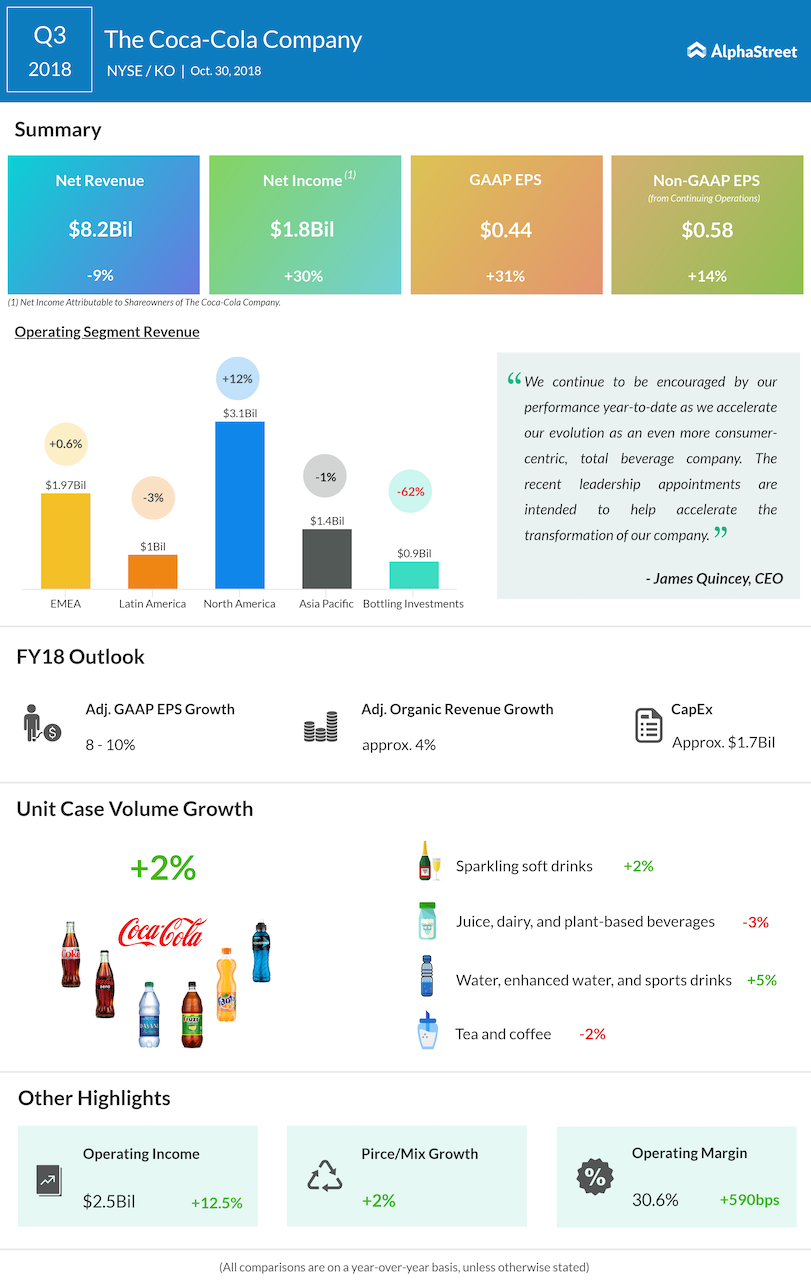

Net operating revenues fell 9% to $8.25 billion. The top line was hurt by a 13 points headwind from the refranchising of company-owned bottling operations. Organic revenue increased 6% on concentrate sales growth of 4% that benefited from the timing of shipments and price/mix growth of 2%.

Unit case volume grew 2%, led by Trademark Coca-Cola. The company continued to gain value share in total nonalcoholic ready-to-drink (NARTD) beverages. Price/mix rose 2% for the quarter led by solid performance in the core business. Concentrate sales increased 2 points ahead of unit case volume largely due to the timing of shipments within Latin America.

Sparkling soft drinks rose 2% on Trademark Coca-Cola along with strong growth in the low- and no-calorie offerings of Sprite and Fanta. Water, enhanced water and sports drinks increased 5% on strong growth of water in single-serve packaging in China and Mexico along with the premium offerings in North America.

Juice, dairy, and plant-based beverages fell 3% as challenging macroeconomic environment hurt the Middle East and North Africa as well as package downsizing in North America impacted the results. Tea and coffee declined 2% due to a decline in its local tea brand in Turkey and the impact of Nestea resulting from the dissolution of Beverage Partners Worldwide.

Coca-Cola also announced several strategic actions, including a number of acquisitions and investments, and continued to lift, shift and scale brands around the world. The company’s disciplined growth strategies and an ongoing focus on productivity led to double-digit profit growth for the quarter.

Looking ahead into the full year 2018, the company still expects organic revenues to increase at least 4% and comparable currency neutral operating income growth of at least 9%. Capital expenditures are still anticipated to be about $1.7 billion and cash from operations are predicted to be about $8 billion. Comparable EPS from continuing operations are projected to increase in the range of 8% to 10% from $1.91 in 2017.

Shares of Coca-Cola ended Monday’s regular session up 1.18% at $46.46 on the NYSE. The stock has risen over 1% in the year so far and 0.85% in the past year.