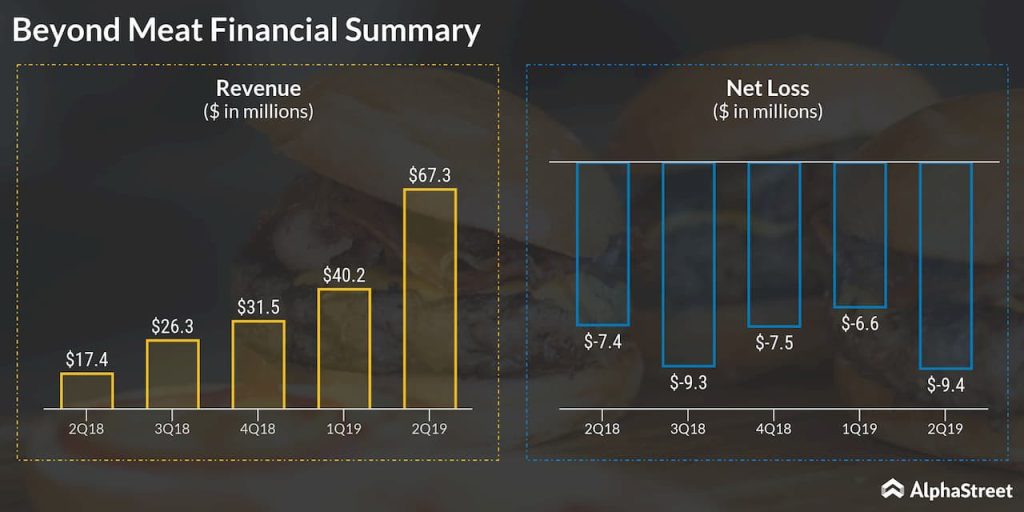

Revenue surged 287% year-over-year to $67.3 million. Net loss was $9.4 million, or a loss of $0.24 per common share, compared to net loss of $7.4 million, or a loss of $1.22 per common share in the year-ago period. The company surpassed Street’s predictions for the top line, while missing on the bottom line in the second quarter. Analysts had predicted Beyond Meat to post a loss of 9 cents per share on revenue of $52.7 million.

Second quarter revenue growth was primarily due to an increase in sales volumes of products in the company’s fresh platform across both its retail and restaurant and foodservice channels.

The El Segundo, California-based company lifted its outlook for 2019. The company now expects revenue to exceed $240 million versus the prior outlook of exceeding $210 million, which represents an surge of 170% compared to 2018. Adjusted EBITDA is predicted to be positive compared to prior expectations of break-even adjusted EBITDA.

You might also like: Weakness in Financial Services and Healthcare segments likely to continue for Cognizant in Q2

“We are very pleased with our second quarter results which reflect continued strength across our business as evidenced by new foodservice partnerships, expanded distribution in domestic retail channels, and accelerating expansion in our international markets. We believe our positive momentum continues to demonstrate mainstream consumers’ growing desire for plant-based meat products both domestically and abroad,” said CEO Ethan Brown.

The underwritten public offering of 3.25 million shares of common stock, consist of 3 million shares of common stock offered by certain selling stockholders of Beyond Meat and 250,000 shares of common stock offered by Beyond Meat. The net proceeds received from the offering will be used to continue to increase the company’s production and supply capabilities, to pay for marketing and promotional activities, and for general working capital purposes.

Last week, the restaurant chain Dunkin’ Brands (NASDAQ: DNKN) joined hands with Beyond Meat by announcing that that the company will add Beyond Meat’s Beyond Sausage in its menu.

Beyond Meat stock, which reached a new high ($239.71) last Friday, dropped as low as $201.00 and hit a peak of $233.87 during today’s regular trading session.