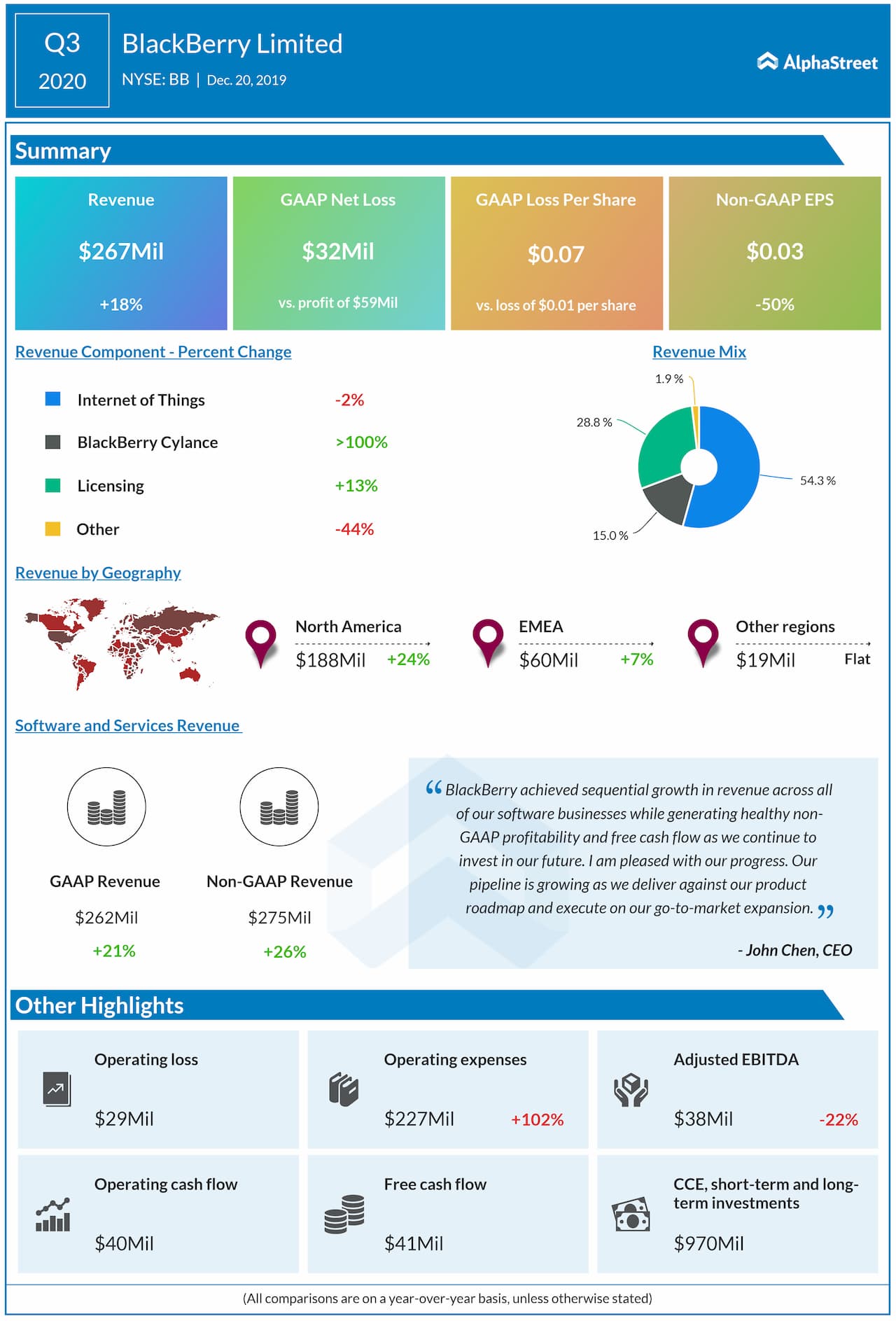

On a GAAP basis, BlackBerry reported a net loss of $32 million compared to a net income of $59 million last year. GAAP loss per share was $0.07 compared to a loss of $0.01 per share last year. Adjusted EPS totaled $0.03.

Total GAAP software and services revenue increased 21% year-over-year to $262 million. On an adjusted basis, software and services revenue rose 26% to $275 million. Adjusted recurring software and services revenue (excluding IP licensing and professional services) was over 90%.

Also read: Accenture Q1 2020 Earnings Report

On a geographic basis,

revenues increased in the North America and EMEA regions while in Other

regions, it remained flat versus the prior-year quarter. By products and

services, IoT revenues dipped slightly during the quarter versus last year

while licensing revenues saw a double-digit increase. BlackBerry Cylance

generated $40 million in revenues during the quarter.

Total cash, cash equivalents, short-term and long-term investments was $970 million as of November 30, 2019. Capital expenditures totaled $3 million in the third quarter.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.