

Meanwhile, the company withdrew its previously released guidance for fiscal 2019 and revealed plans to unveil a new strategic vision in the coming weeks, which will reflect the growth strategy laid down by newly appointed CEO Mark Tritton.

Related: Bed Bath & Beyond Q2 2019 Earnings Call Transcript

ADVERTISEMENT

“Our performance in the third quarter was unsatisfactory and underscores the imperative for change and strengthens our sense of priorities and purpose. We must respond to the challenges we face as a business, including pressured sales and profitability, and reconstruct a modern, durable model for long-term profitable growth,” said Tritton.

The board of directors of Bed Bath & Beyond declared a quarterly dividend of $0.17 per share this week, to be paid on April 14, 2020, to shareholders of record on March 13, 2020. During the third quarter, the company repurchased about 87,000 shares for $1.2 million.

Also see: Home Depot misses Q3 revenue estimates

The company’s shares have been on a downward spiral for the past several months. After falling to a 20-year low mid-2019, the stock recovered modestly and moved past the $15-mark towards the end of the year. It lost sharply during Wednesday’s extended session, after the announcement.