Slowdown

The stock price has nearly halved in the past five years though it made a few short-lived recoveries. Taking advantage of the production slowdown, the Boeing leadership has initiated a program to review safety measures and train employees to ensure quality standards across production lines. In the first half of the fiscal year, overall performance will likely remain under pressure from near-term delivery shortfalls.

Boeing’s CEO Dave Calhoun, who took the helm after the ouster of former chief Dennis Muilenburg in 2019 following the twin crashes, will be stepping down by year-end. His retirement is part of a major management shakeup initiated by the company amid heightened concerns over the safety of Boeing aircraft, especially after the January accident.

Spirit Deal

As part of its efforts to revive the business, Boeing this week signed an agreement to acquire a majority stake in longtime supplier Spirit AeroSystems (NYSE: SPR), a leading manufacturer of aerostructures for commercial aircraft and defense platforms, for about $4.7 billion. Boeing’s arch-rival Airbus SE will be buying the remaining stake in Spirit. The deal is expected to lift the confidence of Boeing shareholders, but the market will be closely watching how effectively the company integrates the new business while solving its own problems.

It might not be an easy task for the company to execute its recovery strategy and get back on track as planned. Winning back the trust of stakeholders and the broad market is very important for Boeing’s stock to move in the right direction, and it is likely to take some time.

“As we operate at these lower production rates, we’re actively monitoring our liquidity levels and believe we have significant market access and are continuously monitoring and evaluating opportunities should we decide to supplement our liquidity position. Longer-term, we remain confident in our ability to achieve $10 billion of free cash flow. However, given our continued focus on safety, quality, stability, we continue to expect that this goal will take us longer than we originally planned and later in the 2025, 2026 window primarily tied to the 737 and 787 production delivery ramps of 50 per month and 10 per month, respectively,” Boeing CFO Brian West said at the Q1 earnings call.

Financials

When Boeing reports second-quarter results on July 24, before the opening bell, the market will be looking for an adjusted loss per share of $1.09 per share, as per analysts’ latest estimates. In the year-ago quarter, the company had incurred a loss of $0.82 per share, excluding special items. The consensus revenue forecast for the June quarter is $17.8 billion.

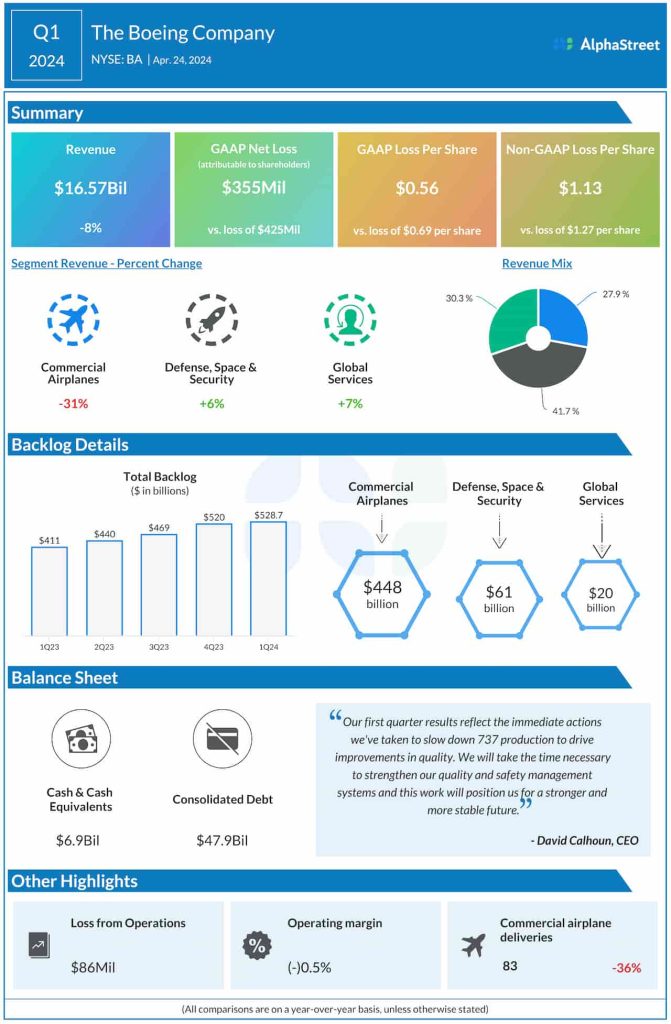

For the first three months of fiscal 2024, the company reported a narrower adjusted loss of $1.13 per share than the $1.27/share loss recorded a year earlier. Meanwhile, Q1 revenues decreased 8% annually to $16.6 billion as Commercial Airplanes revenue declined by a third. Deliveries in that segment plunged 38% year-over-year.

Boeing’s shares dropped a dismal 32% so far this year. They traded slightly lower on Tuesday afternoon after closing the previous session lower.