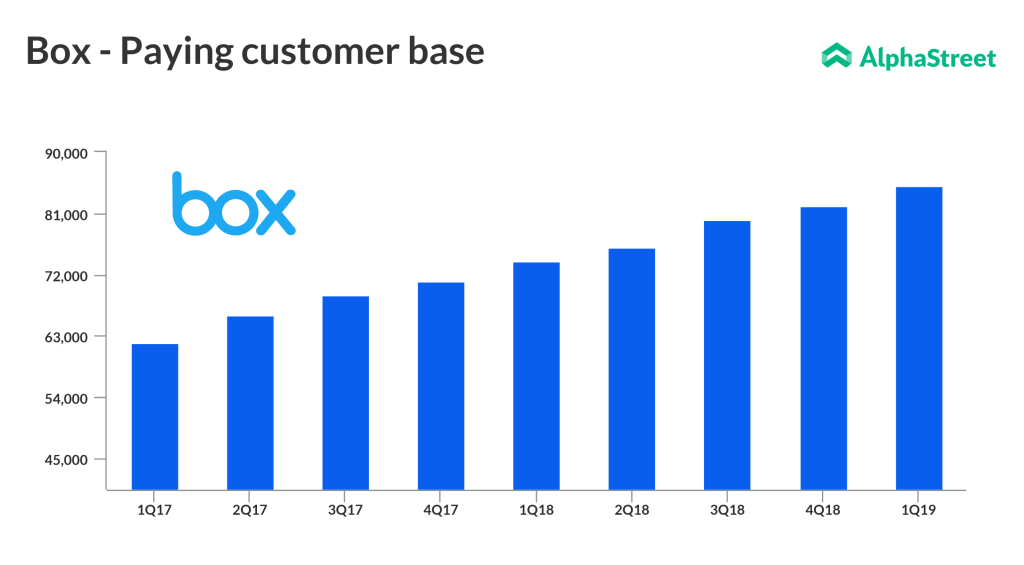

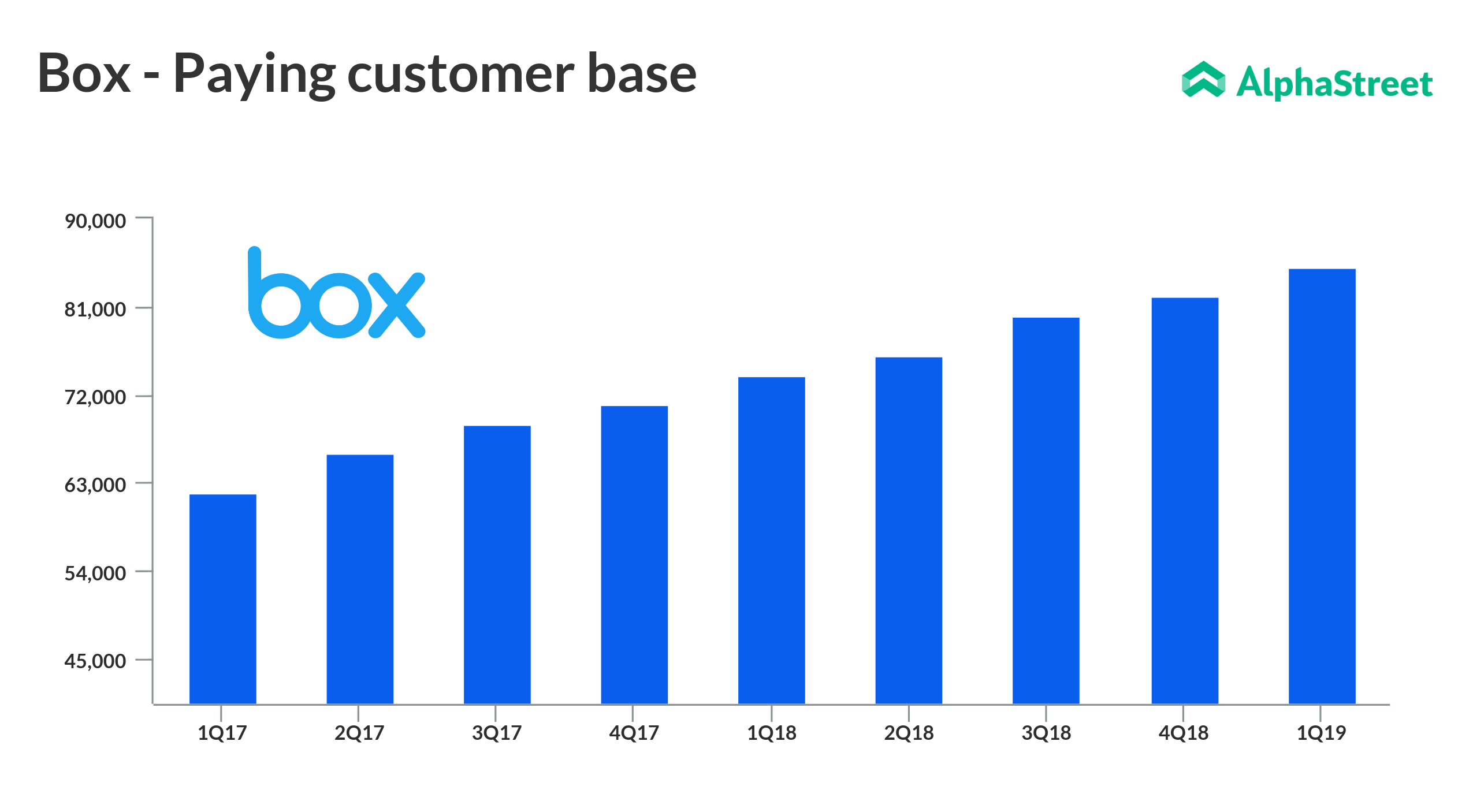

First-quarter revenues climbed 20% year-on-year to $140.5 million exceeding estimates. At $116.7 million, total billing revenue was higher by 17% compared to last year. During the quarter, the number of paying customers rose by 3,000 to about 85,000.

“In the first quarter, we drove strong attach rates for new products, expanded our international customer base and delivered product innovation and security for some of the largest and most regulated enterprises in the world,” said Box CEO Aaron Levie.

During the first quarter, the number of paying customers rose by 3,000 to about 85,000

Looking ahead, Box forecasts revenues between $146 million and $147 million in the second quarter of 2019. The company expects to record a net loss in the range of $0.28 to $0.27 per share in the second quarter and adjusted net loss between $0.06 and $0.05 per share.

For fiscal 2019, the company expects revenues in the $603 – $608 million range. Full-year net loss is forecast between $1.07 and $1.04 per share, and adjusted net loss in the range of $0.19 to $0.16 per share.

Since going public in 2015, Box’s revenues grew at a compound annual rate of 32%, all along benefitting from its partnerships with major tech firms including Microsoft (MSFT), IBM (IBM) and Alphabet (GOOGL).

Shares of Box closed Wednesday’s regular trading session up 2%, but lost nearly 4% in the afterhours following the earnings announcement.