New Deals

Outlook

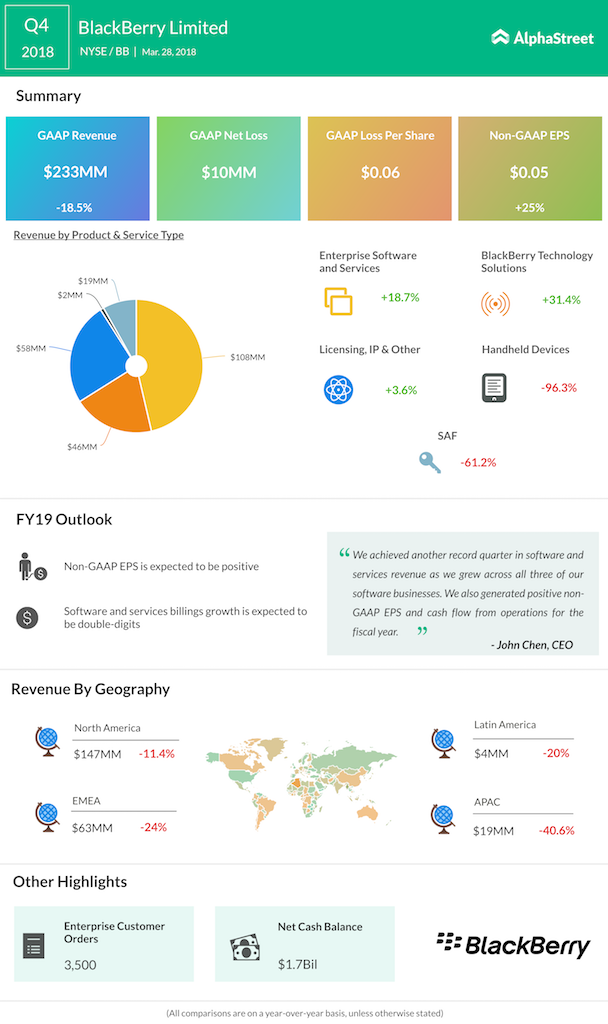

For the fiscal year 2019, the company expects software and services billings growth to be in double-digits, while adjusted EPS is expected to be positive.

Enterprise software and IoT giant BlackBerry (BB) continued its bad run for the fourth quarter, with revenue plunging 18.5% to $233 million, driven by a decline in handheld devices sales, which nosedived to $2 million from $55 million a year ago. As a percent of overall revenue, handheld devices revenue dropped to 0.9% from 19.2%. The […]

“Enterprise software and IoT giant BlackBerry (BB) continued its bad run for the fourth quarter, with revenue plunging 18.5% to $233 million, driven by a decline in handheld devices sales, which nosedived to $2 million from $55 million a year ago. As a percent of overall revenue, handheld devices revenue dropped to 0.9% from 19.2%. The […]

· March 28, 2018

Enterprise software and IoT giant BlackBerry (BB) continued its bad run for the fourth quarter, with revenue plunging 18.5% to $233 million, driven by a decline in handheld devices sales, which nosedived to $2 million from $55 million a year ago. As a percent of overall revenue, handheld devices revenue dropped to 0.9% from 19.2%. The reported net loss for the quarter, however, narrowed to $10 million, or $0.06 per share, from the year ago loss of $47 million, or $0.10 per share. The narrowed loss was helped by the double-digit growth in software and service billings. On an adjusted basis, earnings stood at $0.05 per share, up 25% year-over-year.

The once-dominant smartphone giant announced new partnerships with Pana-Pacific to make BlackBerry Radar available to more than 2,800 commercial vehicle dealers in North America. Additionally, the company also entered into a multi-year agreement with Jaguar Land Rover to develop and license BlackBerry QNX and Certicom technology for their next-generation vehicles.

For the fiscal year 2019, the company expects software and services billings growth to be in double-digits, while adjusted EPS is expected to be positive.