The COVID vaccination campaign and the upbeat stock market, which witnessed a rally as many industries thrived on the virus-driven business boom, have added to the recovery hopes of the financial service sector. Citigroup Inc. (NYSE: C), which has embarked on a restructuring program under new chief Jane Fraser, is probably entering a period of sustained growth after navigating the crisis.

A Buying Opportunty?

It is estimated that the bank’s stock market performance would improve in the coming months, despite the concerns surrounding its lackluster revenue performance. It is worth noting that the stock has recouped most of the COVID-induced losses in recent months. While the majority of analysts following Citi see a buying opportunity, others have adopted a cautious stance citing the continuing macroeconomic uncertainty. Their average price target is $83.31, which is up around 15%.

Read management/analysts’ comments on Citigroup’s Q1 report

Fraser, who is the first woman to head a Wall Street bank, has an important task at hand – to lead the company’s recovery from the pandemic and regain investors’ confidence. Under her regime, the bank resumed its share buyback program, after enhancing the capital position. In a strategic move, the management has decided to exit more than a dozen consumer banking markets, including China, to focus more on the wealth management business. Currently, the focus of the growth strategy is on moving resources to high-returning businesses and away from underperforming areas.

Strain on Revenue

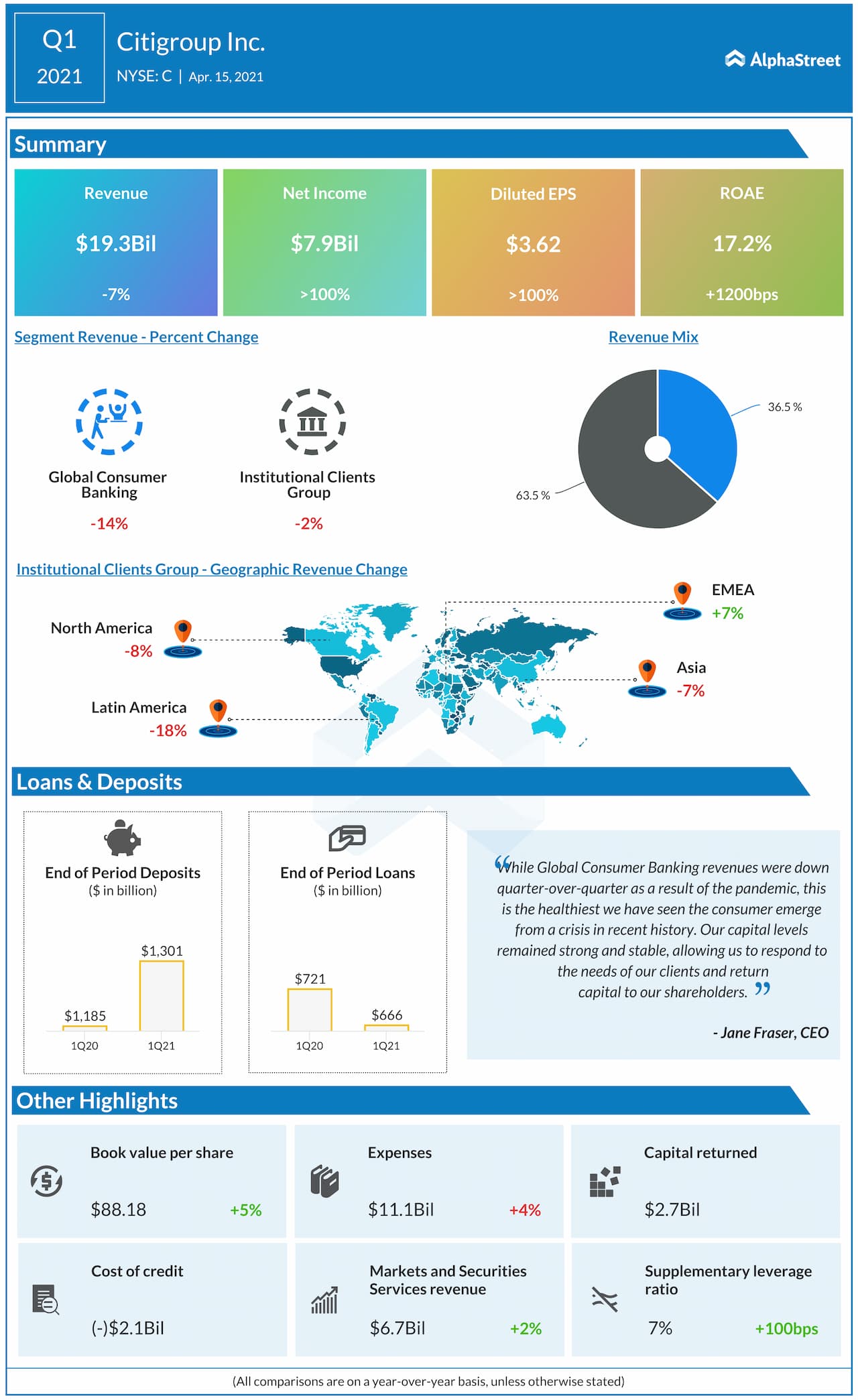

Net profit, on a per-share basis, grew more than two-fold to $3.62 in the first quarter of 2021 and topped the Street view. Earnings got a boost from the release of loan loss reserves of about $3.9 billion. Meanwhile, revenues of the main operating divisions – global consumer banking and institutional clients group – dropped, resulting in a 7% decline in total revenues to $19.3 billion. Though the bottom-line experienced weakness during the crisis period, it stayed above the estimates consistently.

From Citigroup’s Q1 2021 earnings conference call:

“The bigger impact on loans is from the high payment rates. This is creating revenue pressure, but it’s also benefiting our delinquency and loss trends. So the good news is that we’re seeing the recovery in spend, which should continue, and our credit portfolio is proving to be quite resilient. We are now focused on loan and revenue recovery through driving spend activity, reentering the market for new account acquisitions, and investing in lending capabilities and new value propositions.”

Stock Performance

In a sign that the mixed first quarter outcome did not go well with investors, Citi’s stock began Thursday’s regular trading on a low note and maintained the downtrend throughout the session. In the past twelve months, the stock moved up 58% and is currently trading close to the pre-pandemic levels.