Bolder is a private firm that offers revenue cycle management solutions to hospitals and specialty care providers. Through this transaction, which is expected to close in the second quarter of the year, Cognizant plans to expand its services to more hospitals and healthcare providers.

Bolder acquisition will create value for all the shareholders, as a report from Zion Market Research indicated, the global revenue cycle management is expected to grow to around $43.80 billion by 2022 from $23.40 billion in 2016. Also, a major chunk of the market share is expected to come from North America, which poses an enormous advantage for Cognizant as over 70% of its revenue is derived from this region.

IT-services major Cognizant is now expanding its reach into the healthcare sector with its intention to acquire Bolder Healthcare Solutions.

Cognizant derives most of its revenue from two industries: Financial services and healthcare business. Over the past few years, Cognizant has been pretty serious with its healthcare business, as it accounts for almost 30% of the company’s total revenue. In the latest fourth quarter, the company reported 12% growth in its revenue from healthcare business.

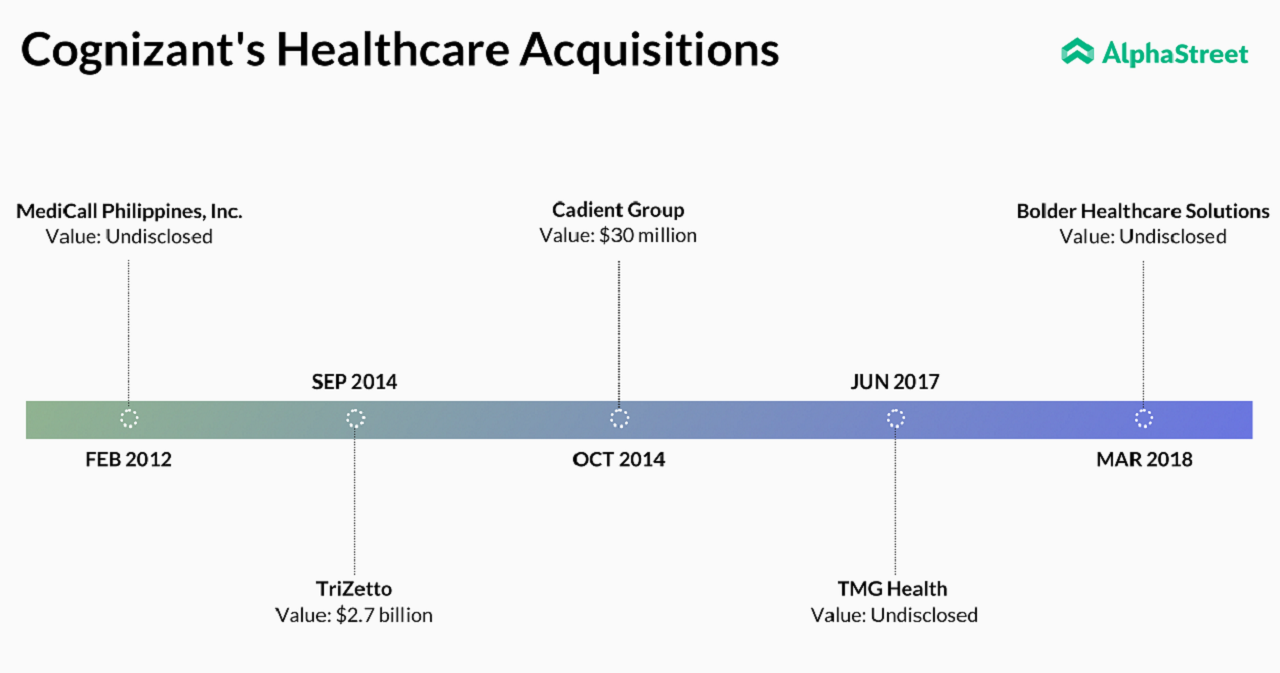

Cognizant’s largest healthcare deal occurred in 2014 when the company purchased TriZetto for $2.7 billion, which was followed by the acquisition of TMG Health.