Solid AI Revenue

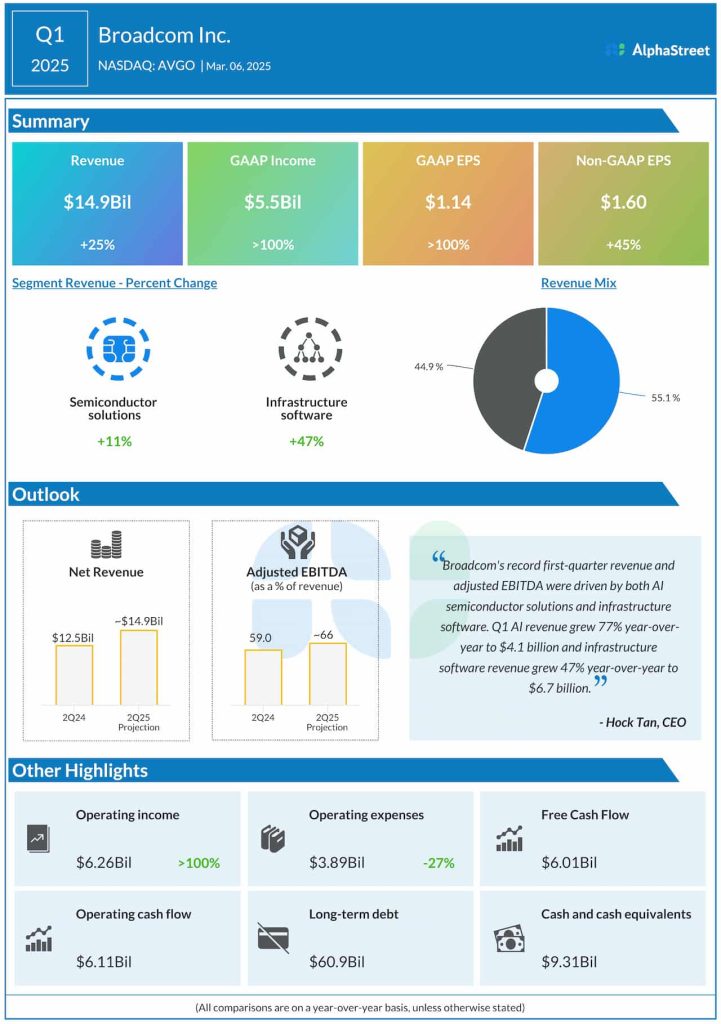

Broadcom’s revenue increased to $14.92 billion in the first three months of fiscal 2025 from $11.96 billion in the year-ago period, beating Wall Street’s estimates. Revenues of Semiconductor Solutions and Infrastructure Software increased by 11% and 47% respectively during the three months, with strong contributions from VMware which joined the Broadcom fold more than a year ago. AI revenue surged 77% annually to $4.1 billion in Q1, aided by strong adoption of custom-made accelerators.

Adjusted earnings moved up to $1.60 per share in the January quarter from $1.1 per share in the corresponding period a year earlier. Quarterly profit has beaten estimates consistently over the past five years. On an unadjusted basis, net income was $5.5 billion or $1.14 per share, compared to $1.33 billion or $0.28 per share in Q1 2024. The bottom line benefitted from a decline in operating expenses.

Road Ahead

For fiscal 2025, Broadcom expects revenues to be approximately $14.9 billion and adjusted EBITDA as a percentage of revenue to be 66%. The company’s R&D investments are currently focused on meeting the substantial orders for custom AI accelerators from hyperscalers. Additionally, it is working with more such customers who could generate strong demand in the coming years. The company continues to expect that its top three customers will generate a serviceable addressable market in the range of $60 billion to $90 billion in fiscal 2027.

From Broadcom’s Q1 2025 earnings call:

“Our hyperscaler partners continue to invest aggressively in their next-generation frontier models, which do require high-performance accelerators, as well as AI data centers with larger clusters. And, consistent with this, we are stepping up our R&D investment on two fronts. One, we’re pushing the envelope of technology in creating the next generation of accelerators. We’re taping out the industry’s first two-nanometer AI XPU packaging 3.5D as we drive toward a 10,000 teraflops XPU. Secondly, we have a view toward scaling clusters of 500,000 accelerators for hyperscaler customers. We have doubled the RAID X capacity of the existing Tomahawk sites.“

AVGO has grown a whopping 34% in the past twelve months. The stock traded up 5% on Friday afternoon, extending the post-earnings uptrend.