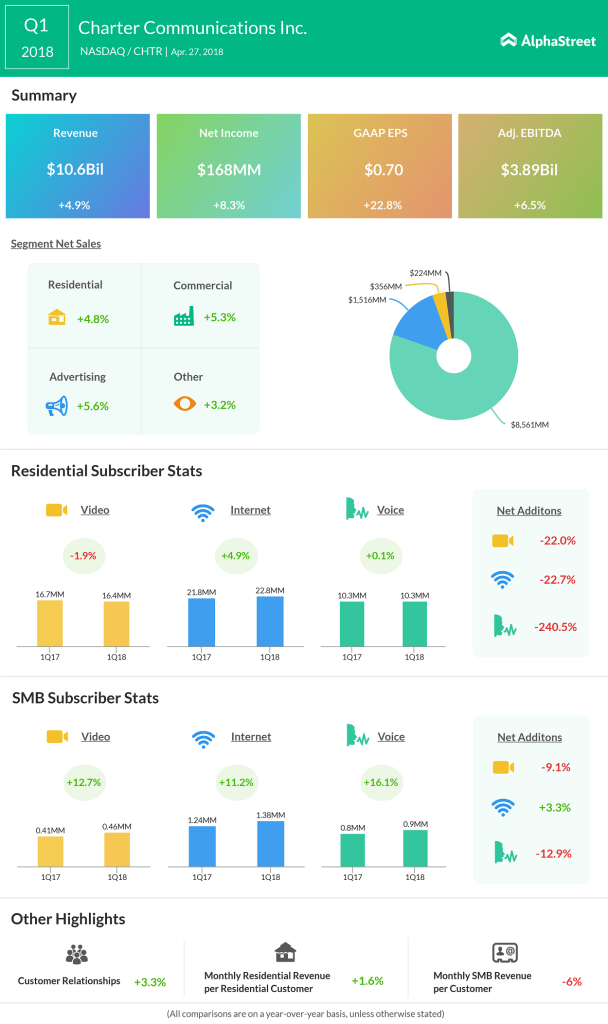

Revenue benefited from growth in Internet, video, commercial and advertising revenues. Video revenue rose 5.3% driven by rate adjustments and a higher number of expanded basic video customers.

Internet revenue grew 9.1% helped by growth in internet customers as well as promotional roll off. Meanwhile, Commercial revenue increased 5.3% on SMB and enterprise revenue growth. Higher political revenue drove advertising revenue higher by 5.6%.

On the other hand, Voice revenues fell 19.8% due to value-based pricing and revenue allocation relating to the launch of Spectrum pricing and packaging in Legacy TWC and Legacy Bright House.

In the first quarter, total residential and SMB video, internet and voice customers increased by 225,000, with internet net additions of 362,000.

Video revenue rose 5.3% driven by rate adjustments and a higher number of expanded basic video customers.

Capital expenditures increased by 37.5% primarily due to in-year timing differences and Charter’s all-digital initiative. The latest quarter Capex included all-digital costs and 2018 mobile launch costs.

During the quarter, the company incurred a 3.6% decline in cash flow from operating activities due to a more unfavorable change in working capital and higher cash paid for interest. Lower cash flow from operating activities and higher Capex, including a larger decrease in accrued expenses associated with Capex, hurt free cash flow, which turned negative from positive last year.