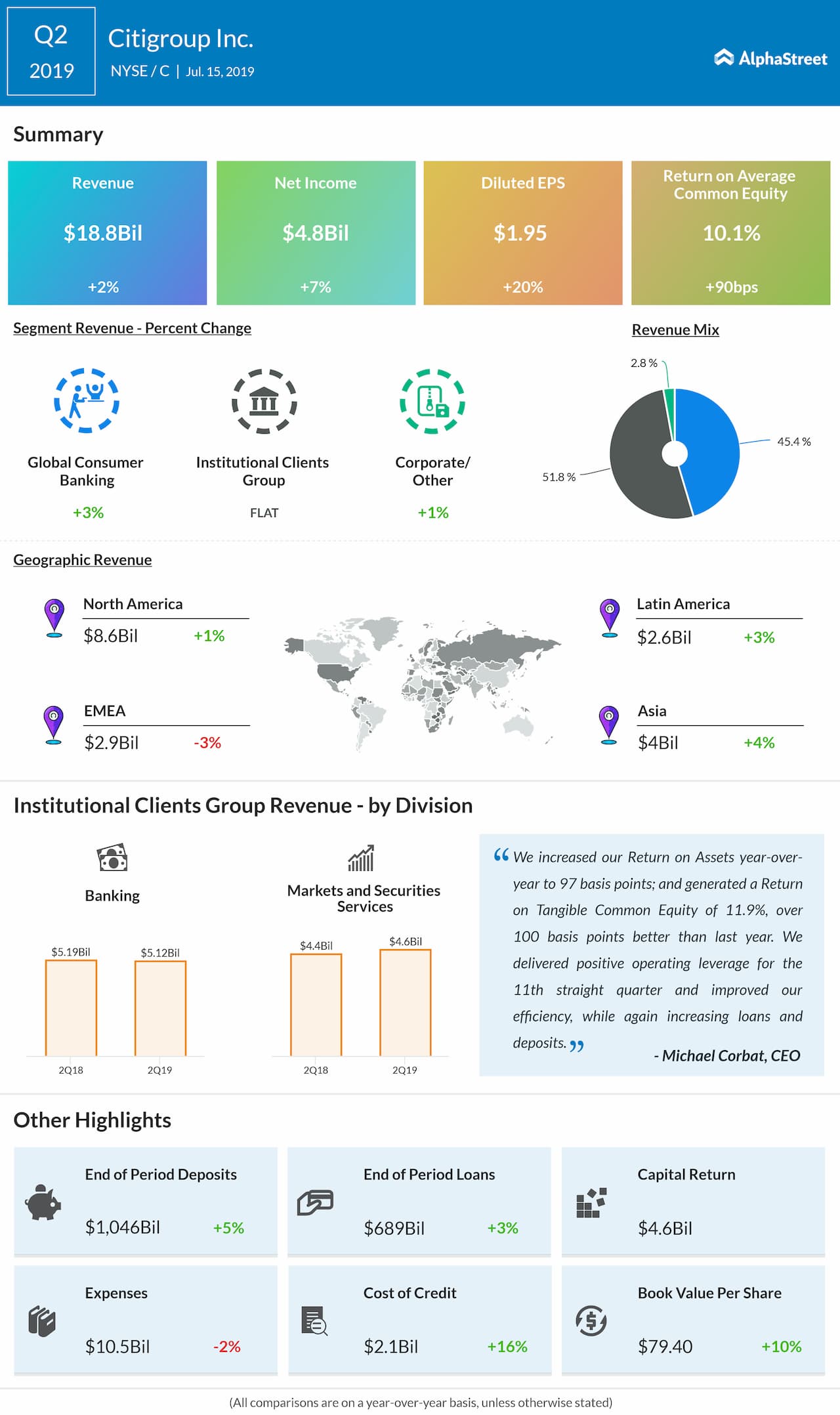

Citigroup Inc. (NYSE: C) topped market estimates on revenue and earnings for the second quarter of 2019. Analysts had forecast earnings of $1.81 per share on revenues of $18.4 billion. After climbing in premarket hours, the stock fell by 1.3% in morning trade on Monday.

Total revenues of $18.8 billion were up 2% from the same period last year, reflecting a pretax gain of approx. $350 million on Citi’s investment in Tradeweb as well as higher revenues in the Global Consumer Banking division.

On a GAAP basis, net income rose 7% year-over-year to $4.8 billion,

helped by higher revenues, lower expenses and a lower effective tax rate while EPS

grew 20% to $1.95. Adjusted EPS rose 12% to $1.83, driven mainly by a 10%

reduction in average diluted shares outstanding and the lower effective tax

rate.

Allowance for loan losses was $12.5 billion, or 1.82% of total

loans at quarter-end compared to $12.1 billion, or 1.81% of total loans last

year.

During the quarter, revenues in the Global Consumer Banking (GCB) division

increased 3% on a reported basis and 4% in constant dollars to $8.5 billion,

driven by growth across all geographic regions.

In Institutional Clients Group (ICG), revenues totaled $9.7 billion, relatively flat versus the prior-year period, as the Tradeweb gain and growth in Treasury and Trade Solutions revenues offset revenue declines in Investment Banking, Fixed Income Markets and Equity Markets.

Corporate/Other revenues grew 1% to $532

million, as higher treasury revenues and gains were largely offset by the

wind-down of legacy assets.

End-of-period loans increased 3% to $689 billion from last year

both on a reported and constant dollar basis. The constant-dollar increase was

driven by a 4% aggregate growth in the ICG and GCB segments.

End-of-period deposits were $1 trillion as of quarter-end, up 5% versus the prior-year period on both a reported and constant dollar basis. The constant-dollar growth was aided by a 6% increase in ICG and a 3% growth in GCB.

Citigroup’s peers JP Morgan (NYSE: JPM) and Wells Fargo (NYSE: WFC) will be publishing results for their most recent quarter on Tuesday while Bank of America (NYSE: BAC) is set to release its second-quarter report on July 17.