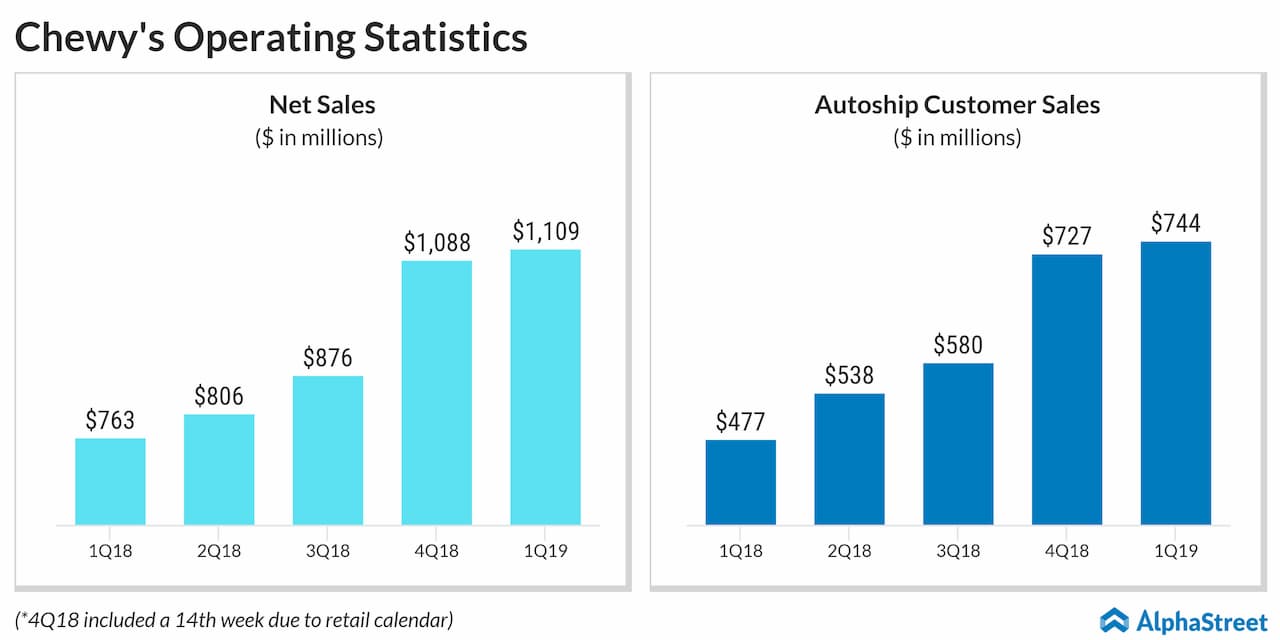

Net sales soared by 45.2% to $1.11 billion. This is mainly driven by pet food sales apart from supplies, medicines, vet care, pet services and sale of pets. The company continued to see growth in its customer base as well as increased spending among its customers.

Looking ahead, the company expects net sales for the second quarter to jump by 39% to 42% year-over-year to the range of $1.12 billion to $1.14 billion. For fiscal 2019, net sales are anticipated to increase by 32% to 34% year-over-year to the range of $4.675 billion to $4.75 billion. Adjusted EBITDA margin for the full year is projected to be 400 to 450 basis points improvement year-over-year.

For the first quarter, active customers soared by 44.6% year-over-year to 11.3 million and net sales per active customer increased by 9.2% to $343. Autoship customer sales, customers for whom an order is shipped through its Autoship subscription program, surged by 55.8% to $743.85 million from the previous year quarter.

For the first quarter, the company used more cash in operating activities due to net loss, depreciation and amortization expense, share-based compensation expense, as well as a rise in cash consumed by working capital arising from the timing of payables and inventory build.

The negative free cash flow turned wider in the first quarter due to the impact of capital investments associated with the launch of Dayton, Ohio fulfillment center and capacity build at Kentucky and Phoenix pharmacy locations.

Chewy has been facing stiff competition from behemoths like General Mills (NYSE: GIS), Walmart (NYSE: WMT) and Amazon (NASDAQ: AMZN) that have firm footing in the market.

Shares of Chewy ended Thursday’s regular session up 3.76% at $32.85 on the NYSE. Following the earnings release, the stock rose 0.49% in the after-market session.