User base

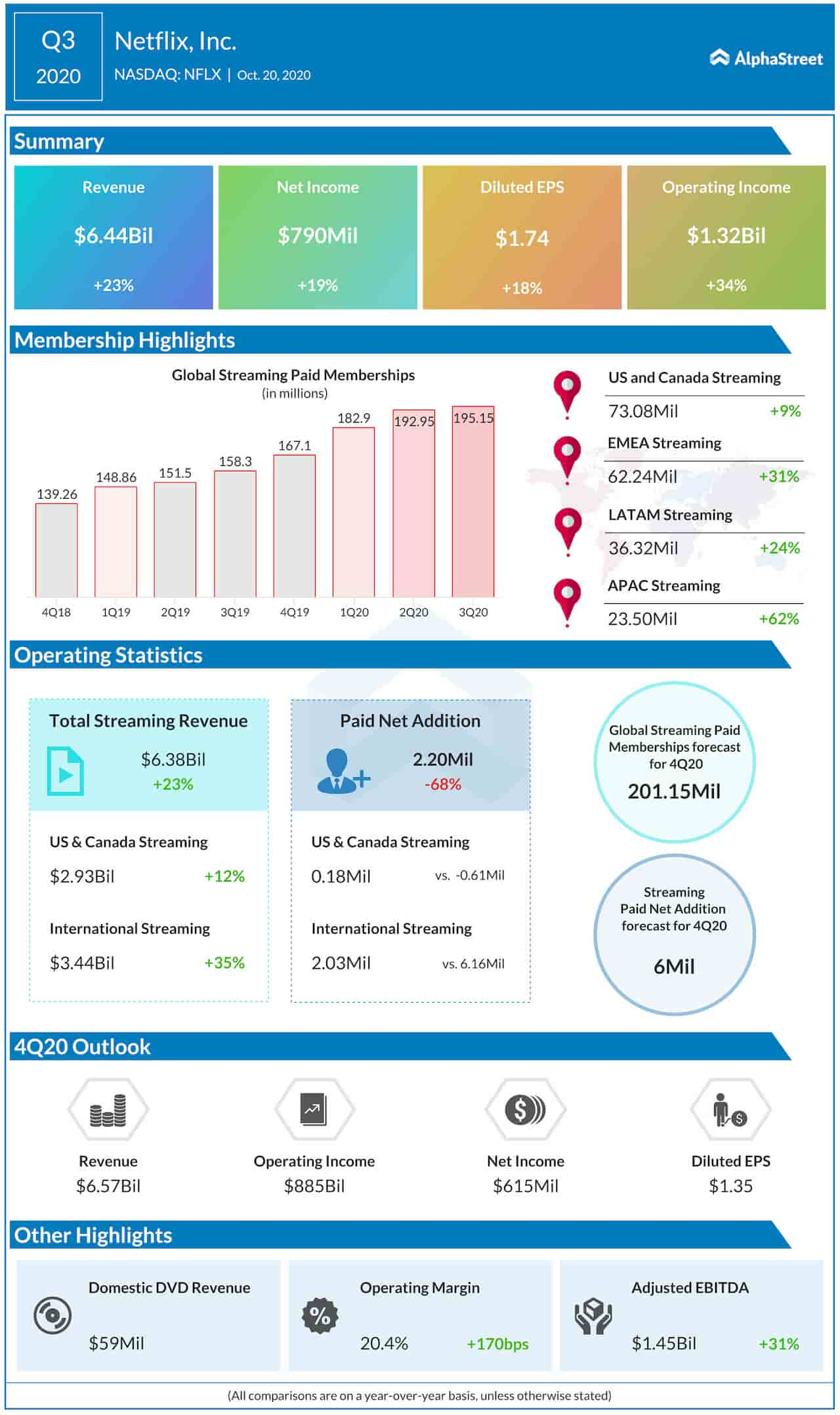

This was a sharp decrease from 15.7 million and 10 million seen in the first two quarters of this year which the company attributed to a pull-forward effect as more users turned to online entertainment options during the COVID-19 pandemic.

Netflix has projected net adds of 6 million for the fourth quarter of 2020 compared to 8.8 million in the same period in 2019 as the momentum seen in the first half of the year decelerates in the second half.

The company anticipates its growth will return to pre-pandemic levels in 2021 even though net adds are expected to be down in the first half of the year versus the same period in 2020. There is a bit of uncertainty surrounding this growth projection when you consider the rapid growth of Netflix’s competitors and the share that they are picking up in the streaming market.

At the time of its launch, Walt Disney (NYSE: DIS) expected its streaming service Disney + to gain 60-90 million subscribers by 2024. Within its first year, Disney + reached approx. 74 million subscribers and appears to be on track on achieve its goal before the projected timeframe.

AT&T’s (NYSE: T) total domestic HBO and HBO Max subscribers topped 38 million and 57 million worldwide respectively at the end of its most recent quarter. This included 8.6 million HBO Max activations. As of Tuesday, this number stood at 12.6 million activations, with the number of hours of engagement per week rising 36% in the past 30 days.

Content

Content is an area where Disney + and HBO Max may have an edge over Netflix as both of them have several movies and popular TV shows in their library while also investing in original content. AT&T’s Warner Bros. division recently announced that it would release 17 new movies in theaters and on HBO Max simultaneously in 2021.

Meanwhile, Netflix has lost access to a couple of popular TV series as rivals launched their own services with their exclusive content. To counter this, Netflix has been investing in original content and this strategy has paid off well to an extent. However, the production of original content has reportedly faced challenges due to the pandemic and this may take a toll on the company’s performance in the near-term.

Expansion opportunity

Almost half of Netflix’s global paid net adds came from the APAC region during its third quarter while revenues increased double-digits. The company has seen good momentum in countries like South Korea and Japan and it is focused on taking advantage of the opportunity in regions like India.

India is a country where there appears to be significant growth potential for streaming service providers. Disney+ holds a good share of this market through its Disney+ Hotstar service. Disney+ Hotstar subscribers comprise a little over a quarter of the global subscriber base.

Disney has plans to launch Disney + in various markets in the Asia-Pacific region in 2021 and it plans to unveil a general entertainment DTC video streaming offering under the Star brand outside the US next year.

In conclusion, Netflix appears to be holding its ground at present but things might get difficult going forward considering the rapid growth its rivals are making in terms of subscriber growth, market expansion and content.

Click here to read the full transcripts of these companies’ recent earnings conference calls