At the time of its Q4 earnings report, Conagra said that food companies, in general, were seeing a lag in volume recovery which seemed to be due to consumers buying fewer items. Although this trend is likely to be temporary, the company still considers it as a headwind for the near term. Another headwind for the Slim Jim owner is deflation in certain single ingredient brands. CAG also expects the reduction of pension income and decline in contribution from Ardent Mills to impact its earnings performance in FY2024.

Sales and profit expectations

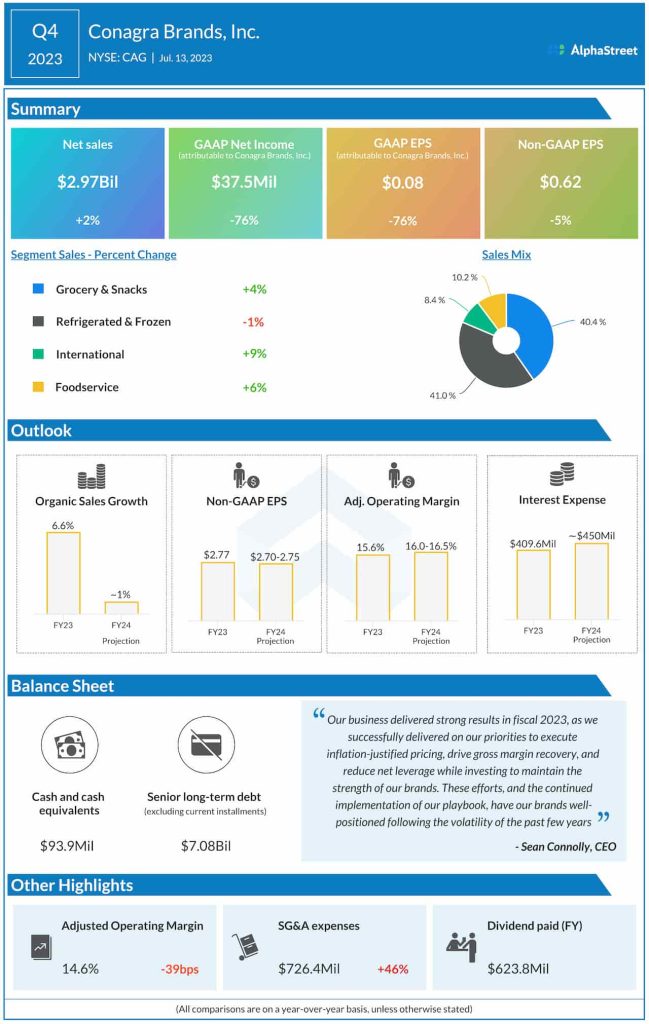

Conagra expects organic sales in fiscal year 2024 to grow approx. 1% compared to fiscal year 2023. Adjusted operating margin is expected to be 16.0-16.5% and adjusted EPS is expected to range between $2.70-2.75.

The company expects improvement in adjusted gross profit to be offset by impacts from higher investments, higher interest expense, and an adjusted tax rate of around 24%. Lower income from the Ardent Mills joint venture along with lower pension income due to higher interest rates are expected to offset growth in underlying business operations. In FY2024, CAG expects a lower income contribution from Ardent Mills of approx. $150 million.

Conagra expects net cost of goods sold inflation of approx. 3% in FY2024. Capex is expected to be around $500 million while gross productivity savings are estimated to reach approx. $300 million during the year.