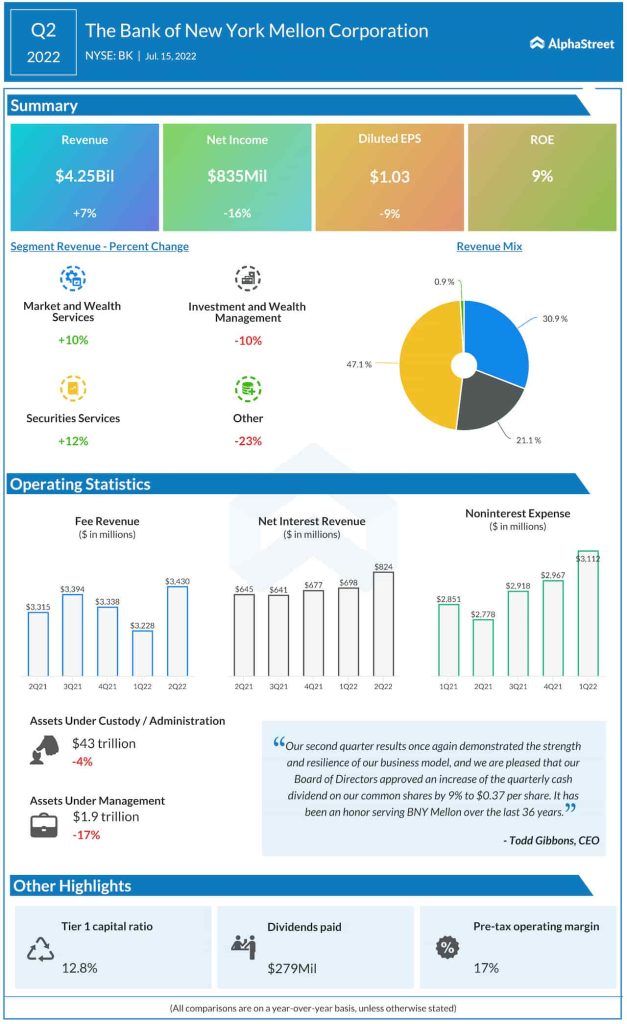

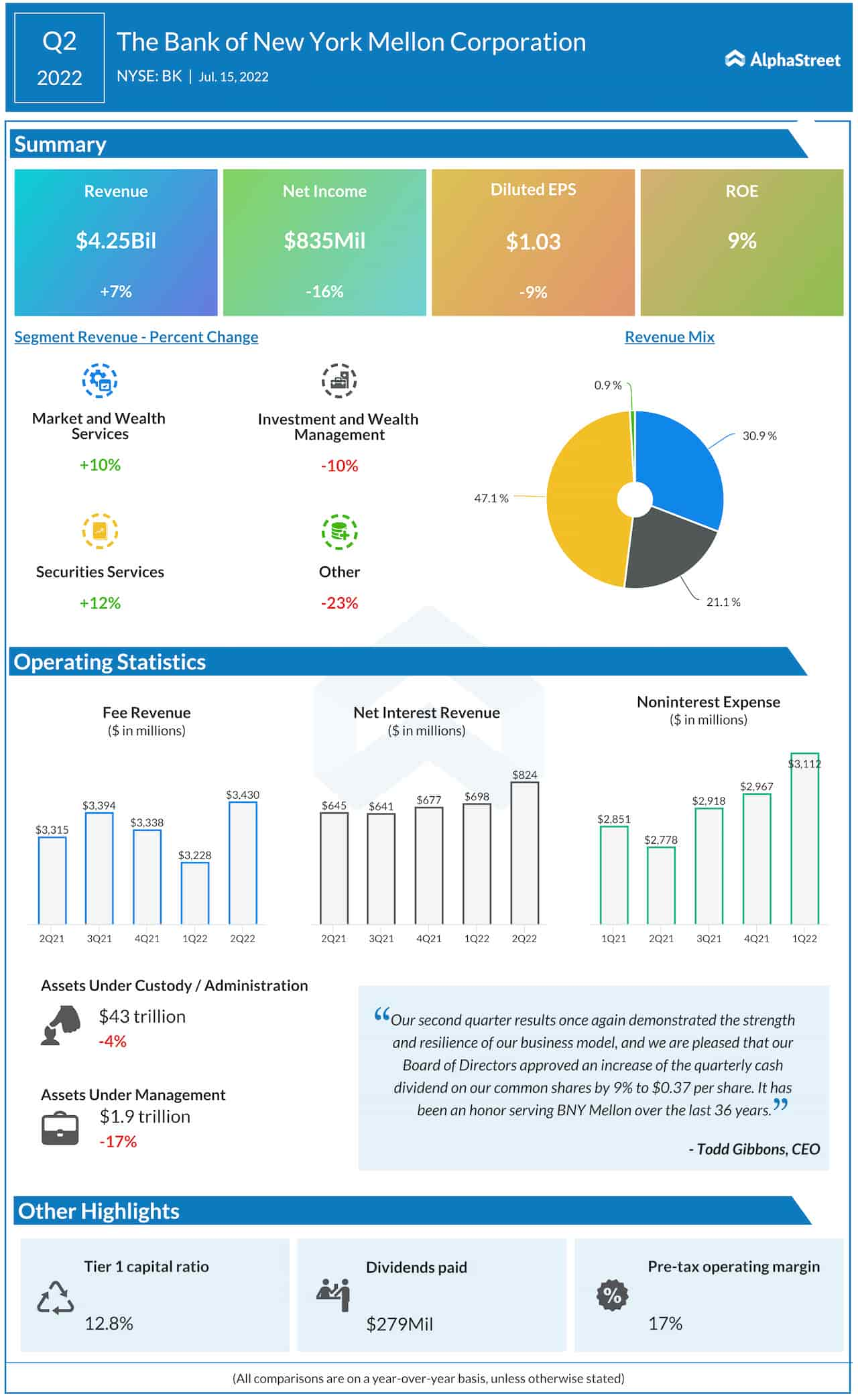

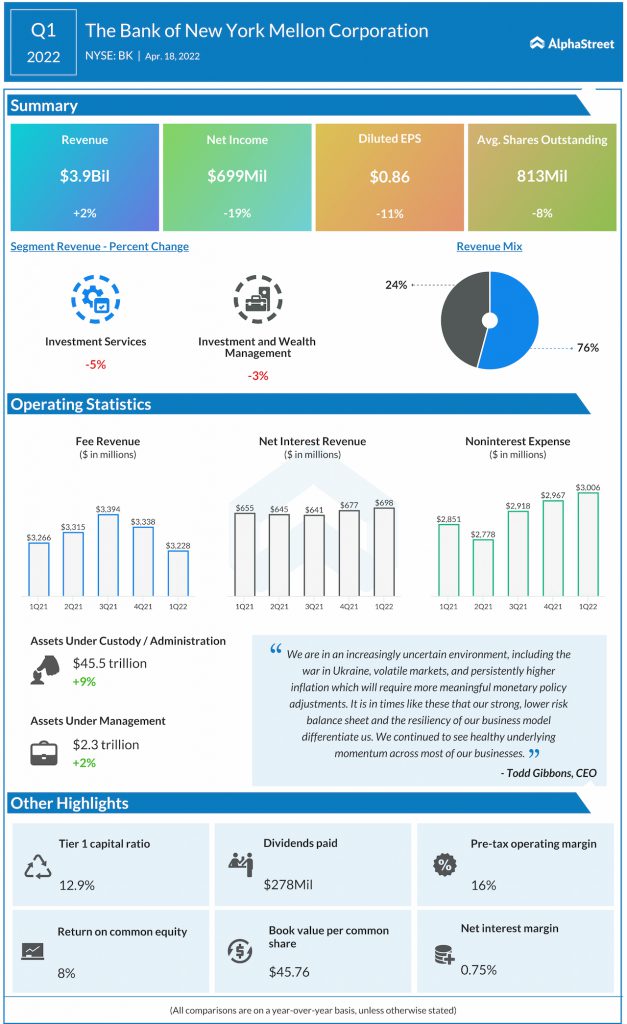

The second quarter net income decreased to $835 million or $1.03 per share from $699 million or $0.86 per share in the corresponding period of 2021.

At $4.3 billion, net revenues were up 7% year-over-year, with the core Market & Wealth Services and Securities Services segments registering double-digit growth.

Read management/analysts’ comments on quarterly reports

“We continued to see good sales momentum across most of our businesses, and healthy client volumes tempered the impact of lower market values. We deeply appreciate our employees’ commitment in these more volatile markets. Our clients clearly value our resilience, the quality of our services and insights, and the trusted relationship that they have with BNY Mellon,” said the bank’s president Robin Vince.