Campbell Soup Company (CPB) topped consensus estimates on revenue and earnings for the second quarter of 2019, sending shares climbing over 5% in premarket hours on Wednesday.

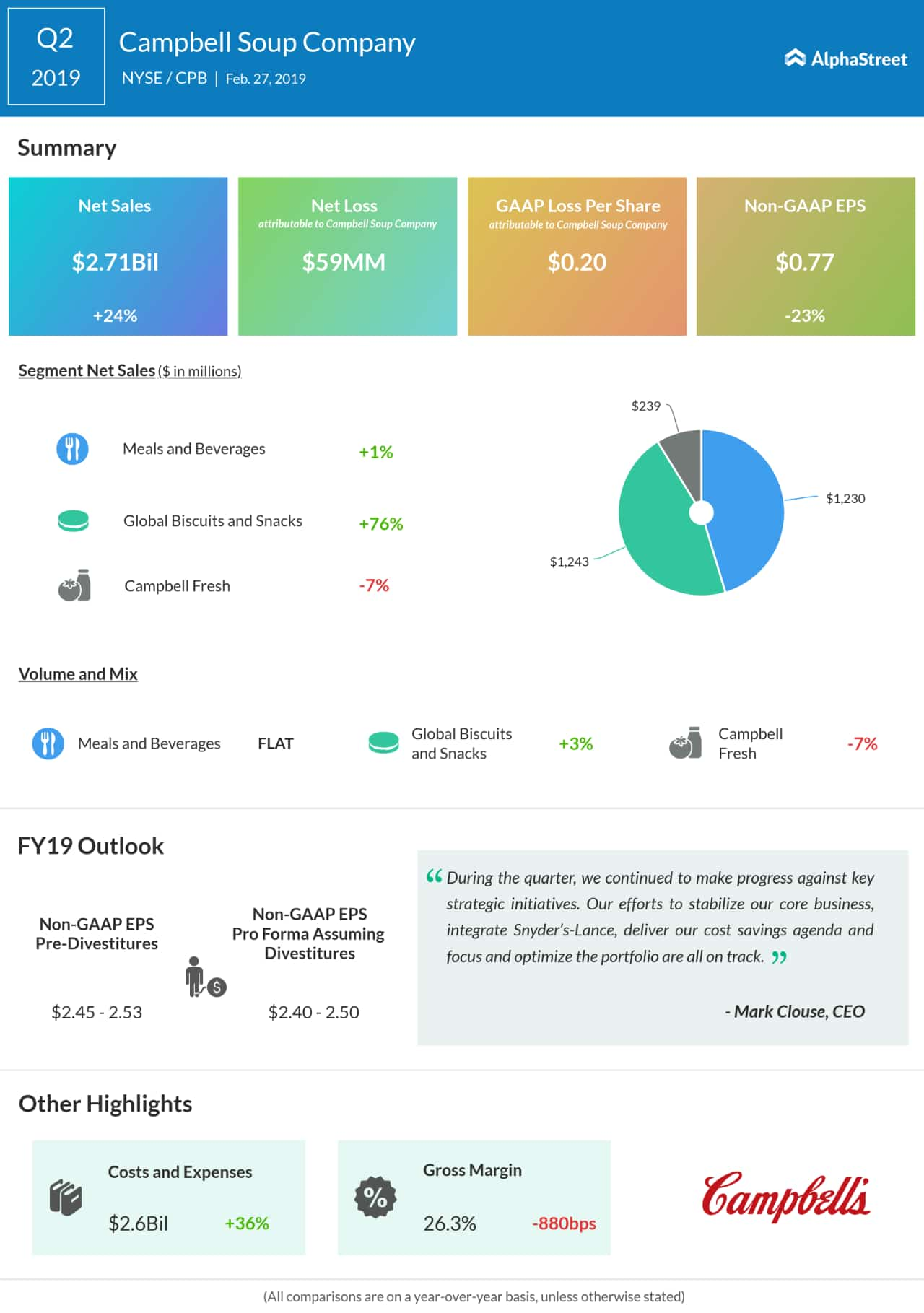

Net sales rose 24% to $2.7 billion from the same period a year ago, reflecting benefits from the recent acquisitions of Snyder’s-Lance and Pacific Foods. Organic sales were comparable to the prior year as gains in Global Biscuits and Snacks were offset by declines in Campbell Fresh as well as Meals and Beverages.

Net loss attributable to Campbell Soup Company totaled $59 million, or $0.20 per share, compared to a net income of $285 million, or $0.95 per share, in the prior-year quarter. The GAAP results reflect impairment charges related to the Campbell Fresh segment.

Adjusted EPS dropped 23% to $0.77, reflecting EBIT declines in the base business, a higher adjusted tax rate and a dilutive impact from the Snyder’s-Lance and Pacific Foods acquisitions.

Sales in the Meals and Beverages segment inched up by 1% to $1.23 billion during the quarter. In Global Biscuits and Snacks, sales jumped 76% year-over-year, reflecting strength in Pepperidge Farm. In the Campbell Fresh segment, sales fell 7% due to declines in refrigerated soup, Bolthouse Farms refrigerated beverages and Garden Fresh Gourmet.

For the full year of 2019, on a pro forma basis, assuming divestitures, net sales are expected to be $7.9 billion to $8.0 billion and adjusted EPS is expected to be $2.40 to $2.50. Pre-divestitures, net sales is expected to range between $9.9 billion and $10.1 billion while adjusted EPS is expected to be $2.45 to $2.53.

During the second quarter, Campbell achieved $50 million in savings under its multi-year cost savings program, inclusive of Snyder’s-Lance synergies, bringing total program-to-date savings to $550 million. The company expects cumulative annualized savings of $945 million by the end of fiscal 2022.