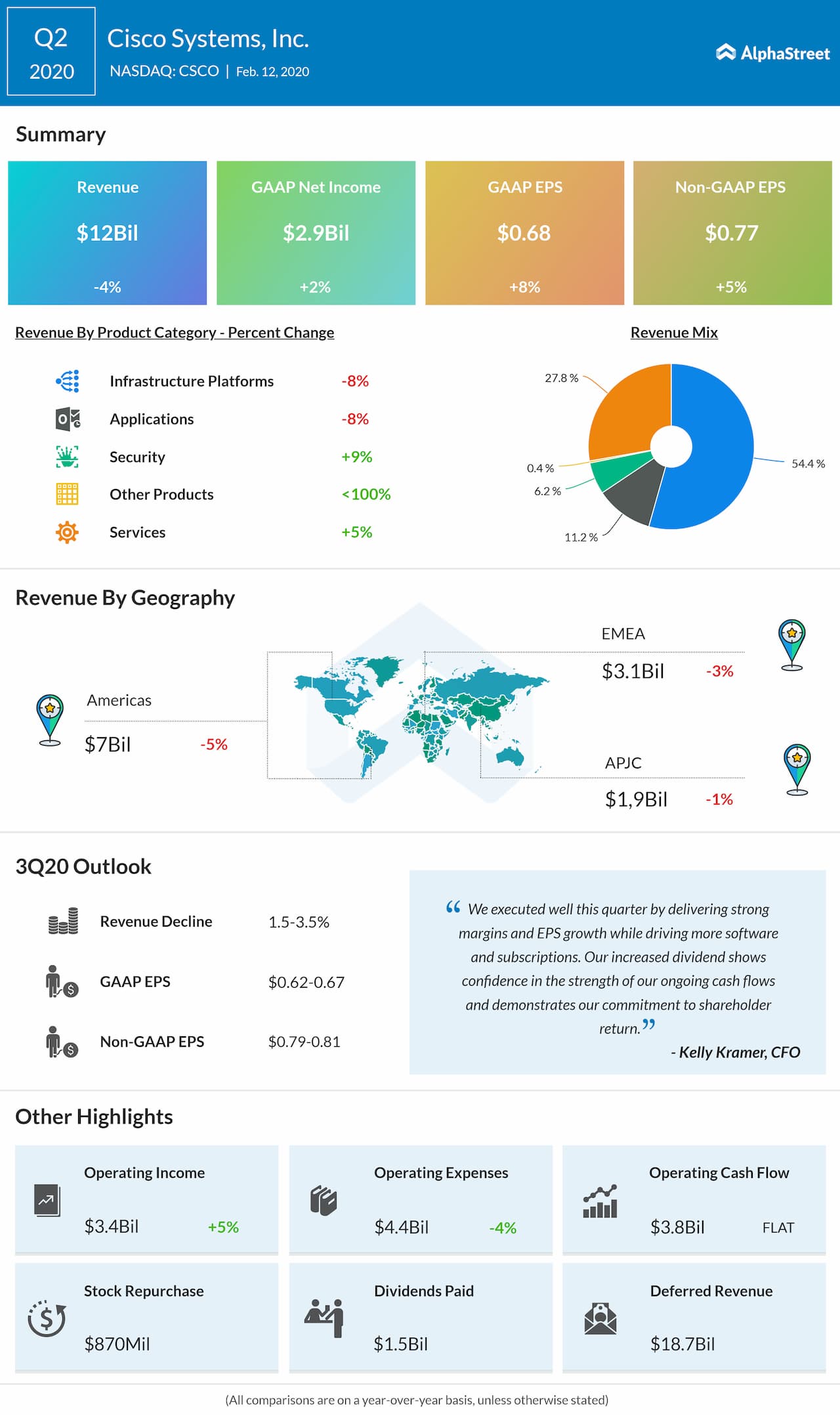

The top line was hurt by lower product revenue, which partially offset higher service revenue. A decline in the infrastructure platforms and applications overshadowed the security growth in the product revenue. Geography-wise, the company experienced a decline in all the regions.

Looking ahead into the third quarter, the company expects revenue to decline by 1.5-3.5% year-over-year and adjusted earnings in the range of $0.79-0.81 per share. The consensus estimates EPS of $0.80.

The company has declared a quarterly dividend of $0.36 per common share, up 3% over the previous quarter. The dividend is payable on April 22, 2020, to all shareholders of record on April 3, 2020. The increased dividend shows confidence in the strength of the company’s ongoing cash flows and commitment to shareholder return.

Cisco has been managing to transform itself into a networking service provider from a hardware company as the future lies in software as a subscription. The company believes this transformation could turn the tables around and achieve better returns.

During the second quarter, the company managed to return $2.4 billion to shareholders through share buybacks and dividends. There remained $11.8 billion authorized for stock buyback under the current stock repurchase program with no termination date.