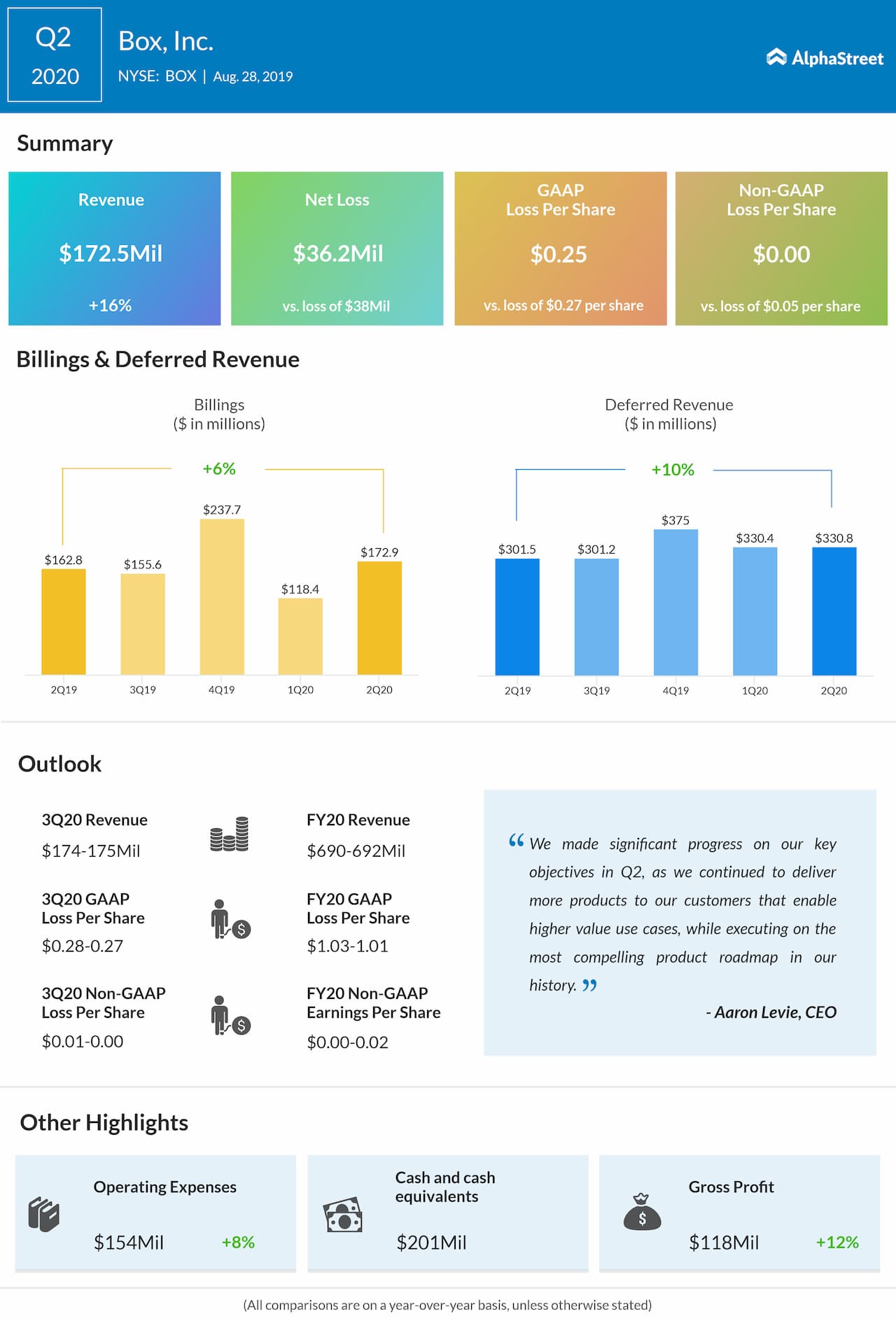

Box Inc. (NYSE: BOX) reported better-than-expected revenue and earnings for the second quarter of 2020. Analysts had forecast a loss of $0.02 per share on revenue of $169.5 million. Despite the win, shares were down 4% in aftermarket hours on Wednesday.

Total revenues of $172.5 million were up 16% from the same period last year.

The company

reported a net loss of $36 million, or $0.25 per share, compared to $38 million,

or $0.27 per share, last year. Adjusted EPS was $0.00.

Aaron Levie, co-founder and CEO said, “We drove strong add-on product attach rates of more than 80% across our six-figure deals in Q2. Customers are increasingly adopting Box’s comprehensive Cloud Content Management solutions to protect their most important information with frictionless security and compliance, streamline internal and external collaboration and workflows, and enable a more productive workplace by leveraging a best-of-breed IT stack.”

Also see: Box Q2 2020 Earnings Preview

ADVERTISEMENT

Billings increased

6% to $172.9 million during the quarter from the prior-year period. At

quarter-end, remaining performance obligations were $640.5 million, up 9% from

the year-ago period. Deferred revenue was $330.8 million, up 10% from last year.

For the third quarter of 2020, revenue is expected to be $174 million to $175 million. GAAP net loss per share is expected to be $0.28 to $0.27. On an adjusted basis, earnings are expected to range between a loss of $0.01 to $0.00.

For fiscal year 2020, revenue is expected to be $690 million to $692 million. GAAP net loss per share is expected to be $1.03 to $1.01. Adjusted EPS is expected to be $0.00 to $0.02.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.