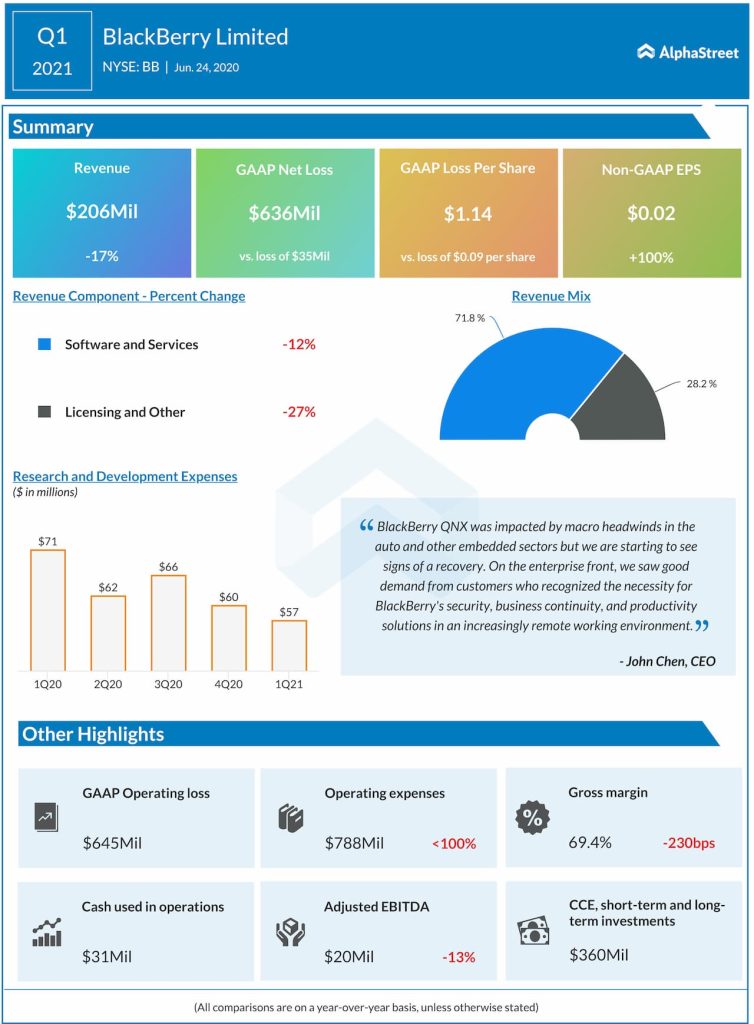

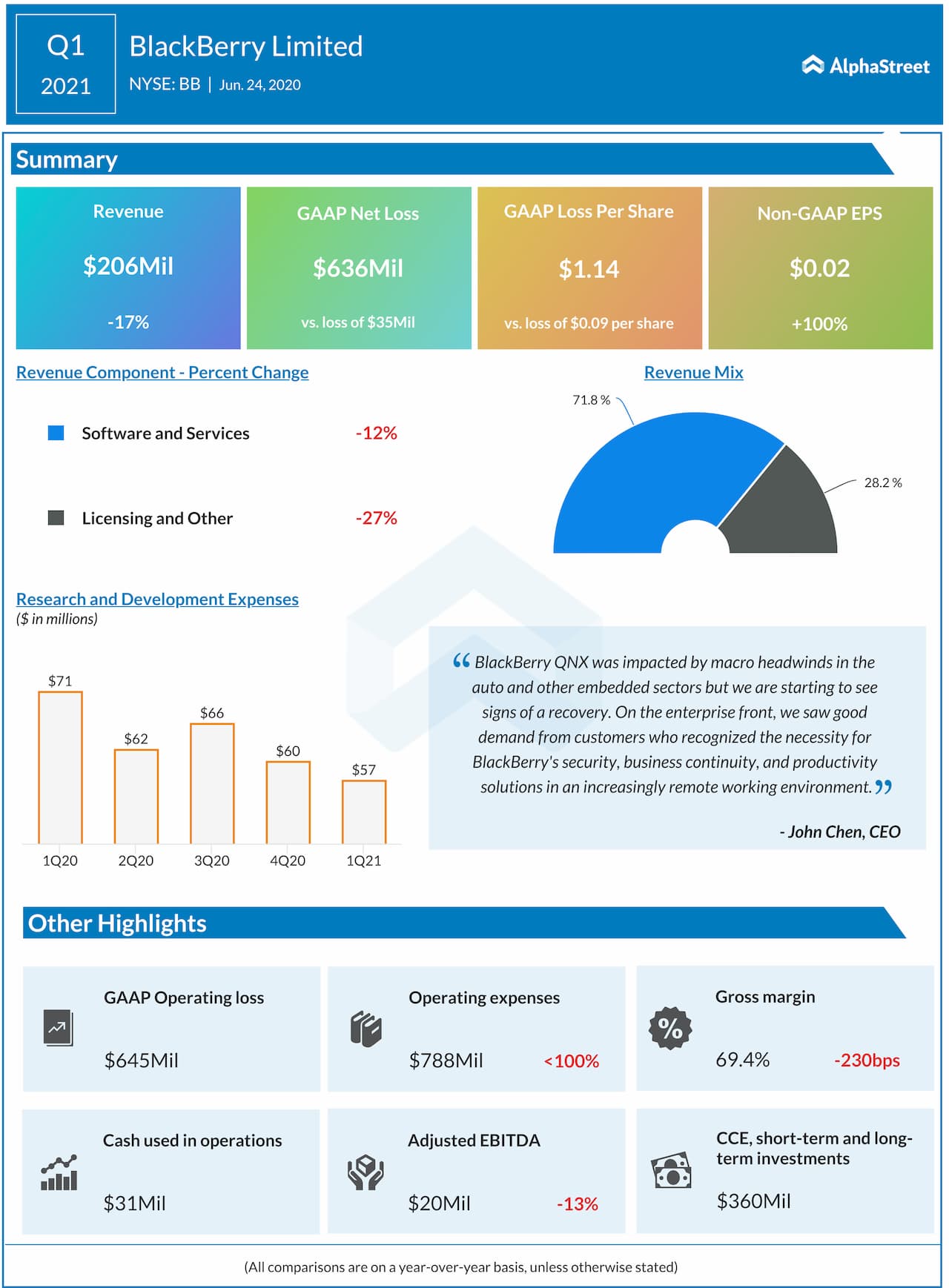

Q1 results

In the Software and Services business, QNX. development seat, professional serviced and royalty revenue were all negatively impacted, primarily due to the auto-shutdown, production shutdown and the project delays. The management said,

“We’re starting to see signs of recovery in the auto sector evidenced by the reopening of the production facilities. Engagement with our auto and general embedded customer has increased on projects that we were working on prior to the shutdown as well as new opportunity that came out. We anticipated a slow and gradual recovery for QNX throughout the year. It will take time for the production to ramp back to full capacity.”

Expenses & hiring

R&D expenses and selling, marketing and administration expenses declined both sequentially and annually as the company controlled the spending, given the current macro landscape. Going forward, BlackBerry expects its sales and marketing costs to increase in FY21. BlackBerry stated that it has reduced headcount in some areas and hired a lot of people in some areas on a global basis. The company had moved 10% of its resources from the back office to the front office. Since most of the things are done virtually, it’s able to save money on travel.

Auto sales and production forecast

At April end, market research firm IHS Markit revised its outlook for global light vehicle sales and production as the pandemic impact had reduced the demand. Global light vehicle sales in 2020 are now forecast to decline to 69.6 million units, 22% lower than in 2019, with risks of deteriorating further. Auto sales in North America is projected to decline by 26.7% year-over-year in 2020.

IHS Markit also stated that global light vehicle production is now expected to decline to 69.3 million units in 2020, a drop of 19.6 million units from 2019. IHS Markit sees North American production dropping to 12.2 million units, from 16.3 million in 2019.

Outlook

BlackBerry expects a small incremental improvement in software and services in the enterprise business and a slow incremental improvement in QNX business. CEO John Chen stated that the company expects a difficult quarter in Q2 but expects the second half of FY21 to be better. BlackBerry also expects to be cash flow positive for the year. When asked about the longer-term growth targets, Chen said once the company recovers from the pandemic, it expects the Software and Services group to register double-digit growth.