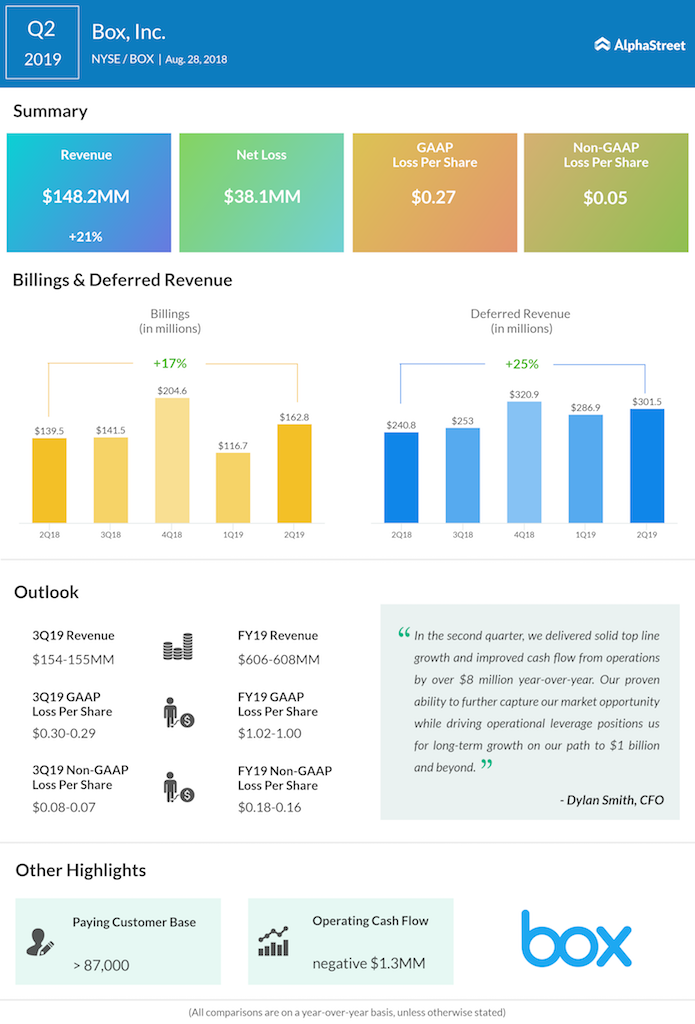

Revenues climbed 21% to $148.2 million, exceeding estimates. At $162.8 million, total billing revenue was higher by 17% than last year. During the quarter, the number of paying customers rose by 2,000 to about 87,000.

Looking ahead into the third quarter of 2019, Box predicts the net loss in the range of $0.30 to $0.29 per share and the adjusted loss of $0.08 to $0.07 per share. Revenues are anticipated to be between $154 million and $155 million for the third quarter.

For the fiscal year 2019, the company narrowed its adjusted loss per share guidance to the range of $0.18 to $0.16 from prior estimate of $0.19 to $0.16, and its revenue outlook to $606 million to $608 million from the previous forecast of $603 million to $608 million.

GAAP net loss guidance was lowered to a range of $1.02 to $1.00 from prior estimate of $1.07 to $1.04.

The company benefited from the deeper relationships with customers such as JLL, Nationwide, and Societe Generale, as well as focusing on strategic solution sales. This led to another quarter of strong attach rates for add-on products like Box Governance, Zones, and Platform.

Shares of Box closed Tuesday’s regular trading session up 2.35% but lost nearly 3% in the after-hours following the earnings announcement.