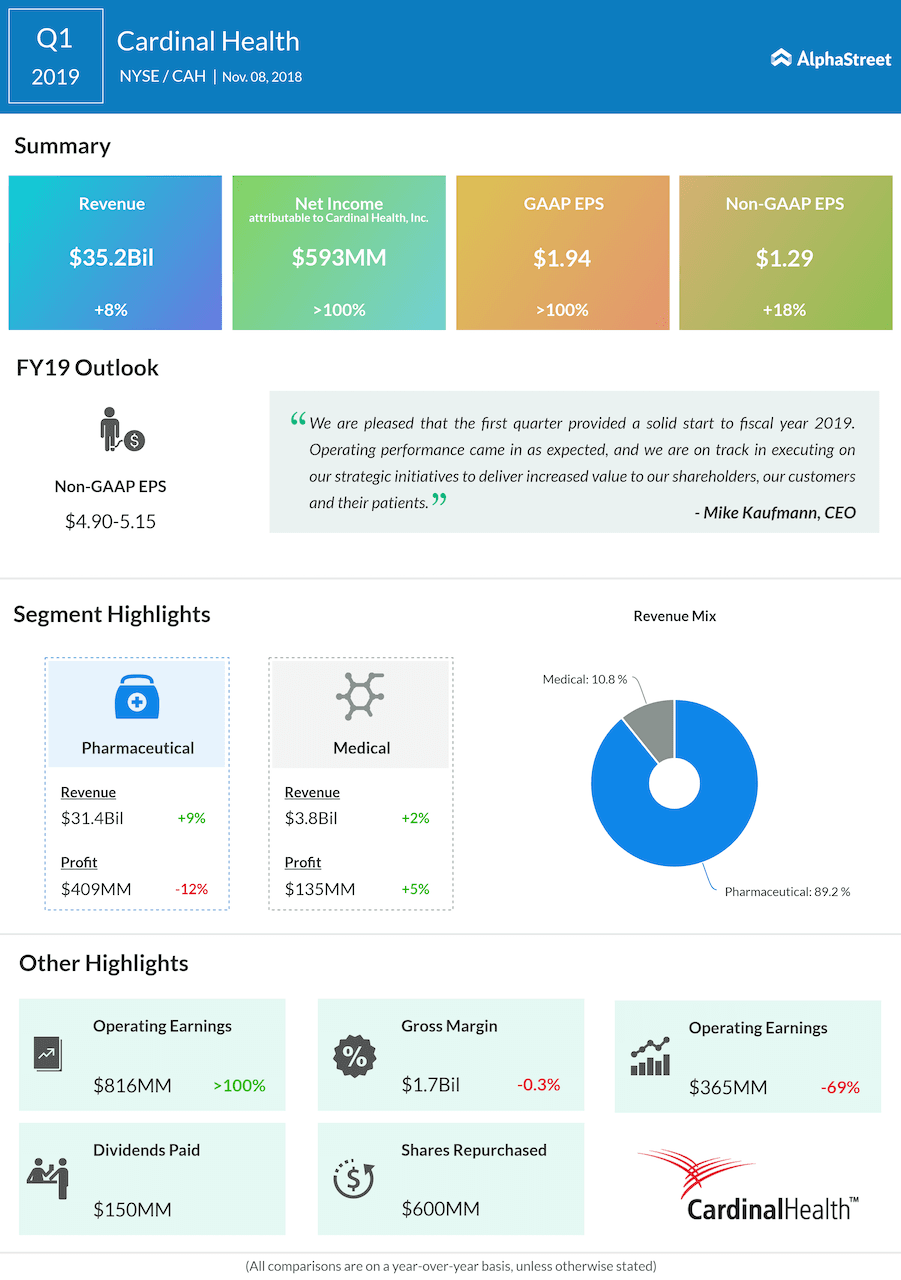

Revenue increased 8% to $35.21 billion. The results were driven by sales growth from Pharmaceutical Distribution and Specialty Solutions customers as well as new and existing Medical segment customers.

Revenue for the Pharmaceutical segment increased 9% on sales growth from Pharmaceutical Distribution and Specialty Solutions customers, partially offset by the divestiture of the company’s China distribution business. Revenue for the Medical segment rose 2% driven primarily by new and existing customers.

Looking ahead into the fiscal year 2019, the company reaffirmed its non-GAAP earnings guidance in the range of $4.90 to $5.15 per share.

Pelosi in the lead for Speaker job as tech, healthcare stocks jump on midterm results

During the third quarter, Cardinal Health said Victor Crawford will join the company as CEO of the Pharmaceutical segment on November 12. In addition, the board of directors approved a quarterly dividend of $0.4763 per share. The dividend will be payable on January 15, 2019, to shareholders of record at the close of business on January 2, 2019.

The company recently completed a $600 million share repurchase program, and this week, the board of directors approved a three-year authorization to repurchase up to an additional $1 billion of Cardinal Health common shares, which will expire on December 31, 2021. The company is now authorized to repurchase up to $1.3 billion of its common shares.

Shares of Cardinal Health ended Wednesday’s regular session up 2.13% at $53.65 on the NYSE. The stock has fallen over 10% in the past year and over 12% in the year so far.