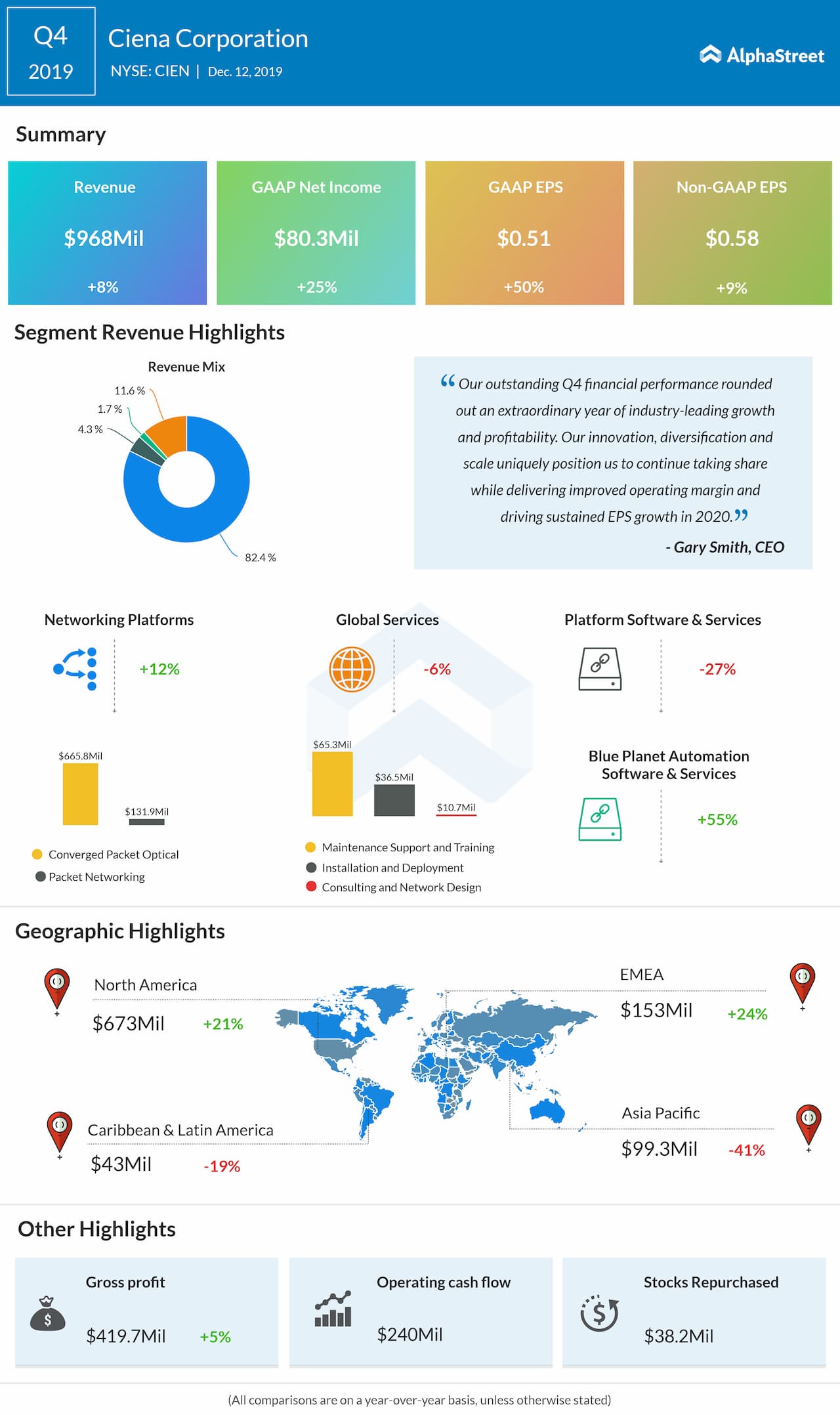

— Ciena Corporation (NYSE: CIEN) reported its fourth-quarter 2019 adjusted earnings of $0.58 per share versus $0.63 per share expected.

— Revenue grew by 8% to $968 million versus $964.29 million expected.

— Revenue from networking platforms grew by 12% while that from platform software and services dropped by 27%.

— Total global services revenue decreased by 6% while revenue from blue planet automation software and services rose by 55%

— Geography-wise, revenue from North America grew by 21% while that from the Asia Pacific fell by 41%.

— Revenue from Europe, Middle East, and Africa increased by 24% and that from the Caribbean and Latin America dropped by 19%.

— Over the next three years, Ciena predicts revenue of about 6-8% annual growth and adjusted EPS of over 20% annual growth.

— The adjusted operating margin is projected to be 15% for fiscal 2020 and at least 15% in fiscal 2021.

— In each of the next three years, free cash flow is expected to be about 60-70% of adjusted operating income.