Signet Jewelers Limited (SIG) reported net sales of $1.5 billion for the first quarter of the fiscal year 2019, an increase of 5.5% from the first quarter of 2018. The increase was driven by the addition of James Allen, a calendar shift due to the 53rd week in FY18, Forex benefits, and new accounting standards.

E-commerce sales, including James Allen, rose nearly 81% to $146.5 million while James Allen sales improved 29% to $53.3 million during the quarter. Total company same-store sales remained flat with the prior-year period.

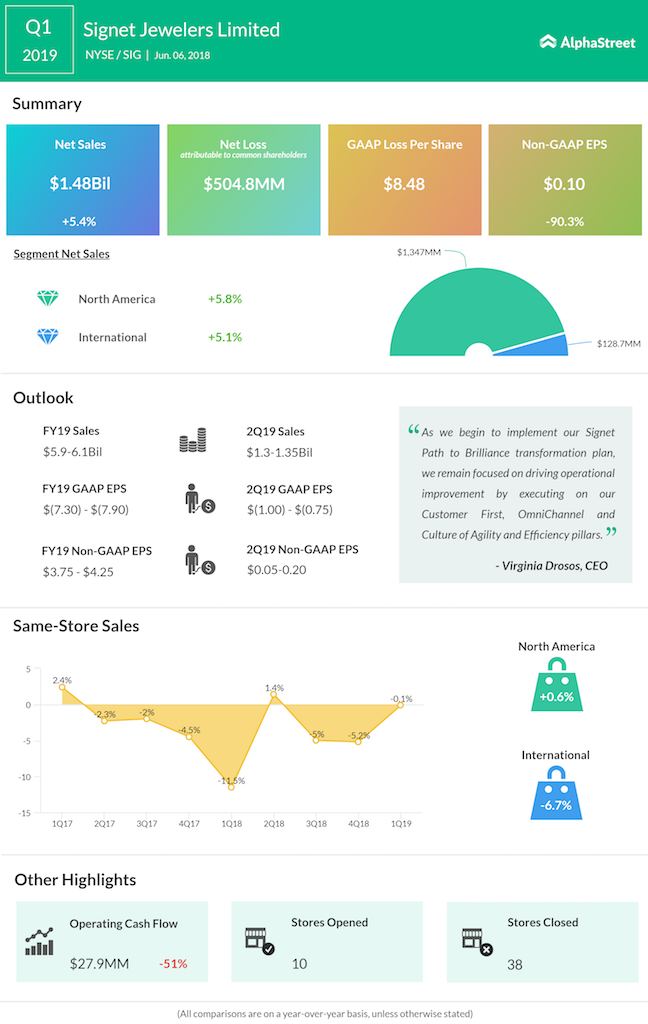

Net loss attributable to common shareholders was $504.8 million or $8.48 per share compared to a net income of $70.3 million or $1.03 per share last year. The net loss included impacts from a non-cash impairment charge related to goodwill and intangibles, loss associated with non-prime receivables and restructuring charges. Adjusted diluted EPS was $0.10. The company beat market estimates on revenue and adjusted EPS sending shares climbing 8% premarket. The upward momentum continued when the market opened and the stock soared 17% at 10 AM ET.

Looking at revenues by segment, in the North America segment, total sales increased 5.8% to $1.34 billion while in the International segment, sales grew 5.1% to $128.7 million. Turning to sales for each brand, Kay total sales improved 3.1%, and Zales jumped 7.9% from last year. Piercing Pagoda saw a 6.7% growth in sales while Jared saw a 2.2% decline.

For the second quarter of 2019, Signet expects same-store sales to decrease in the mid-single-digit percentage range. Total sales are expected to be $1.3 billion to $1.35 billion. GAAP diluted loss per share is touted to be $0.75 to $1.00 while adjusted diluted EPS is estimated to be $0.05 to $0.20.

For the fiscal year 2019, same-store sales are expected to be down in the low to mid-single digit percentage range. Total sales are expected to be $5.9 billion to $6.1 billion. GAAP diluted loss per share is expected to be $7.30 to $7.90 while adjusted diluted EPS is expected to be $3.75 to $4.25. The company plans to close more than 200 stores and open 35 to 40 stores in FY19.

The Board of Directors declared a quarterly cash dividend of $0.37 per share for Q2 2019, payable on August 31, 2018, to shareholders of record on August 3, 2018. Signet also announced the appointments of Mary Elizabeth Finn as Chief People Officer and Stephen E. Lovejoy as Chief Supply Chain Officer, effective immediately. Finn and Lovejoy will report directly to CEO Virginia C. Drosos.