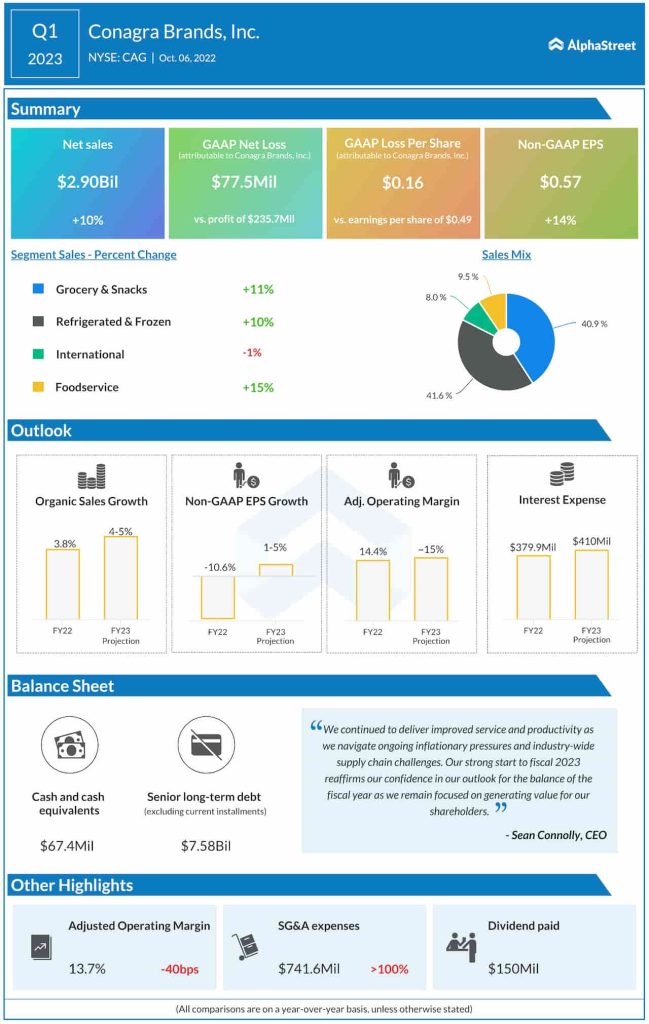

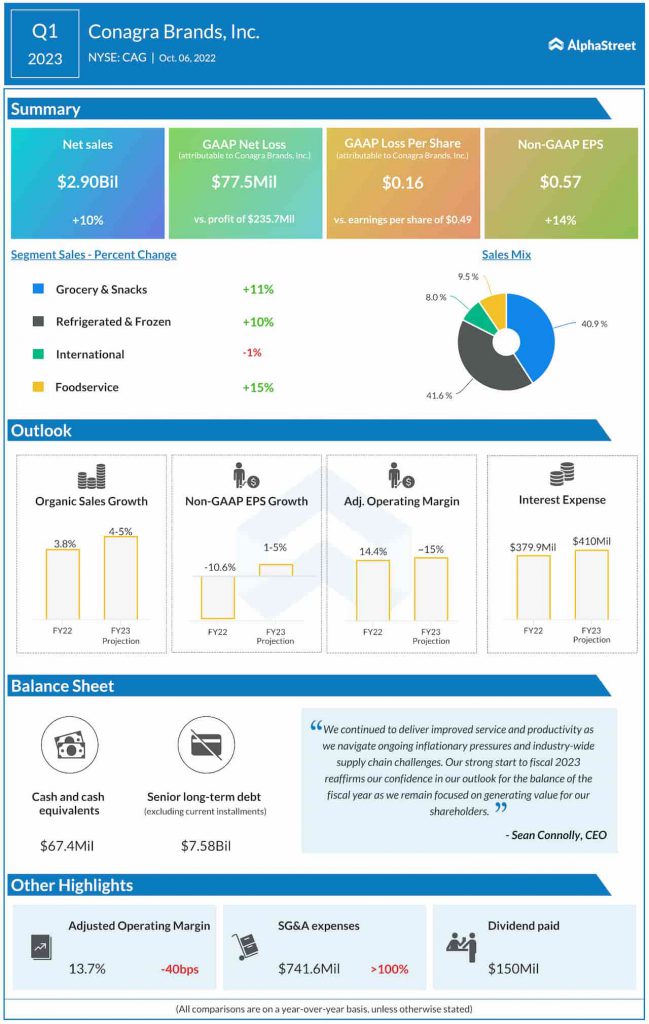

Better-than-expected numbers

Category performance

Conagra recorded sales growth across most of its segments during the first quarter helped by pricing. However, volumes declined as a result of the price increases. Total retail sales grew 9% YoY in Q1 and the company continued to gain market share with the strongest gains in the Frozen and Snacks categories.

Retail sales in the Frozen category grew 8% YoY, with solid gains from plant-based protein, breakfast sausages, and single-serve meals. Breakfast sausages witnessed the highest growth at 19.5% followed by plant-based protein at 13.2%. Single-serve meals increased over 11% indicating customers’ preference for convenient options.

Retail sales for Snacks increased 13%, with the highest growth coming from microwave popcorn that increased 21.7%. This was followed by meat snacks which were up nearly 16% in the quarter. The Staples category saw retail sales growth of 8%, driven by single-serve dinners and entrees, toppings, pickles and canned tomatoes.

Outlook

Conagra expects supply chain headwinds to continue as the operating environment remains volatile. These disruptions, along with recent pricing actions, are expected to impact volumes during the second quarter of 2023. The company expects gross inflation to continue but moderate through the remainder of the fiscal year.

For FY2023, organic net sales are expected to grow 4-5% while adjusted EPS is estimated to increase 1-5% compared to last year. Adjusted operating margin is expected to be approx. 15%. Capex is expected to be approx. $500 million.

Click here to read the full transcript of Conagra Brands’ Q1 2023 earnings conference call