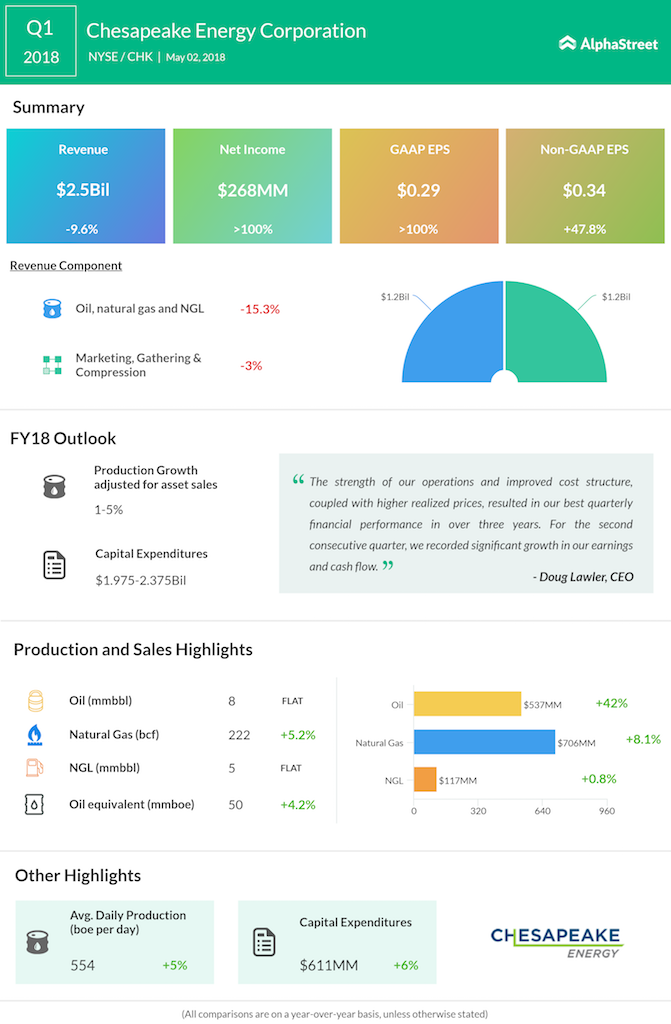

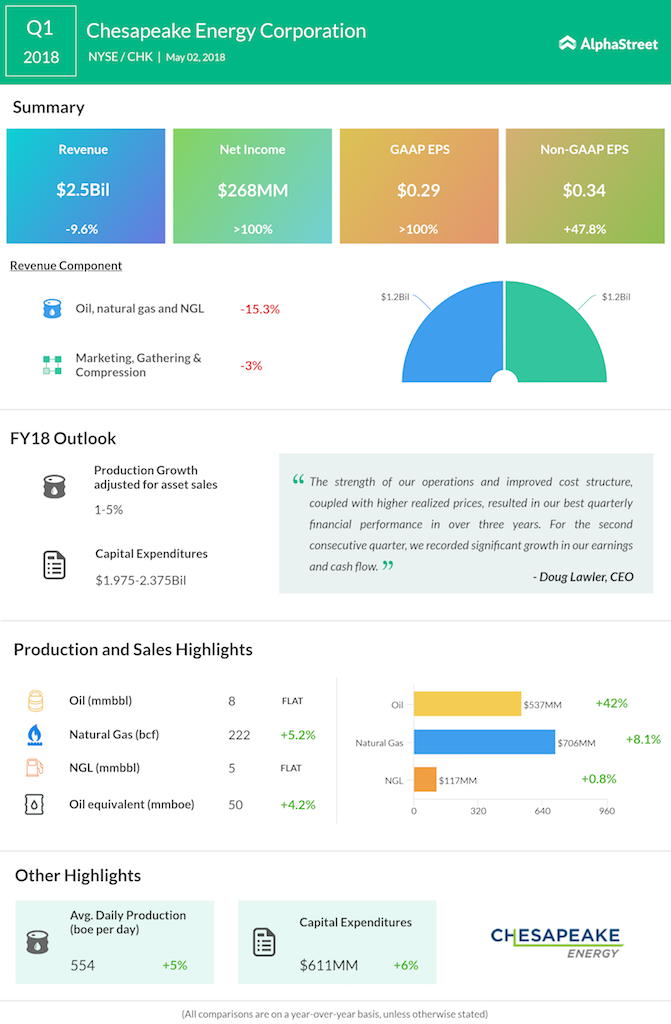

The Oklahoma-based oil producer’s production climbed almost 5% to 554,000 barrels of oil equivalent (boe) per day, while the count of gross wells supplying to the market dropped 25%. Average oil production for the quarter was about 92,000 barrels of oil per day, spiking 16% year-over-year adjusted for asset sales.

Chesapeake’s average realized oil price jumped 10% to $56.89 per barrel in the quarter, while its natural gas price climbed almost 16% to $3.49 per Mcf. This trend was in accordance with the trend among U.S. light crude producers this quarter, who have all profited from an around 33% ascent in costs of U.S. light crude when compared to a year ago.