Conagra Brands Inc. (CAG) missed market expectations on revenue and earnings for the first quarter of 2019 and provided a weak outlook, sending shares falling over 8% during premarket hours on Thursday. The stock is currently down over 5%.

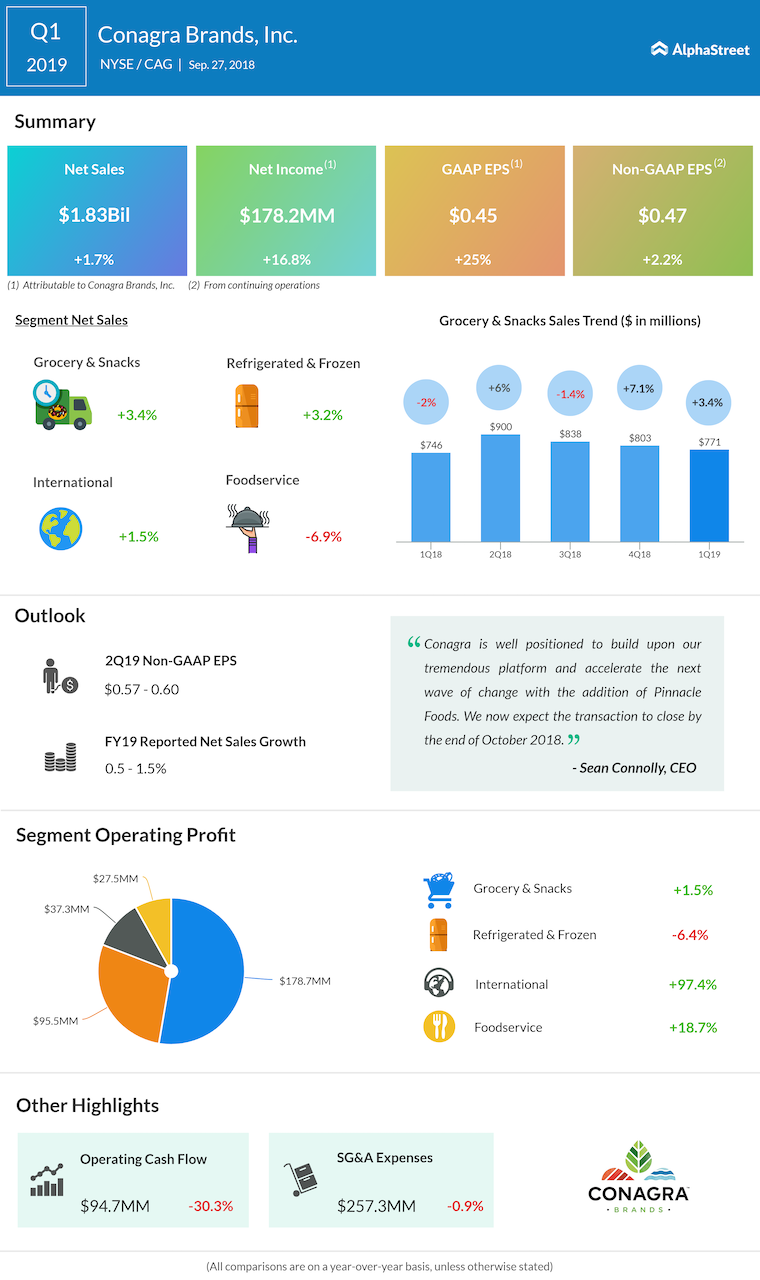

The branded foods company reported a 1.7% increase in sales to $1.83 billion versus last year, helped by the acquisitions of Angie’s BOOMCHICKAPOP and Sandwich Bros. of Wisconsin. The sales of the Missouri production facility and the Canadian Del Monte business impacted net sales growth by 120 basis points. Organic net sales, excluding Trenton, rose 1.2%.

Net income increased 16.8% to $178.2 million and diluted EPS increased 25% to $0.45 per share from the prior-year period. Adjusted diluted EPS from continuing operations grew 2.2% to $0.47.

Conagra posted sales increases across all its segments, barring Foodservice which saw a decline of 6.9%. In July, the company sold its Canadian Del Monte processed fruit and vegetable business to Bonduelle Group and it expects the Pinnacle Foods acquisition to close by the end of October.

For full-year 2019, Conagra expects reported net sales growth of 0.5% to 1.5% with organic net sales growth, excluding Trenton, in the range of 1% to 2%.

For the second quarter of 2019, organic net sales growth, ex Trenton, is anticipated to be flat to slightly down from last year while reported net sales growth is expected to be about 40 basis points lower than the organic net sales growth rate. The company expects adjusted diluted EPS of $0.57 to $0.60.