Estimates

When the company reports August-quarter results, Wall Street will be looking for a net income of $4.09 per share, representing an 11% year-over-year increase. The consensus sales estimate for the second quarter is $2.9 billion, compared to $2.84 billion in the same period last year. Interestingly, Constellation Brands has delivered better-than-expected quarterly earnings consistently for over a year.

The company has a good track record of innovating the business with a focus on aligning the portfolio with changing customer preferences. Of late, there has been a steady increase in beer shipments, reflecting the shift in people’s consumption behavior. That, combined with higher pricing, translated into a surge in the company’s earnings in recent quarters. Healthy cash flows enable it to effectively deploy capital and execute growth initiatives like international expansion and acquisition of new businesses.

Top Brewer

The broad portfolio and powerful brands give Constellation a clear edge over other alcohol companies. Earlier this year, the company acquired California-based winery Sea Smoke as part of boosting its higher-end wine portfolio. The deal is significant considering the ongoing consumer-led premiumization trends through its higher-end wine and spirit brands. The company is working to advance the wine and spirits business over the coming years but sees a 9-11% drop in operating margin for that business in the current fiscal year.

From Constellation Brands’ Q1 2025 earnings call:

“The tactical investments in the 11 brands that represent 75% of net sales and over 80% of volumes for our wine and spirits business in fiscal ’24 are now underway. And, we expect to see improvements in the select group of our most scaled offerings over the remainder of the year, ultimately underpinning the relatively stable net sales outlook for that business in fiscal ’25. However, these incremental investments did have a near-term impact on the operating income, which declined 25% in the first quarter.”

Q1 Outcome

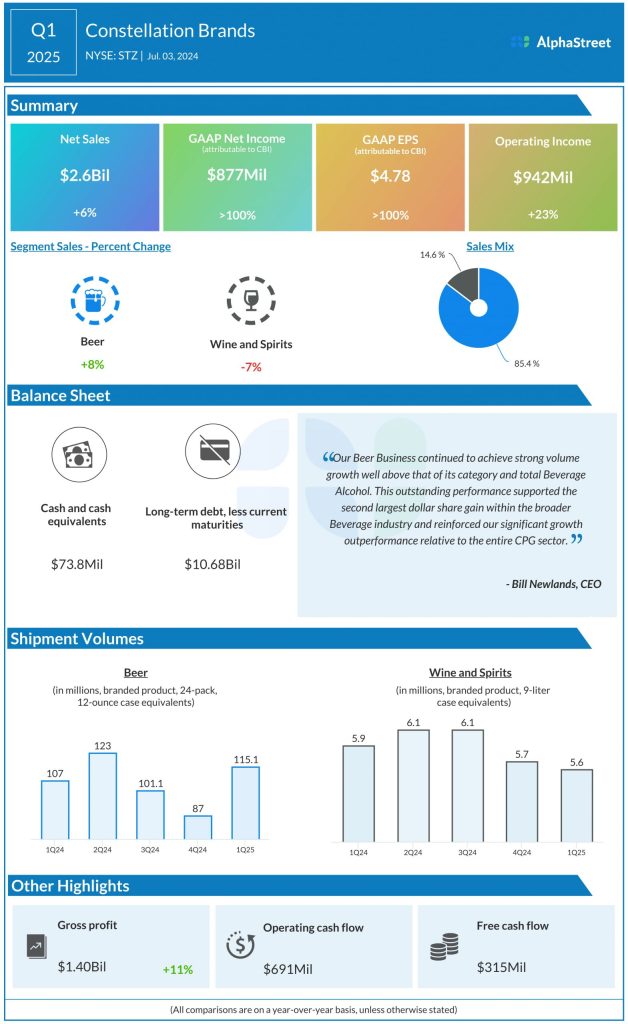

In the first three months of fiscal 2025, sales rose 6% annually to $2.6 billion and came in line with estimates. An 8% increase in beer sales more than offset weakness in wine and spirits sales. Net income more than doubled year-over-year to $877 million or $4.78 per share during the three months.

This week, Constellation Brands’ stock mostly traded above its long-term average, gaining momentum ahead of the earnings. It traded higher on Friday afternoon, after opening the session around $255.