What happened?

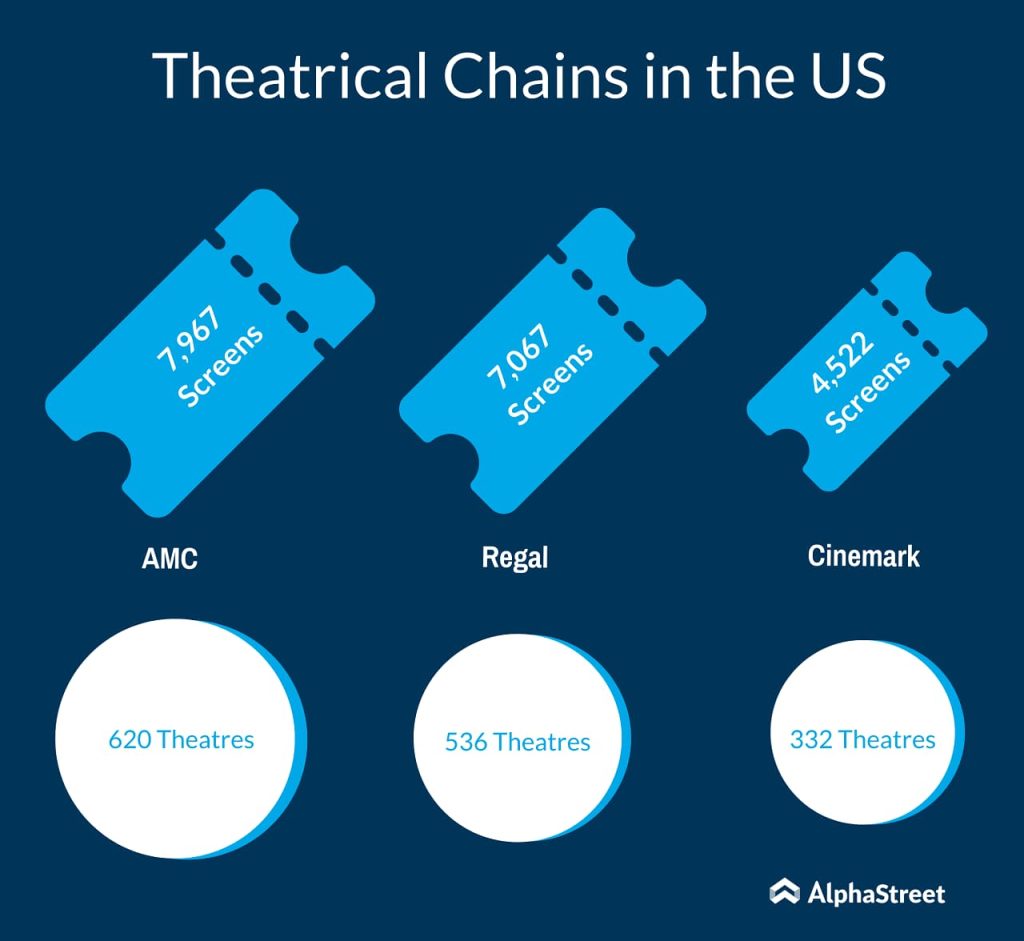

Theatre chain Regal said yesterday that it will temporarily suspend operations at all of its 536 theatres in the US, from Thursday, October 8, 2020. This affected the stock performance of Cinemark (NYSE: CNK), which plunged about 17% and ended at $8.33 on Monday. Another leading theatre chain operator AMC Entertainment (NYSE: AMC) tumbled 11%.

Regal’s parent company, the UK-based Cineworld is also closing its 127 theatres in the UK with effect from October 8.

Cinemark overview

Headquartered in Plano, Texas, Cinemark operates 534 theatres with 5,977 screens globally including 332 theatres and 4,522 screens in the US, and 202 theatres and 1,455 screens in 15 countries throughout South and Central America.

For the second quarter of 2020, Cinemark swung to a loss of $170.4 million from a profit of $101.8 million in the prior-year quarter. Revenue plunged to $9 million from $957.8 million in the year-ago period.

Reopening of theatres

As major US markets, mainly New York, remained closed and without guidance on reopening timing, studios have been reluctant to release their pipeline of new films. In late August, Cinemark reopened its theatres with less audience.

Also read: Is AMC Entertainment (AMC) a buy after reopening of theatres?

During the second quarter earnings call, CEO Mark Zoradi projected that back half of the year will have significant titles including Wonder Woman 1984, James Bond franchise’s No Time to Die, Pixar’s Soul, Black Widow, Dune and West Side Story from Steven Spielberg. With many of these movies getting postponed, theatres will not have the blockbuster releases this year to pull the crowd.

Headwinds to continue

Managing the operating costs, preserving the liquidity, providing safety measures to customers and employees, and the inability to reopen the screens will continue to affect the performance of theatrical chains. As of now, Cinemark and its rival AMC Entertainment have not announced about suspending their theatrical operations. Cinemark announced in the Q2 earnings call that it had significant reductions in the workforce and payroll through layoffs, furloughs and temporary salary reductions.

As of July 31, 2020, Cinemark had a cash balance of $525 million. Based on its current liquidity position, Cinemark projected that its cash runway will extend well into 2021, if theaters remain closed. Cinemark anticipates 2021 to be a transition year and things to get normalized in 2022. Theatrical chains will continue to monitor the situation closely and will decide on either suspending or reopening of their theatres depending on the situation.