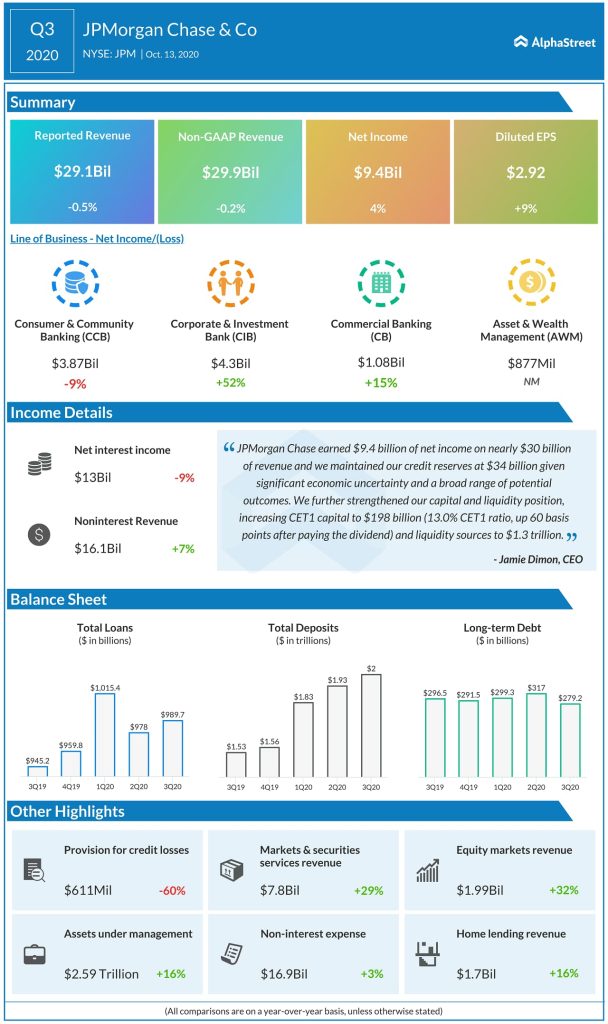

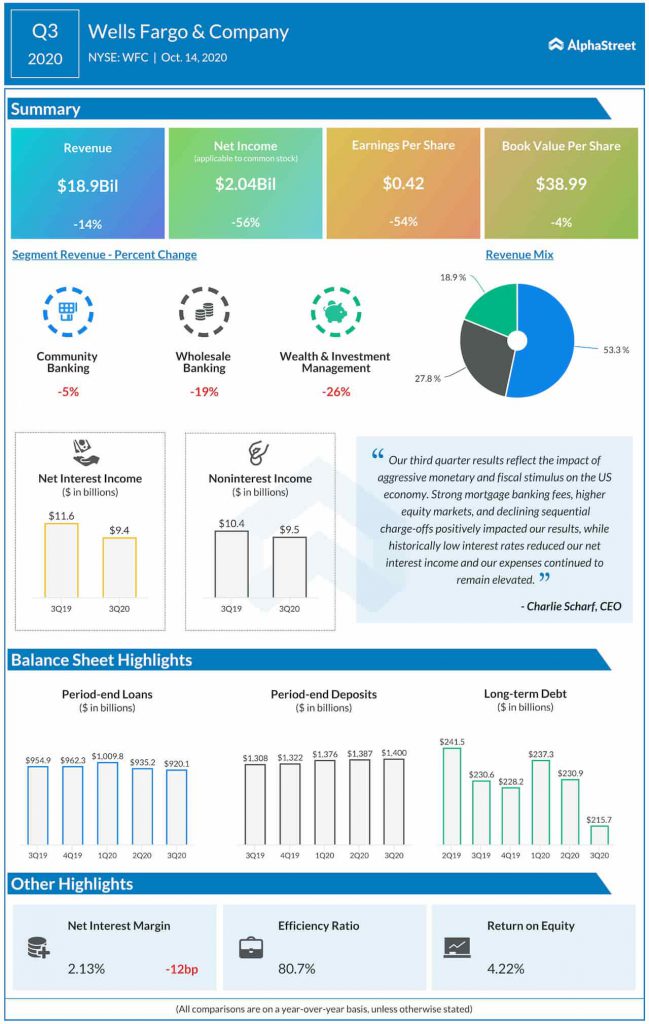

Other banks forecast the same timeline for increase in net charge offs. The Big Five – JPMC, Citi (NYSE: C), Bank of America (NYSE: BAC), Wells Fargo (NYSE: WFC) and Goldman Sachs (NYSE: GS) believe that they are largely prepared for the losses to come. In the first half of the year, $60 billion worth of provisions were reported whereas Q3 has seen a total of just $6.5 billion.

We still don’t know where the stimulus talks are heading. The Fed’s balance sheet is swelling up and aggressive stimulus could lead to excess liquidity, which in turn might cause inflation and spurring of asset bubbles. More stimulus might just shift cash from the Fed into the banking system, according to Barclays.

Former Fed Governor Randall Kroszne has said “…big debts that governments are racking up are going to make it difficult for central banks to raise rates when they feel the need to do so because that will increase borrowing costs”. Interest rates, one of the key profit generators for banks, has also been falling (NII for the Big 5 is down 13% year-on-year). Although banks like GS generate more revenue from stocks, bonds and other financial instruments, they are not immune to the interest rate fluctuations.

The fate of the industry lies in how the macroeconomic forces act, and how well the banks are prepared to deal with adverse cases. Permanent unemployment is on a rise in the States (In September, number of permanent job losses grew to 3.8 million, an increase of pre-pandemic levels by 2.5 million people.) Interest rate environment remain at a lower level, and profitability won’t return till there is an increase in the rates.

The Fed has made policy alterations to ease pressure on banks’ sizes such as excluding Treasury and Fed deposits for calculation of leverage but has also restricted dividend and buyback payout, leading to an increase in the capital levels. So, investors could end up with a bigger payout once the restrictions end.

(Written by Shreya Chandra)

_____

Click here to access the full transcripts of the latest earnings calls