Colgate, which ]makes products ranging from toothpaste to pet food, reported profit margins of 60.2% when compared to 60.3% during first quarter of 2017.

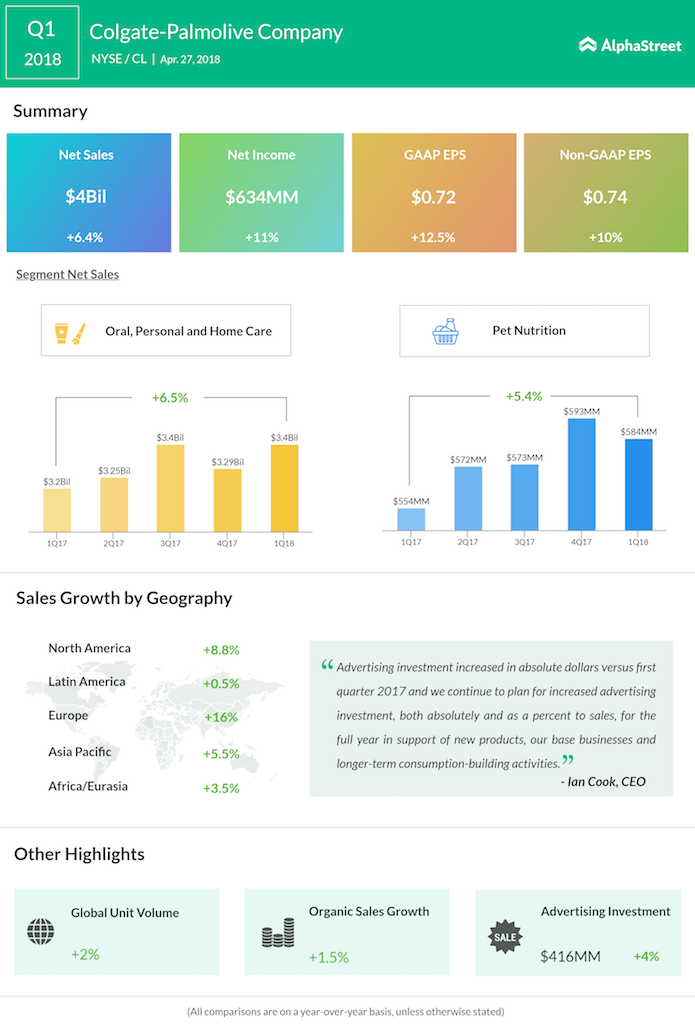

During the quarter, the slowdown was in Latin America that accounts for 23% of the company’s total sales. Net sales in Latin America fell 0.5% though it maintained its toothpaste leadership in this region. Organic sales in Latin America inched up 0.5%.

On the other hand, North America, which makes up for 21% of the company’s total sales, performed well during the quarter. It reported a 9% growth in sales, while organic sales jumped 5%.

Similar to other consumer product company, even Colgate struggles with sluggish growth in key markets due to a shift in consumers taste. According to analysts, Colgate is losing the battle to more health conscious and eco-friendly companies.