The company has an impressive track record when it comes to giving positive surprise to investors, with earnings regularly topping expectations. Bringing cheer to the shareholders, the diversification initiatives to transform Cisco from a hardware maker into a multifaceted tech firm have yielded results so far.

The company has an impressive track record when it comes to giving positive surprise to investors, with earnings regularly topping expectations

As part of its efforts to strengthen the applications and security segments, the company recently acquired Duo Security and Luxtera. The recent initiatives were also marked by a slew of collaborations with other tech firms, mainly in the network infrastructure and security sectors.

The tech giant’s revamped hardware portfolio, with a focus on 5G technology, will be a key growth driver going forward. While the recent launch of new switches and access points gives it a competitive advantage, a new networking standard that is expected to be rolled out in the coming years will ensure that the trend is maintained in the longer term.

Cisco has remained largely resilient to the disruptions caused by the tariffs imposed by President Trump on imports from China, where the company runs facilities that manufacture some of its main products. However, with the uncertainty surrounding the trade dispute deepening, especially after the new round of tariffs, Cisco might face challenges from the changing scenario in the future.

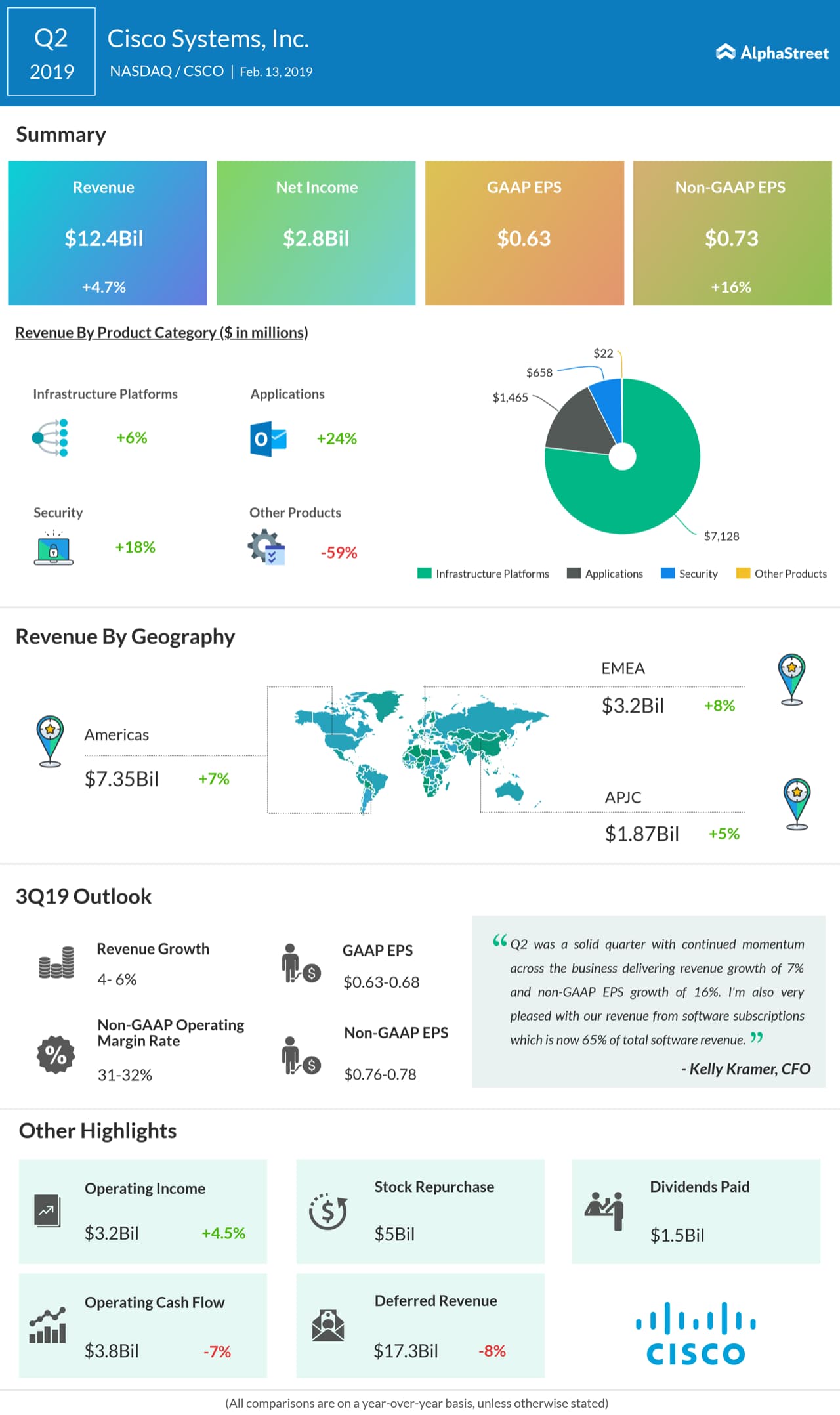

In the second quarter, strong demand growth across the key business segments lifted revenues by 5% to $12.4 billion. Consequently, adjusted earnings moved up 16% annually to $0.73 per share. Both earnings and revenue topped the Street view.

Shares of Cisco have been trading at an 18-year high since the early weeks of the year and hit a new peak of $56.88 last month, but lost momentum since then. The stock’s value more than doubled in the past five years, and it gained 23% since last year.