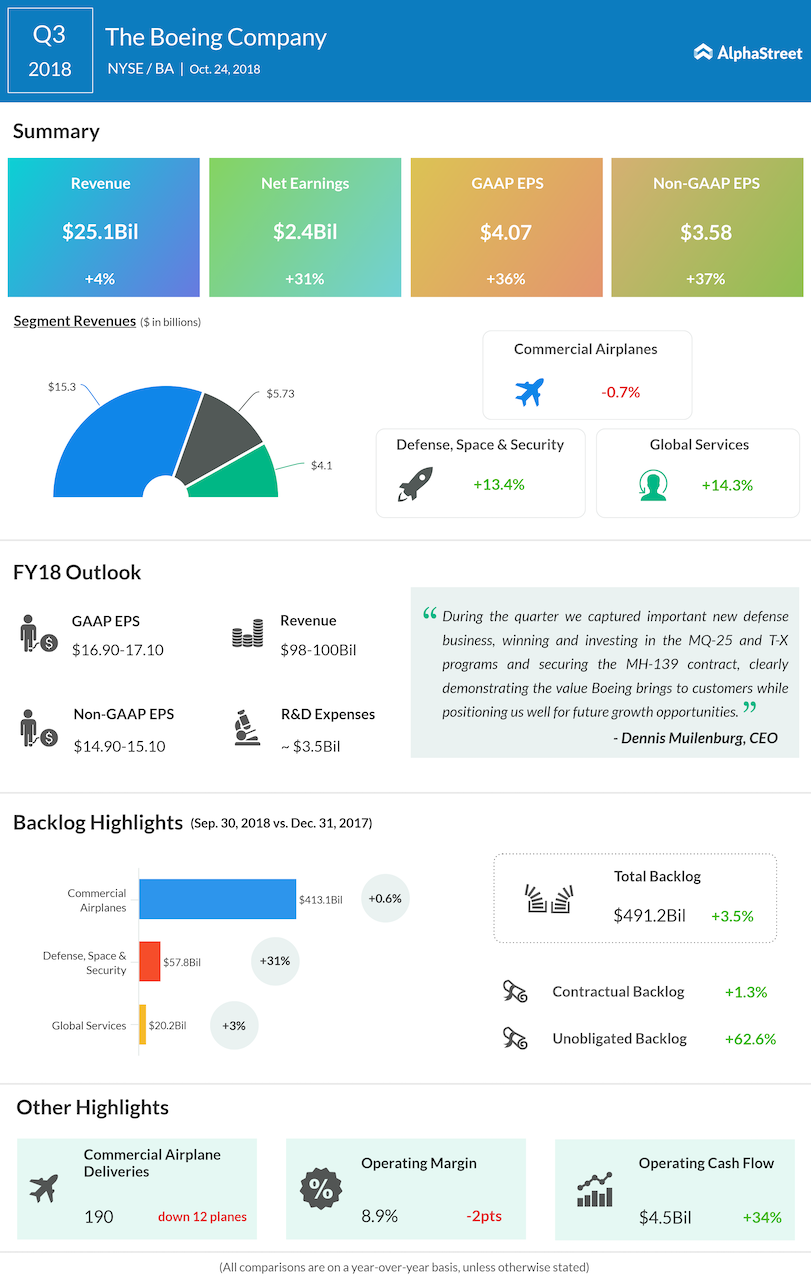

Revenue increased 4% to $25.1 billion from the prior-year period. The aircraft maker saw higher defense volume and services growth during the quarter. Backlogs improved by $3 billion to $491 billion at the end of the quarter and included net orders of $28 billion.

Looking ahead into fiscal 2018, Boeing raised its revenue outlook to the range of $98 billion to $100 billion from the prior estimate range of $97 billion to $99 billion, driven by defense volume and services growth, inclusive of the KLX acquisition.

The aerospace giant lifted its EPS guidance to the range of $16.90 to $17.10 from the previous range of $16.40 to $16.60. Adjusted EPS forecast was increased to the range of $14.90 to $15.10 from the prior range of $14.30 to $14.50. The earnings guidance was revised upward due to a lower-than-expected tax rate and improved performance at Commercial Airplanes.

Research and development expenses are now anticipated to be about $3.5 billion and capital expenditures are predicted to be around $2 billion for the full-year 2018. The effective tax rate is now predicted to be about 9.5% for the full year.

For the third quarter, Boeing’s deliveries declined by 6%. The company faced cost growth on the KC-46 Tanker program. This was due to higher than expected effort to meet customer requirements to support delivery of the initial aircraft, as well as due to incremental delays in certification and testing.

During the quarter, Commercial Airplanes delivered 190 airplanes, including 57 of 737 MAX airplanes. Commercial Airplanes booked 171 net orders during the quarter, valued at $13 billion. The 777X program remains on track for delivery in 2020 as the static test airplane was completed and moved into test setup and the first two flight test airplanes were in production.

Commercial Airplanes revenues declined 1% as lower deliveries largely offset by mix. Defense, Space & Security revenue grew 13% on increased volume across government satellites, KC-46 Tanker, F/A-18 and weapons. Global Services revenue increased 14% on higher parts volume.

Shares of the aerospace giant rose 4.66% in the pre-market trading.