The New York-based firm reported adjusted earnings of $1.10 per share, edging past Wall Street estimates by a cent.

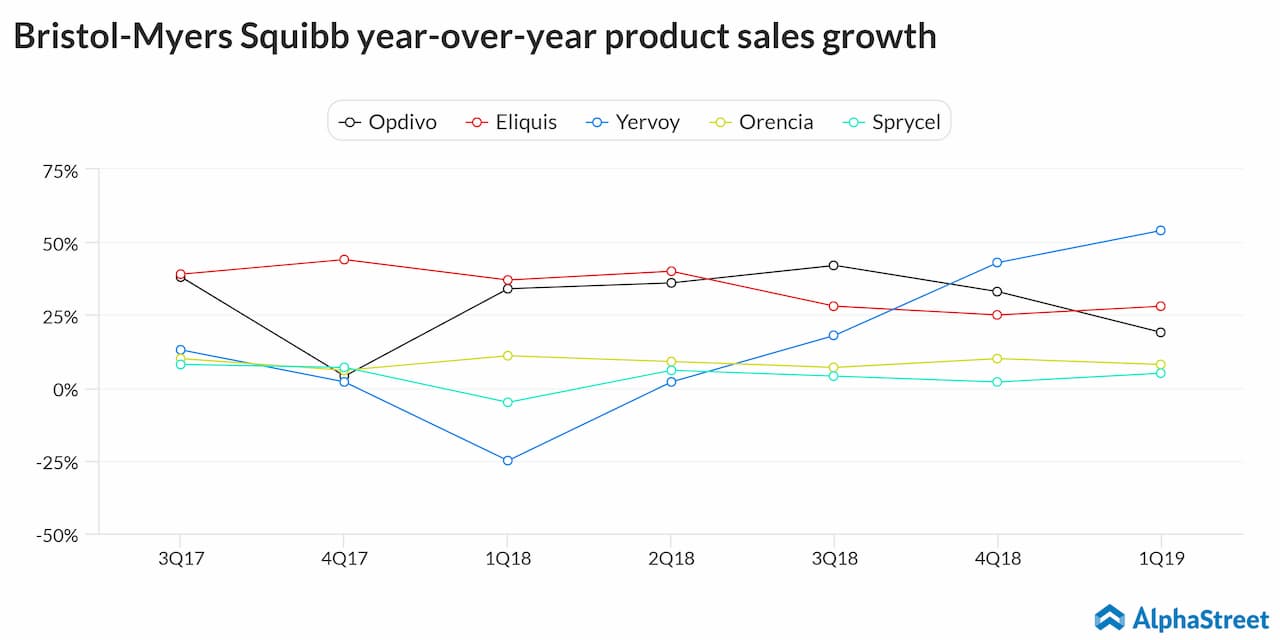

Among the products, melanoma drug Yervoy saw the biggest growth of 54%. Anticoagulant Eliquis was the top-selling product with global sales of $419 million, up 28% year-over-year.

READ: WHAT IS NASH AND WHICH BIOTECH FIRMS ARE VYING FOR THE FIRST-MOVER STATUS

Bristol-Myers added that it has received shareholder approval to move ahead with its acquisition of Celgene Corporation (NASDAQ: CELG). The company expects to close the acquisition in the third quarter.

In February, one of the major shareholders of the company, Wellington Management, had come out in opposition to the proposed $74-billion merger deal, citing the risks and expenses surrounding the deal. A month later, the deal got a new lease of life after proxy advisory firm Institutional Shareholder Services recommended Bristol-Myers shareholders to support it.

Outlook

Bristol-Myers Squibb raised its 2019 GAAP EPS guidance range to $3.84 – $3.94 and reaffirmed its non-GAAP EPS guidance range of $4.10 – $4.20. Gross margin as a percentage of revenue to is expected to be approx 70% for both GAAP and non-GAAP.