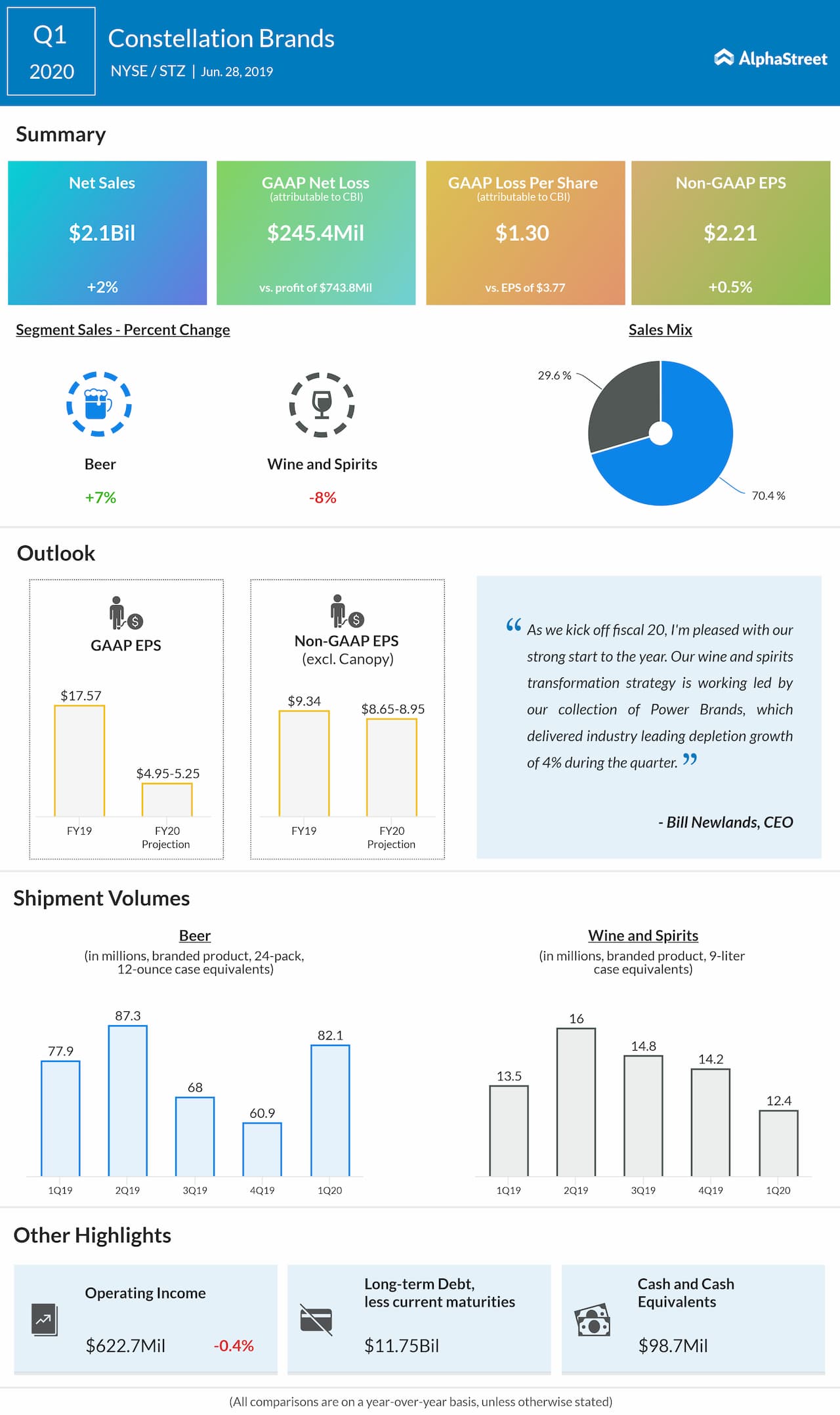

Net sales moved up 2% to $2.1 billion. The company experienced strong portfolio depletion performance backed by Modelo Especial, which achieved the top share gainer spot for the entire US beer category with depletion growth of more than 17%.

Looking ahead into fiscal 2020, the company lowered basis earnings guidance to the range of $4.95 to $5.25 per share from the previous estimate range of $8.47 to $8.77 per share. However, the comparable basis earnings outlook is lifted to the range of $8.65 to $8.95 per share from the prior range of $8.50 to $8.80 per share. The comparable EPS includes the impact of wine and spirits divestiture but excludes Canopy Growth equity earnings, share repurchases and gain or loss on the wine and spirits transaction.

For fiscal 2020, the company now predicts the operating cash flow of about $2.1 billion and free cash flow in the range of $1.2 billion to $1.3 billion. The outlook was revised upward due to the revised timing for the Wine and Spirits transaction.

The company now expects beer net sales growth of 7% to 9%, and sales from wine and spirits to decline by 20% to 25%. Capital expenditures are anticipated to be $800 million to $900 million, including about $600 million targeted for Mexico beer operations expansion activities.

Also read: Canopy Growth Q4 earnings

For the first quarter, beer sales grew by 7.4% as Modelo Especial achieved the top share gainer spot for the entire US beer category and Corona Premier was a top 10 US beer market share gainer. Wine and spirits sales fell by 7.8% as the wine and spirits business transformation strategy is working, led by the Power Brands in the portfolio.

Canopy Growth equity earnings for the first quarter totaled a loss of $106 million on a reported basis and $54.4 million on a comparable basis. Canopy Growth and Acreage Holdings shareholders approved Canopy Growth’s proposed acquisition of Acreage Holdings, which positions Canopy to enter the US cannabis market once federally permissible. The transaction also results in the extended duration of Canopy Growth warrants held by Constellation, which is expected to result in a material gain during the second quarter fiscal 2020.

On June 27, Constellation’s board of directors declared a quarterly cash dividend of $0.75 per share of Class A common stock and $0.68 per share of class B common stock. The dividends are payable on August 27, 2019, to stockholders of record as on August 13, 2019.

Following the earnings, the stock advanced over 7% in the premarket session.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.