“

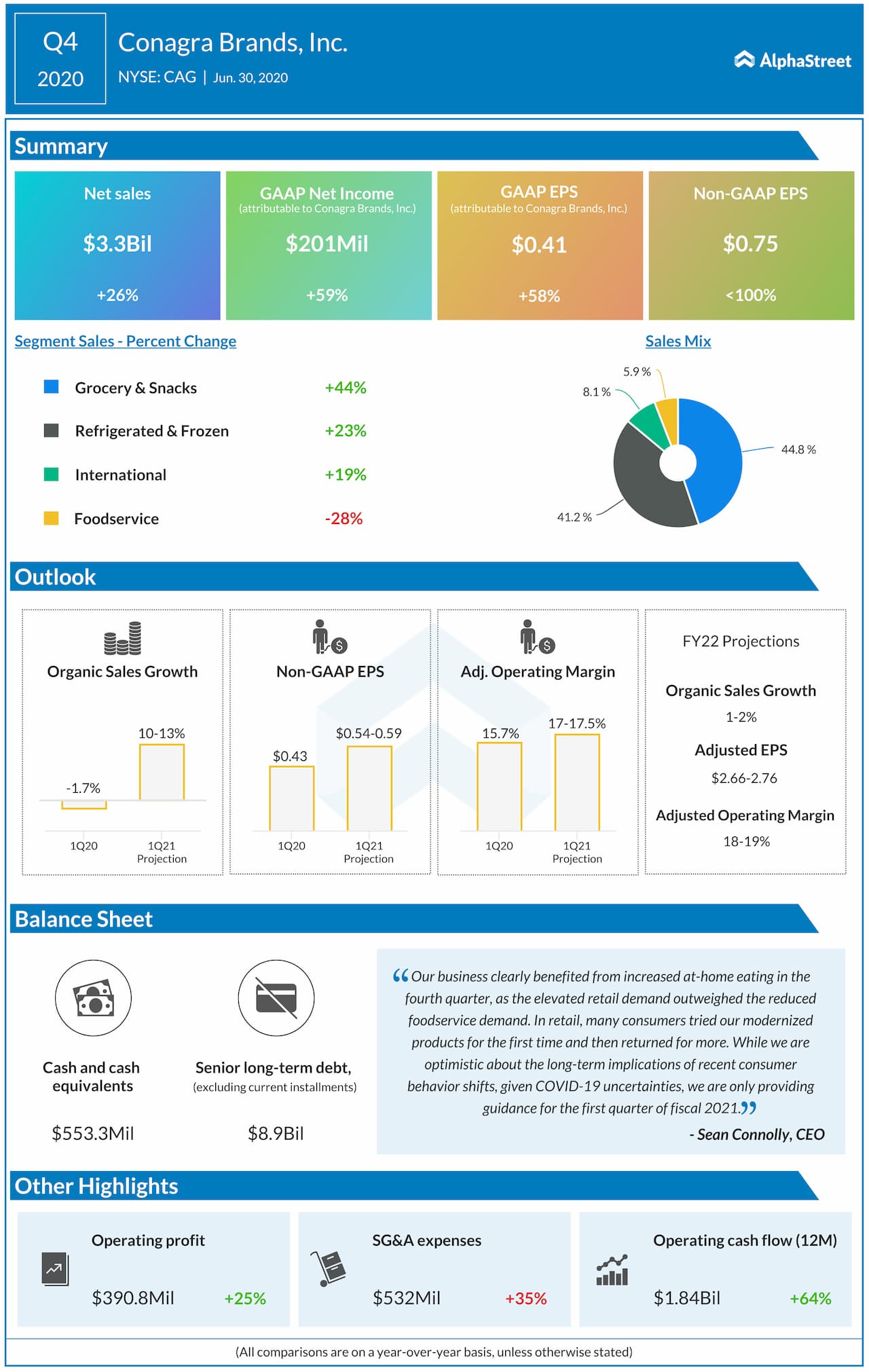

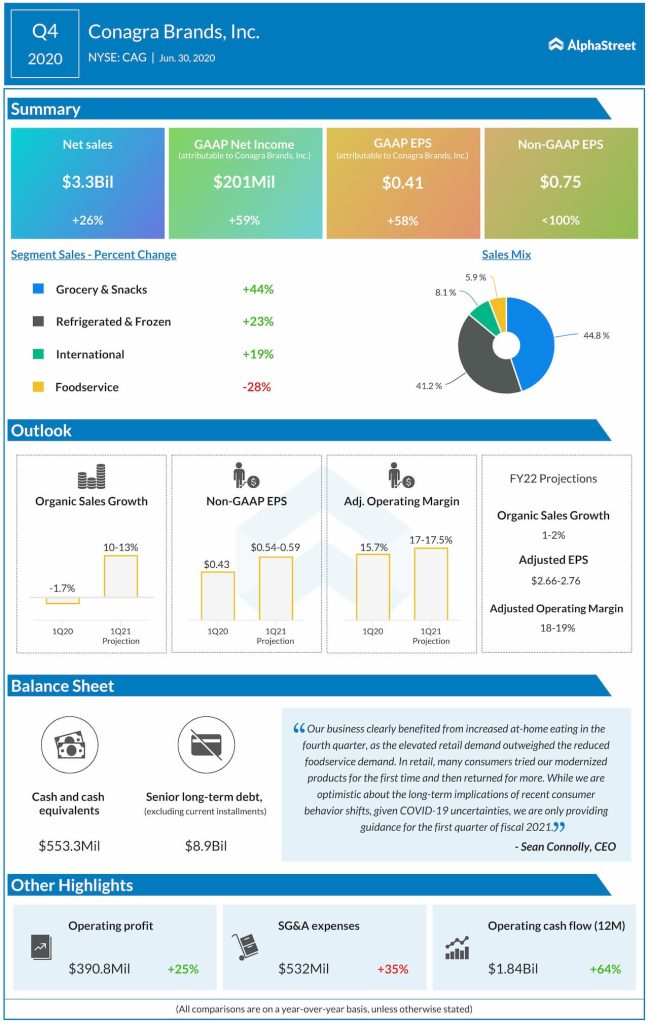

Conagra Brands Inc. (NYSE: CAG) reported a 58% jump in earnings for the fourth quarter of 2020 as strong e-commerce growth, significant consumer trial, and solid repeat sales, and the initial launches of its fiscal 2021 innovation slate drove the top-line higher. The results exceeded analysts’ expectations. During the quarter, the company experienced elevated demand, […]

· June 30, 2020

Conagra Brands Inc. (NYSE: CAG) reported a 58% jump in earnings for the fourth quarter of 2020 as strong e-commerce growth, significant consumer trial, and solid repeat sales, and the initial launches of its fiscal 2021 innovation slate drove the top-line higher. The results exceeded analysts’ expectations.

During the quarter, the company experienced elevated demand, which continued to make good progress on improving the overall business. Conagra’s business benefited from increased at-home eating in the fourth quarter as the elevated retail demand outweighed the reduced foodservice demand.