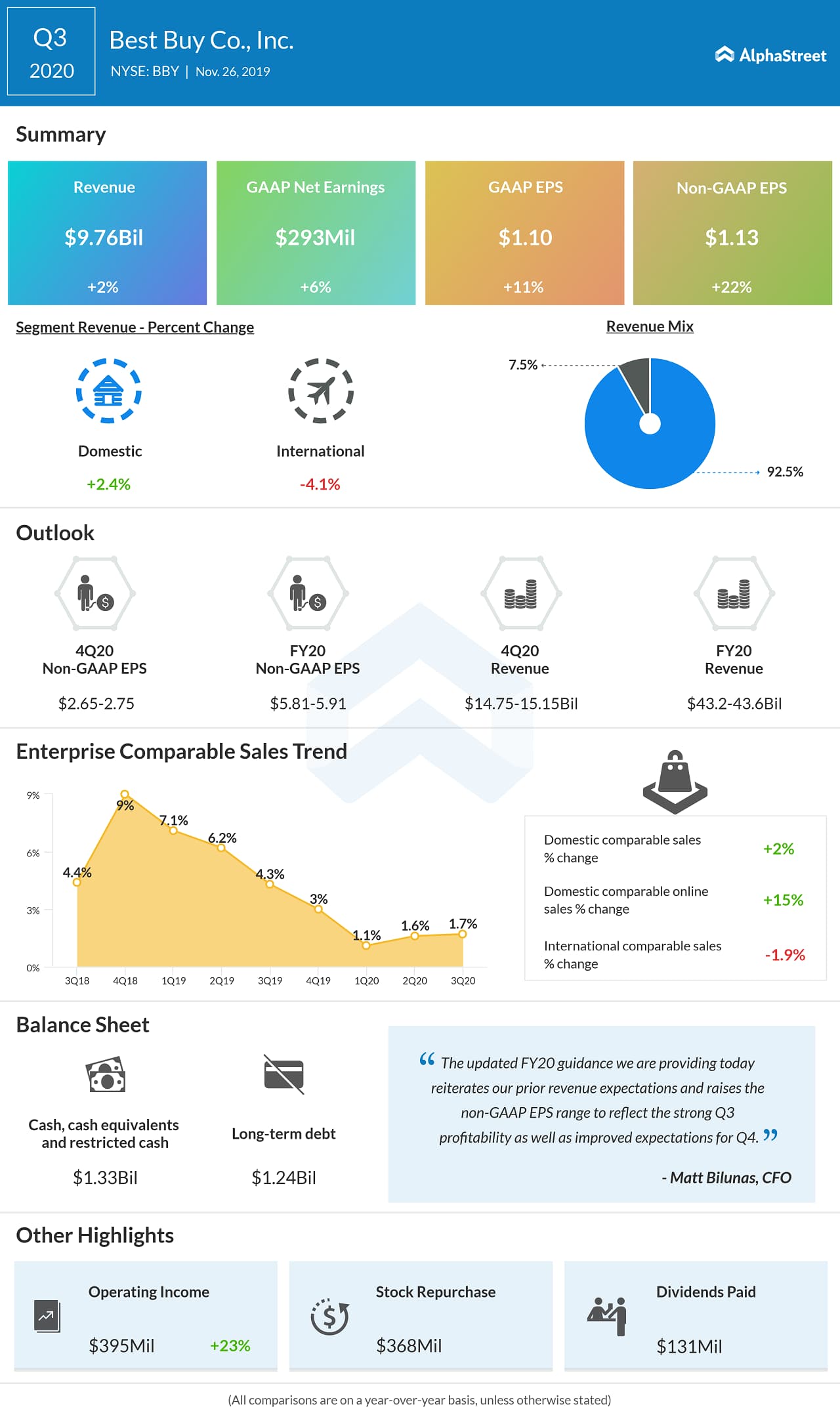

Best Buy (NYSE: BBY) outclassed market estimates for the third quarter of 2020 and lifted its financial outlook for FY20 sending the stock up 5% in the pre-market trading session. Best Buy reported a non-GAAP EPS of $1.13 on revenue of $9.76 billion for the quarter ended November 2, 2019. Analysts had expected the company to earn $1.03 per share on revenue of $9.7 billion.

On a GAAP basis, earnings increased 11% year-over-year to $1.10 for the recently ended quarter. Enterprise comparable sales increased by 1.7%.

The Minneapolis-based retail firm raised its financial outlook for fiscal 2020. The company now expects non-GAAP EPS of $5.81 to $5.91 compared to the prior outlook of $5.60 to $5.75. Enterprise revenue guidance for FY20 hiked to a range of $43.2 billion to $43.6 billion versus the prior guidance of $43.1 billion to $43.6 billion. Enterprise comparable sales growth is expected to be in the range of 1% to 2% compared to the previous outlook of 0.7% to 1.7%.

“The updated FY20 guidance we are providing today reiterates our prior revenue expectations and raises the non-GAAP EPS range to reflect the strong Q3 profitability as well as improved expectations for Q4. Our outlook continues to include our best estimate of the impact of tariffs on goods from China, both implemented and planned,” said CFO Matt Bilunas.

For the fourth quarter of fiscal 2020, Best Buy expects non-GAAP EPS to be in the range of $2.65 to $2.75. Enterprise revenue is touted to be $14.75 billion to $15.15 billion and Enterprise comparable sales growth is expected to be in the range of 0.5% to 3.0%.

Best Buy also gave an update on its plans for the upcoming holiday season. The company said that it has got a best-in-class assortment, prepared a set of deals and has the inventory available for the holiday season. Customers ordering online will get free next-day delivery with no membership or minimum purchase required.

Best Buy shares have risen 10% in the past three months and 40% so far this year.