Delivery Slump

It is expected that December-quarter performance would be negatively impacted by the continuing slowdown in commercial aircraft deliveries and production cuts, though it has been partially offset by stable sales at the defense segment. Initial estimates indicate that commercial deliveries shrunk by a third, year-over-year, in the to-be-reported quarter.

Fresh Setback

The sentiment deteriorated further last week after the management said regulators are unlikely to give green signal for the return of the grounded planes until mid-year, though initially it was expected to come by April. The regulatory decision could be detrimental to the company’s operations this year as there will be no deliveries for one of its key products. On the other hand, Boeing will be forced to pay huge amounts as compensation to those affected by the crisis.

It is bad news for Boeing’s clients who will have to struggle with shortage of flights during the travel season, in the absence of the 737 Max planes. Currently all eyes on Calhoun, who took charge as the chief recently, giving fresh hopes that the company would come out of the crisis under his leadership.

Weak Q3 Results

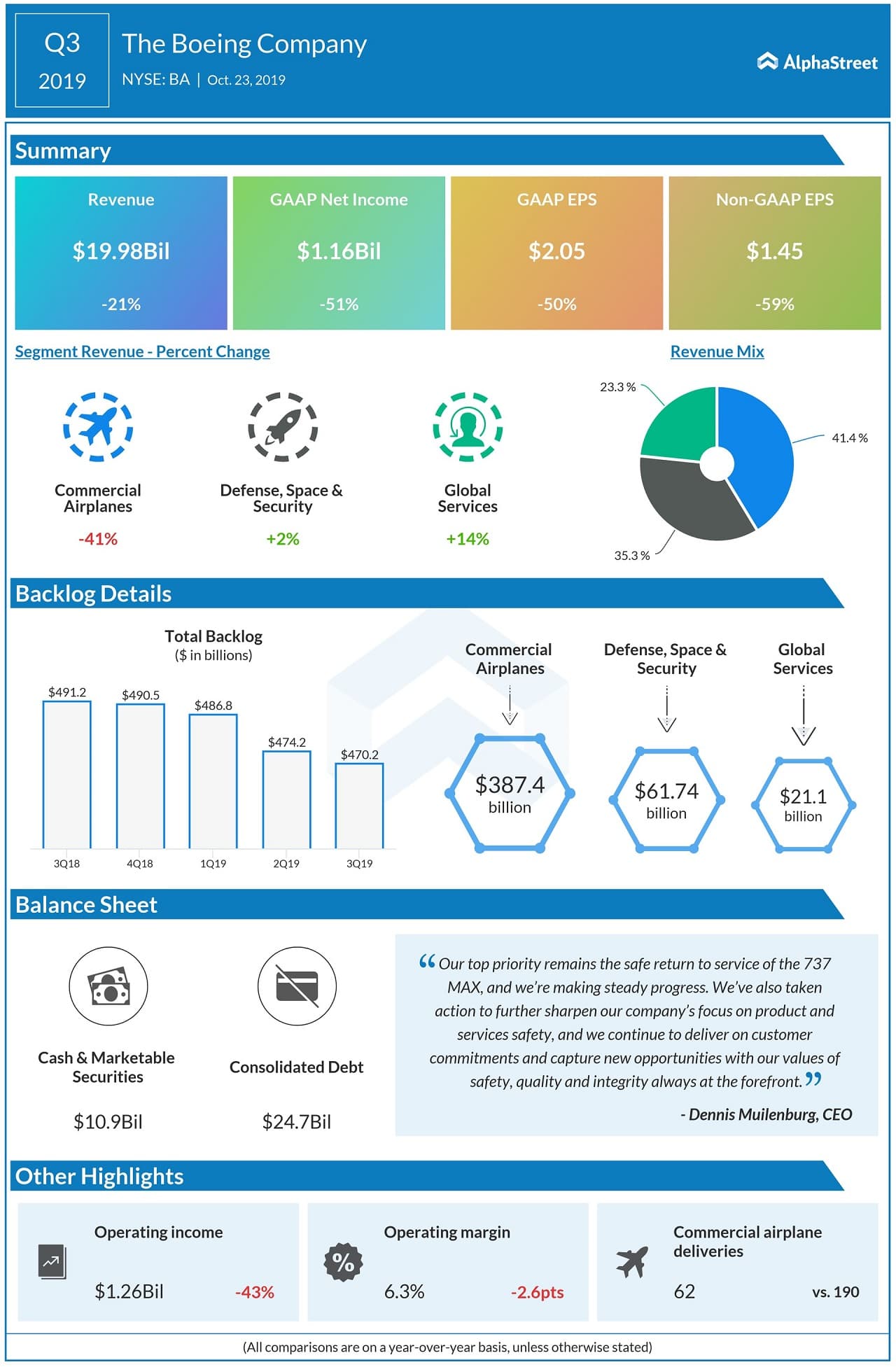

In the third quarter, both revenues and earnings suffered double-digit year-over-year declines, mainly reflecting the slowdown in aircraft deliveries. Earnings plunged 59% to $1.45 per share, while revenues dropped 21% to about $20 billion.

Aviation firms across the globe grounded their 737 Max fleets last March after several people were killed in two deadly crashes that occurred within a span of six months, due to technical glitch.

Market Watchers recommend holding Boeing stock in view of the extended delay in 737 Max resumption. After making a modest start to the year, the stock witnessed a selloff last week and underperformed the market.