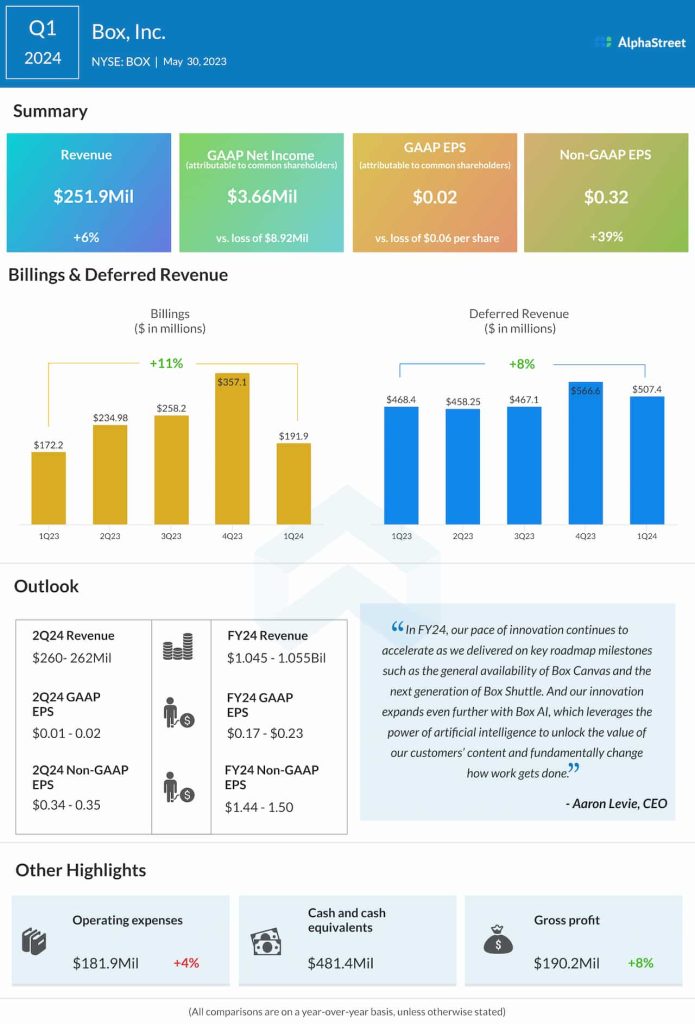

The company’s revenues increased 6% year-over-year to $251.9 million in the first three months of fiscal 2024. Remaining performance obligations, a measure of revenues to be realized in the next twelve months, rose sharply to $1.18 billion.

Reflecting the top-line growth, adjusted earnings moved up to $0.32 per share during the three-month period from $0.23 per share a year earlier. Unadjusted profit was $3.66 million or $0.02 per share, compared to a loss of $8.92 million or $0.06 per share in the prior-year quarter.

“In FY24, our pace of innovation continues to accelerate as we delivered on key roadmap milestones such as the general availability of Box Canvas and the next generation of Box Shuttle,” said Box’s CEO Aaron Levie.