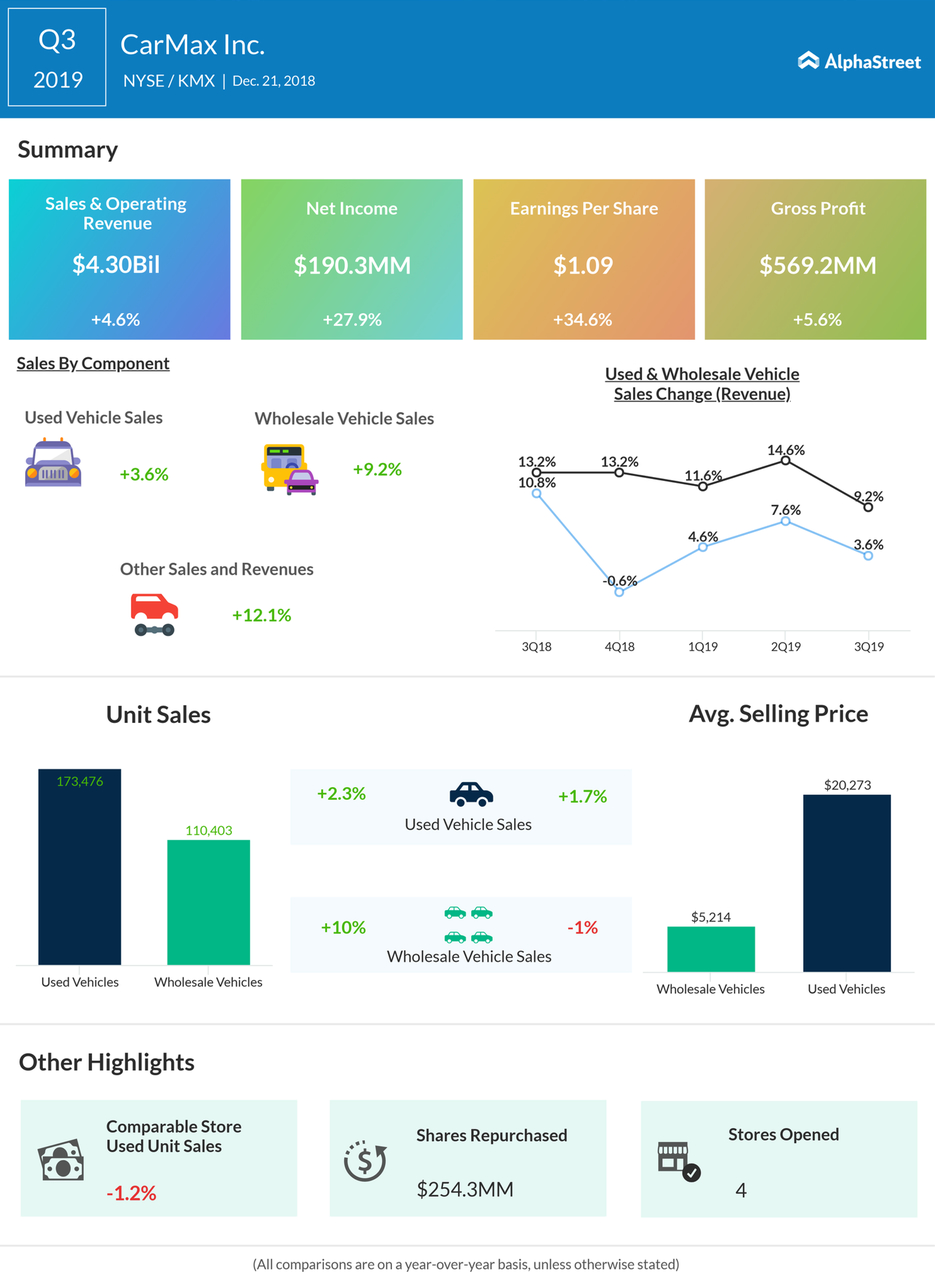

Net earnings rose 34.6% to $1.09 per diluted share or $190.3 million.

Analysts had expected earnings of $1.01 per share on revenue of $4.35 billion for the period.

For the last three months, CarMax shares have underperformed the industry, with the stock declining 12% vs. the 25% rise for the sector.

For the quarter, total used unit sales rose 2.3%, while wholesale unit sales jumped 10.0%. CarMax Auto Finance (CAF) income rose 6.7% to $109.7 million.

Net earnings for the reporting period benefitted from the decrease in the effective tax rate to 23.2% from 33.9% in the prior year’s third quarter, primarily reflecting the effect of the Tax Cuts and Jobs Act of 2017.

Compared with the third quarter of fiscal 2018, SG&A expenses rose 2.5% to $409.5 million. Continued investment in technology platforms and an 11% increase in its store base, representing the addition of 19 stores, were the reason for this rise in expenses.

During the third quarter, CarMax opened four stores, all in new television markets — Wilmington, North Carolina; Lafayette, Louisiana; Corpus Christi, Texas; and Shreveport, Louisiana.

This quarter saw the seconds’ retailer take an aggressive stance to pursue store expansion. In the first half of fiscal 2019, SG&A expenses shot up 10.3% to $891.8 million due to store openings. For fiscal 2019, CarMax had earlier projected capex of around $340 million.