Broadcom continues the efforts to cash in on the rapid adoption of technology in the automotive industry. After bringing significant innovation to its auto offerings, the company recently launched the multilayer ethernet switch. It is likely to have contributed to revenue growth in the to-be-reported quarter.

Having said that, the faltering demand in the wireless market, softness in the core business – semiconductor solutions – and uncertainties in the Chinese market amid the deepening trade crisis might restrict revenue growth.

The faltering demand in the wireless market, softness in the core business and uncertainties in the Chinese market might restrict revenue growth this time

The revamped product portfolio, covering emerging technologies like 5G and the internet of things, helps the tech firm keep pace with its peers. The strong fundamentals and ongoing growth initiatives, with a focus on strategic acquisitions, put the odds in favor of the company that is poised for a positive year ahead.

Also see: Broadcom Q1 2019 Earnings Conference Call Transcript

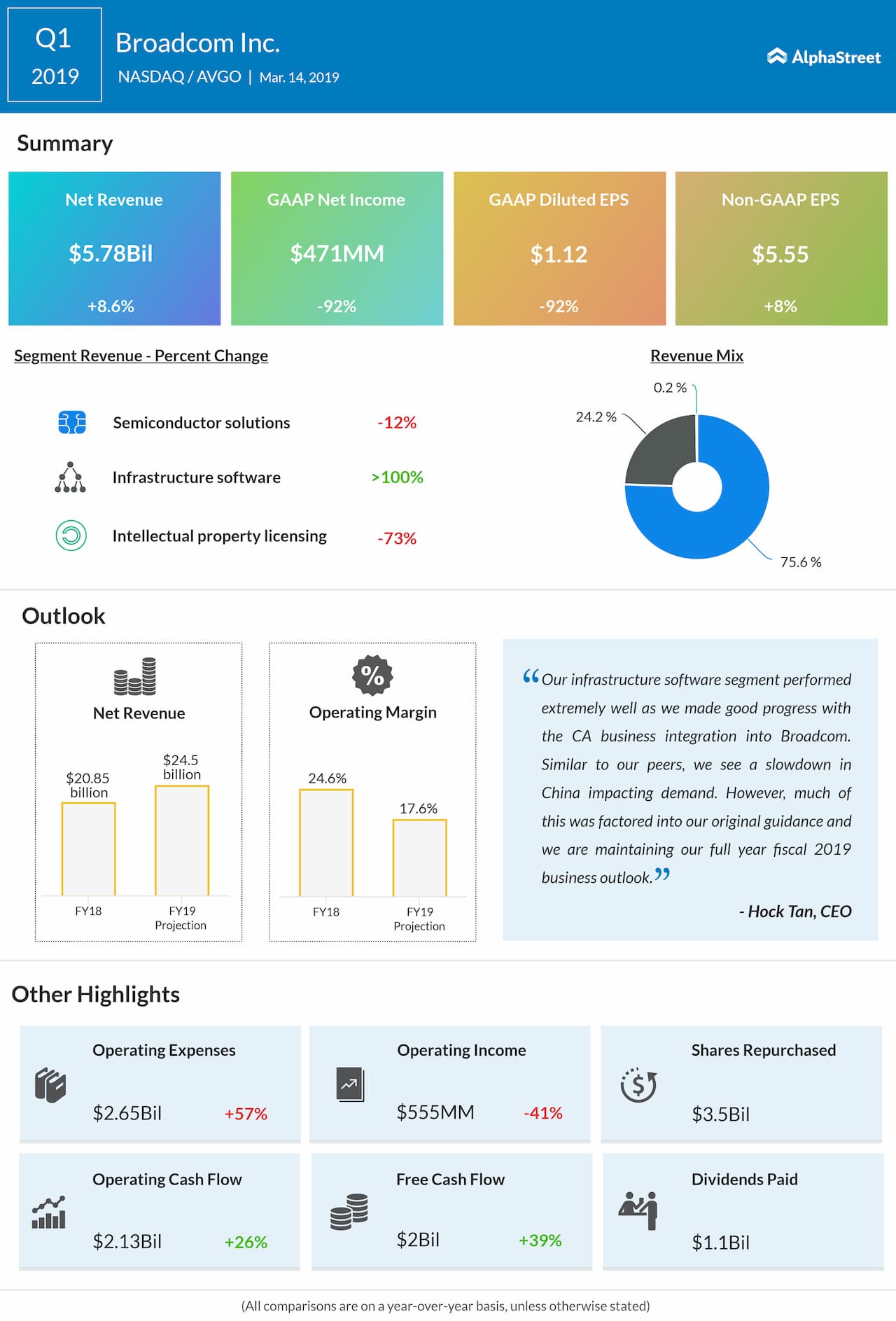

Aided by an increase in the infrastructure software revenues, overall revenues climbed 8.6% annually to $5.78 billion in the first quarter, when earnings rose to $5.55 per share. The results also came in above the estimates.

Among others, Analog Devices (ADI) last month reported lower earnings and revenues for its most recent quarter, hurt by muted demand in the consumer and industrial segments. Earnings decreased year-over-year to $1.36 per share on revenues of $1.53 billion. Earlier, Intel (INTC) posted flat revenues and higher earnings for the first quarter. Revenues matched the market estimates, while earnings beat.

Shares of Broadcom were in the bear territory throughout last month, after peaking in April. But the trend was reversed at the beginning of June and the stock recouped some of the losses. Having gained 3.8% in the past twelve months and 11% since the beginning of the year, it continues to outperform the market.