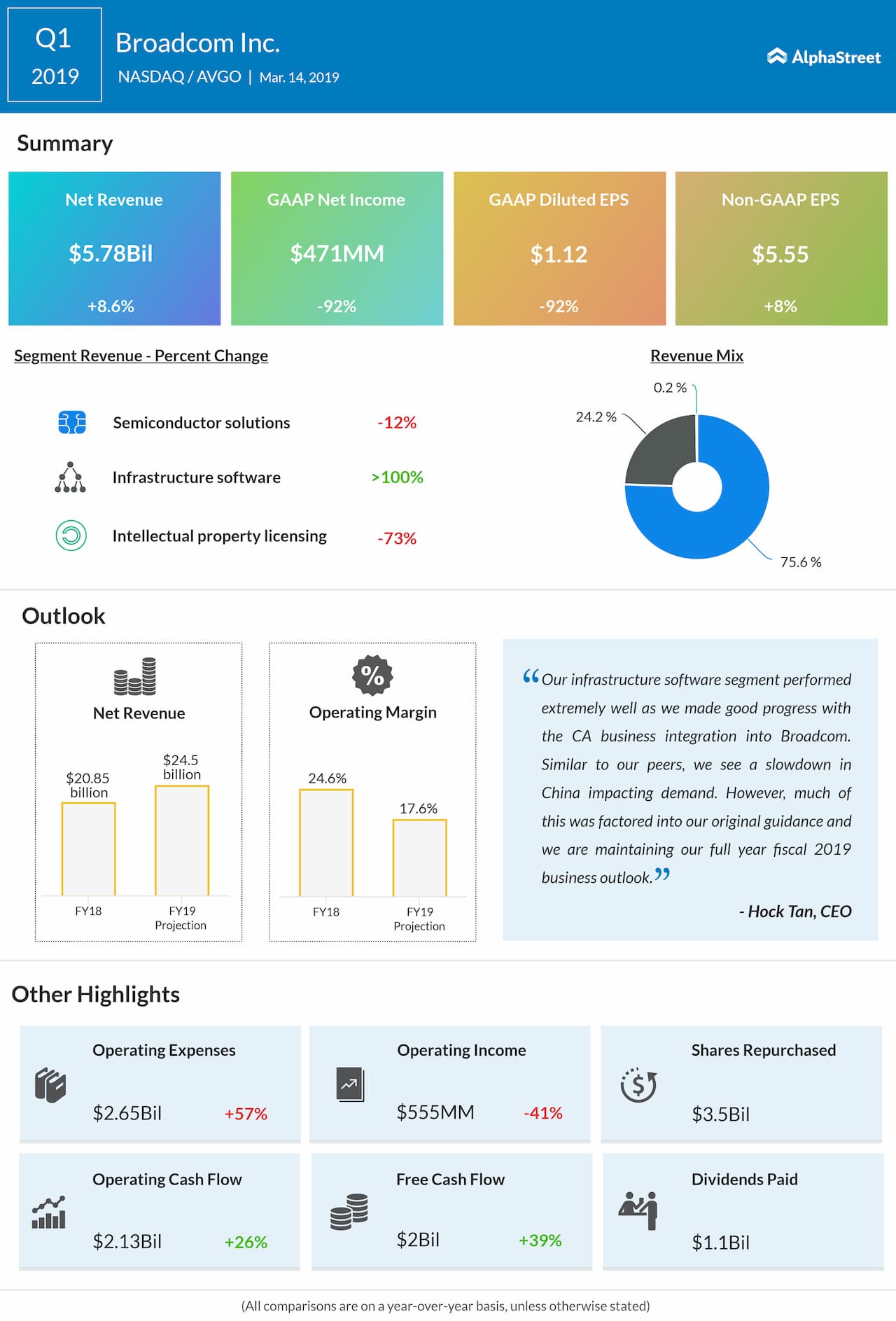

For the quarter, GAAP earnings slipped 92% to $1.12 per diluted share, while adjusted earnings grew 8% to $5.55 per diluted share.

According to Zacks Research, the Street was looking at $5.22 per share in earnings in revenue of $5.74 billion for the semiconductor mammoth.

“We generated over $2 billion in free cash flow in the quarter, which represented 39% growth on a year on year basis,” said Broadcom CFO Tom Krause.

“Consistent with our capital return plan, we returned $4.6 billion to stockholders in the quarter including $1.1 billion of cash dividends and $3.5 billion of share repurchases and eliminations,” added Krause.

LOOKING FORWARD

For the fiscal year 2019, Broadcom now expects net revenue to be about $24.5 billion, with a GAAP operating margin of 17.6% and a non-GAAP margin of 51%.

Net interest expenses and others are touted to be $1.25 billion in the year, with 3% provision for income taxes on a GAAP basis and 1% on an adjusted basis.

Capital expenditures for the fiscal year are expected to amount to $550 million. For FY2019, depreciation is estimated to hit $600 million and total intangible amortization is touted to be about $5.24 billion.

BROADCOM ANNOUNCES DIVIDEND

On Thursday, Broadcom also announced that its board approved a quarterly dividend of $2.65 per share, in cash.

The dividend would be payable on Mar. 29, 2019, to shareholders of record at the close of business on Mar. 21, 2019.