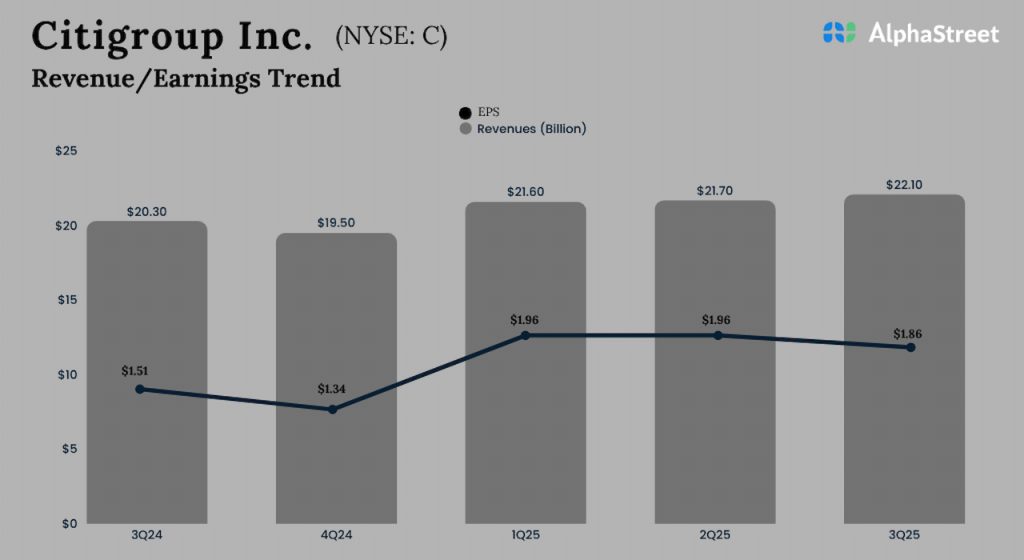

Net income was $3.8 billion or $1.86 per diluted share in the third quarter, compared to $3.2 billion or $1.51 per share in the year-ago quarter. The bottom line exceeded analysts’ expectations. Third-quarter revenues rose to $22.1 billion from $20.2 billion in the prior year quarter and beat estimates.

The bank’s end-of-period loans were $734 billion, up 7% compared to the prior-year period, aided by higher loans in Markets, Services, and Branded Cards.

“The relentless execution of our strategy is delivering stronger business performance quarter after quarter and improving our returns. The cumulative effect of what we have done over the past years – our transformation, our refreshed strategy, our simplification – have put Citi in a materially different place in terms of our ability to compete,” Citigroup’s CEO Jane Fraser said.