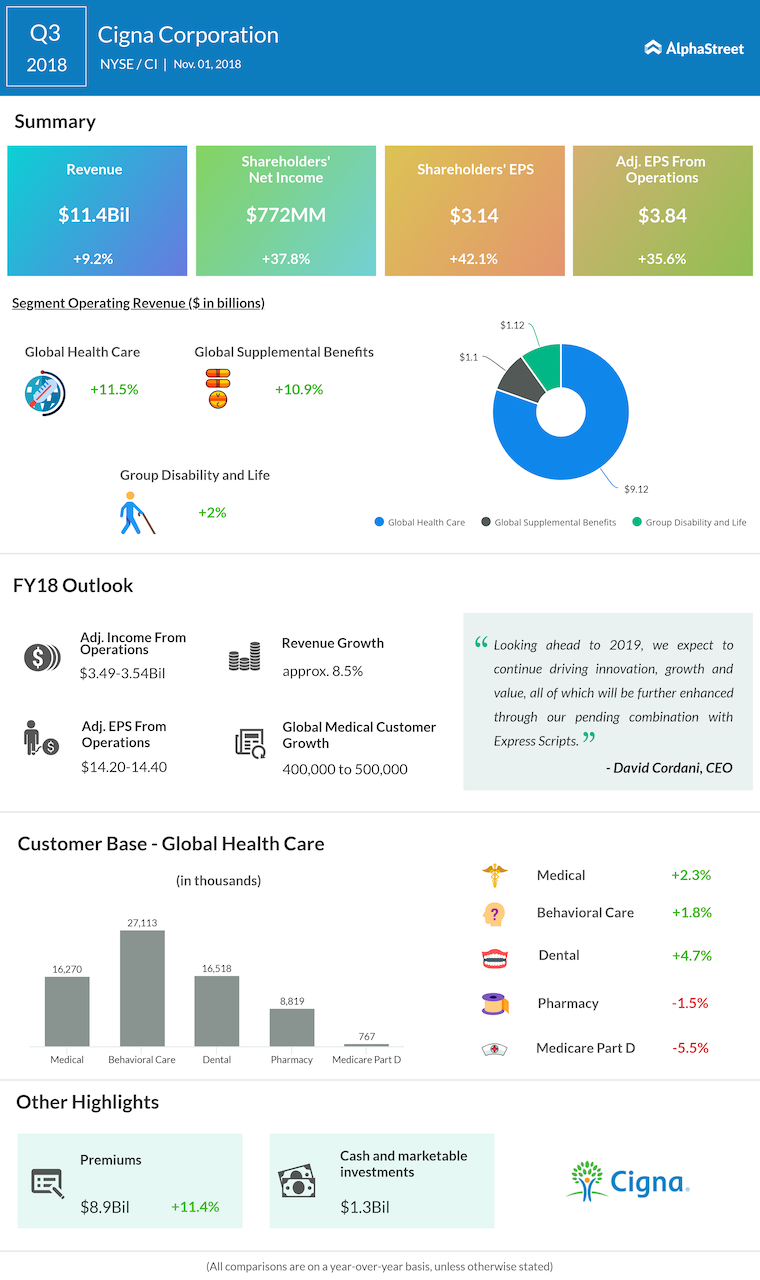

Continued strong business growth in Cigna’s Global Health Care and Global Supplemental Benefits segments drove total revenues higher by 9% to $11.5 billion.

Global Health Care revenues increased 12% year-over-year on Commercial customer growth and expansion of specialty relationships as well as premium rises consistent with underlying cost trends. Cigna’s medical customer base at the end of the third quarter rose by 363,000 to 16.3 million on continued organic growth in Select, Middle Market, and Individual segments.

Global Supplemental Benefits revenues grew 11% on continued business growth in its targeted markets with the further expansion of customer relationships through continued innovation in product design and distribution strategies. Revenue from Group Disability and Life rose by 2% on continued solid performance in both disability and life businesses.

Looking ahead into the full year 2018, the company now expects total revenues growth of about 8.5% and adjusted income from operations in the range of $14.20 to $14.40 per share. Global Medical customer growth is predicted to be 400,000 to 500,000 customers. The per share outlook excludes the impact of additional prior year reserve development and the potential effects of any future capital deployment.

For 2019, Cigna expects to continue driving innovation, growth, and value, all of which will be further enhanced through its pending combination with Express Scripts Holding Corp (ESRX).

Shares of Cigna ended Wednesday’s regular session up 1.70% at $213.81 on the NYSE. The stock has risen over 8% in the past year and over 5% since the beginning of the year.