CEO Jim Umpleby said, “We expect continued global economic uncertainty to pressure sales to users in 2020 and cause dealers to further reduce inventories. We have improved our lead times and remain prepared to respond quickly to any positive or negative changes in customer demand.

READ: Amazon (AMZN) stock jumps after smashing past Q4 earnings estimate

Operating profit margin was 14.1% for the fourth quarter of 2019, compared with 13.1% for the fourth quarter of 2018.

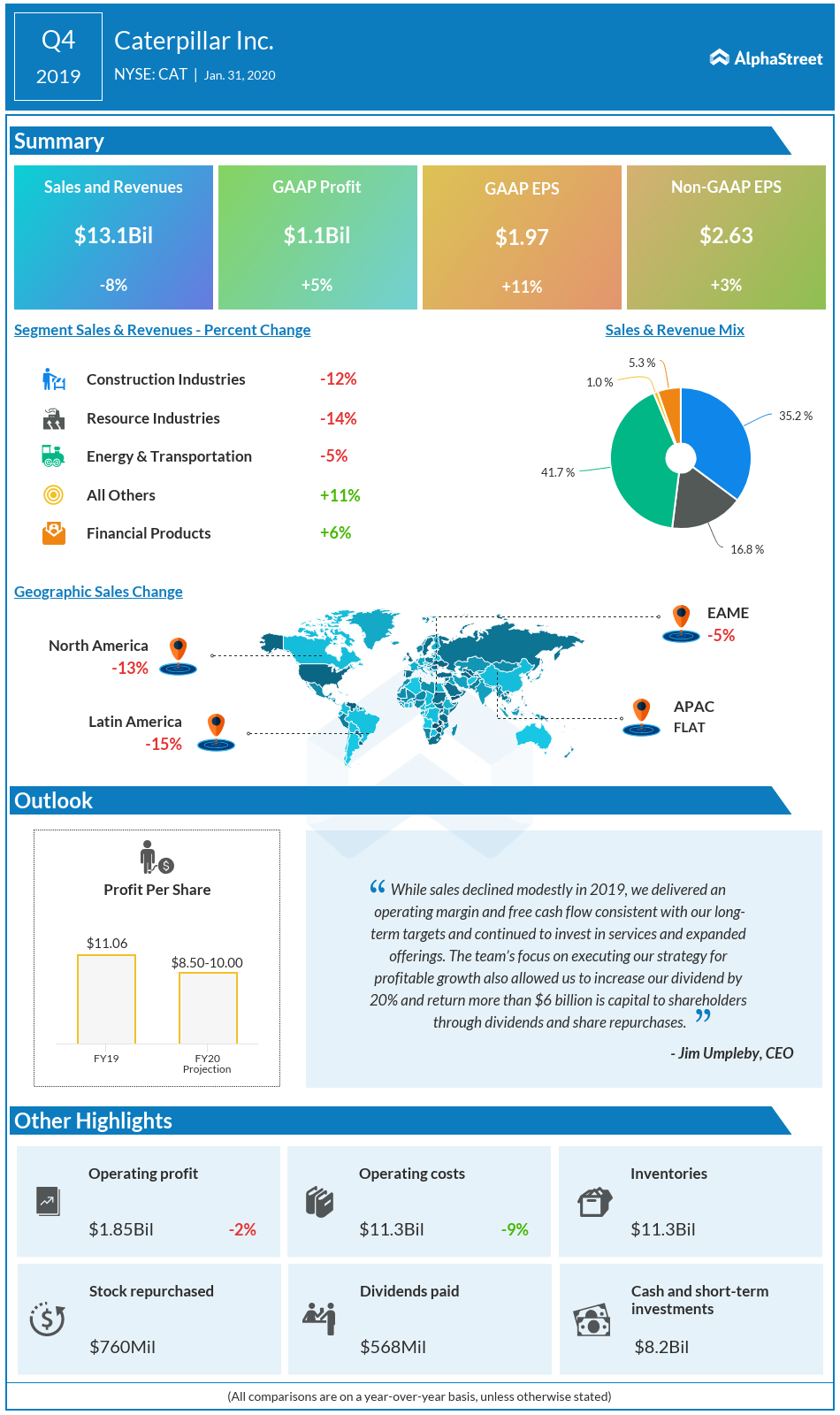

For the fiscal year 2020, the company currently expects adjusted EPS of $8.50 – $10.00.

Caterpillar shares were over 1.5% immediately following the announcement, thanks to the earnings beat. Over the last 12 months, CAT stock has mostly traded sidewise and is currently up about 2%.