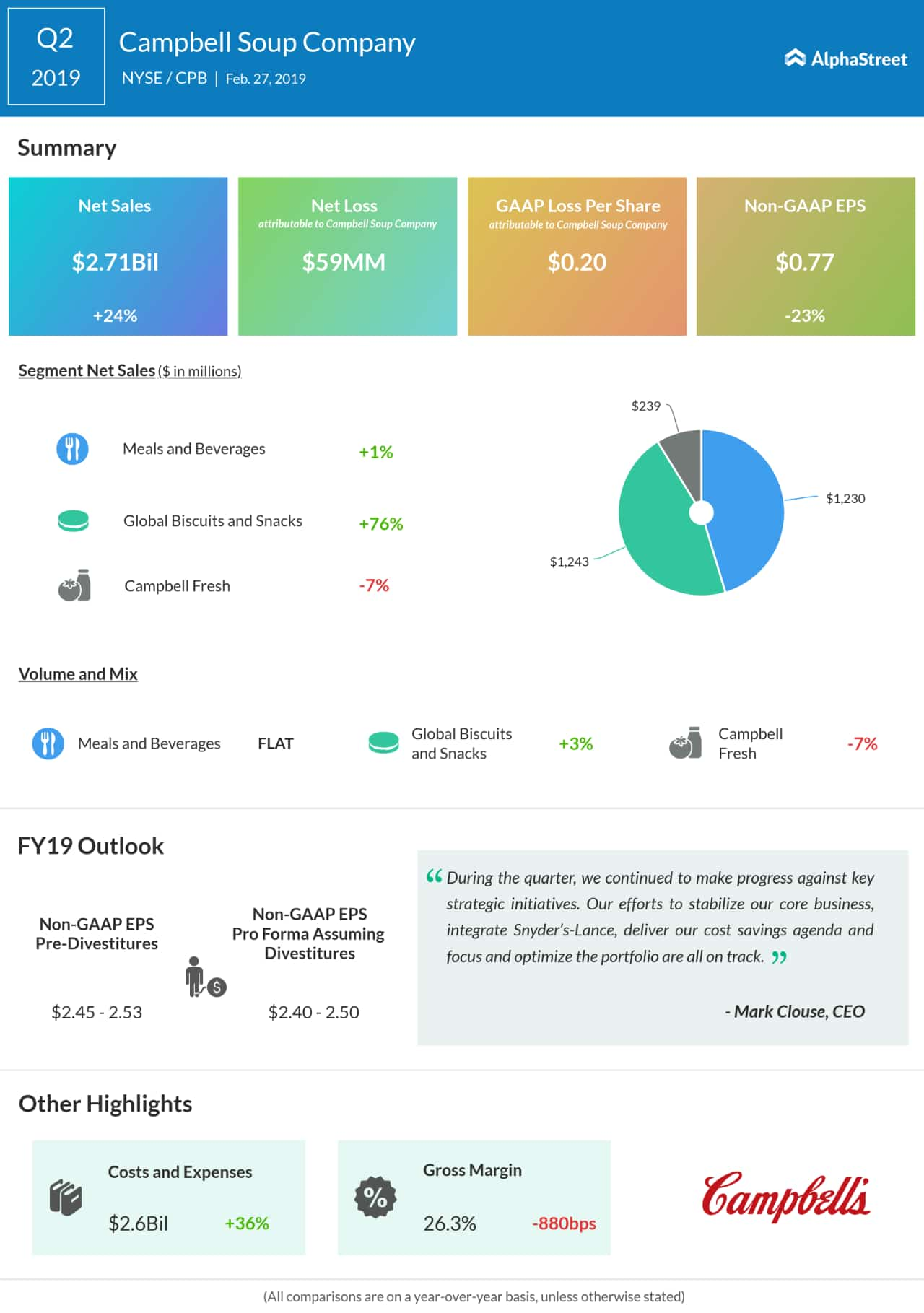

Net loss attributable to Campbell Soup Company totaled $59 million, or $0.20 per share, compared to a net income of $285 million, or $0.95 per share, in the prior-year quarter. The GAAP results reflect impairment charges related to the Campbell Fresh segment.

Adjusted EPS dropped 23% to $0.77, reflecting EBIT declines in the base business, a higher adjusted tax rate and a dilutive impact from the Snyder’s-Lance and Pacific Foods acquisitions.

Sales in the Meals and Beverages segment inched up by 1% to $1.23 billion during the quarter. In Global Biscuits and Snacks, sales jumped 76% year-over-year, reflecting strength in Pepperidge Farm. In the Campbell Fresh segment, sales fell 7% due to declines in refrigerated soup, Bolthouse Farms refrigerated beverages and Garden Fresh Gourmet.

For the full year of 2019, on a pro forma basis, assuming divestitures, net sales are expected to be $7.9 billion to $8.0 billion and adjusted EPS is expected to be $2.40 to $2.50. Pre-divestitures, net sales is expected to range between $9.9 billion and $10.1 billion while adjusted EPS is expected to be $2.45 to $2.53.

During the second quarter, Campbell achieved $50 million in savings under its multi-year cost savings program, inclusive of Snyder’s-Lance synergies, bringing total program-to-date savings to $550 million. The company expects cumulative annualized savings of $945 million by the end of fiscal 2022.