This is the first deal by Broadcom after national security fears forced the hostile takeover bid for rival Qualcomm (QCOM) to be shelved.

With this acquisition, Broadcom — which relocated its home base to the US from Singapore — seem to be exploring new avenues. As the semiconductor giant looks to diversify its business, this deal does not look like it will face any significant hurdles.

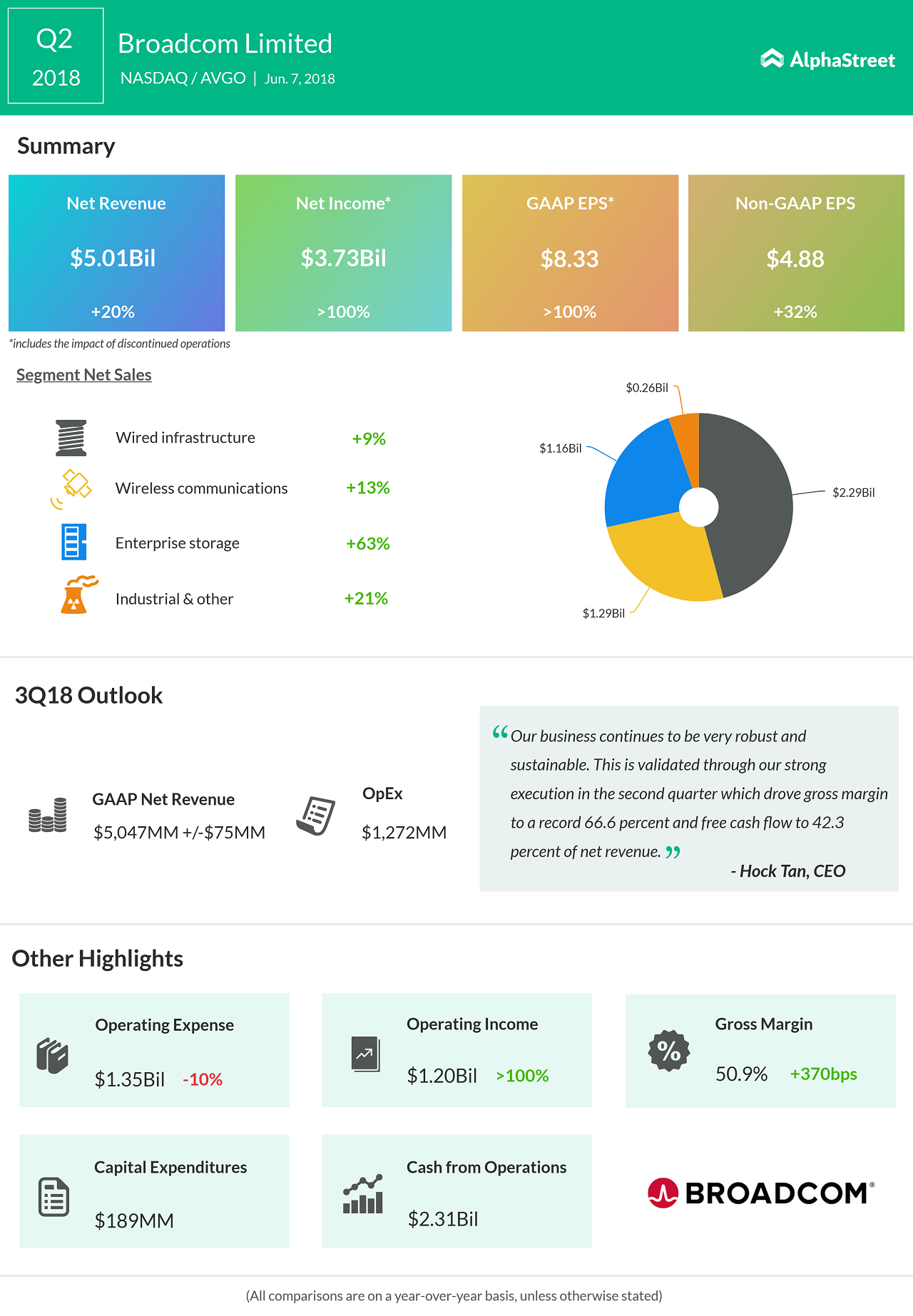

Jump in second-quarter revenue a positive for Broadcom

‘Last month, Broadcom (AVGO) posted upbeat quarterly results as revenue surged 20% to $5.01 billion. With wireless, enterprise and industrial segments showing improvement, earnings came in at a whopping $3.73 billion. Last year same quarter, the semiconductor posted $464 million in profit.

RELATED: Alphastreet’s quarterly coverage of Broadcom results

Rival Qualcomm is out for blood

Earlier this quarter, Broadcom rival Qualcomm (QCOM) unveiled a new Snapdragon 850 processor, specifically for Windows devices, at the Computex 2018 conference in Taiwan.

Samsung is reportedly the first company planning to use this chip in an upcoming 2-in-1 convertible PC.

The new processor – a customized version of the Snapdragon 845 – is designed for use in devices bigger than smartphones. The 850 supports ARM processors, HDR displays, and 4K capture through the onboard camera, artificial intelligence engine, and X20 LTE modem that enables up to 1.2 Gbps transfer. It also comes with long battery life, along with other features that pit it against Broadcom’s lineup.

The latest move by Broadcom towards software might be the company’s bid to diversify and expand the possibilities of its hardware line. In a tight market where even trade tensions seem to affect deals, how Broadcom will now move is to be seen.