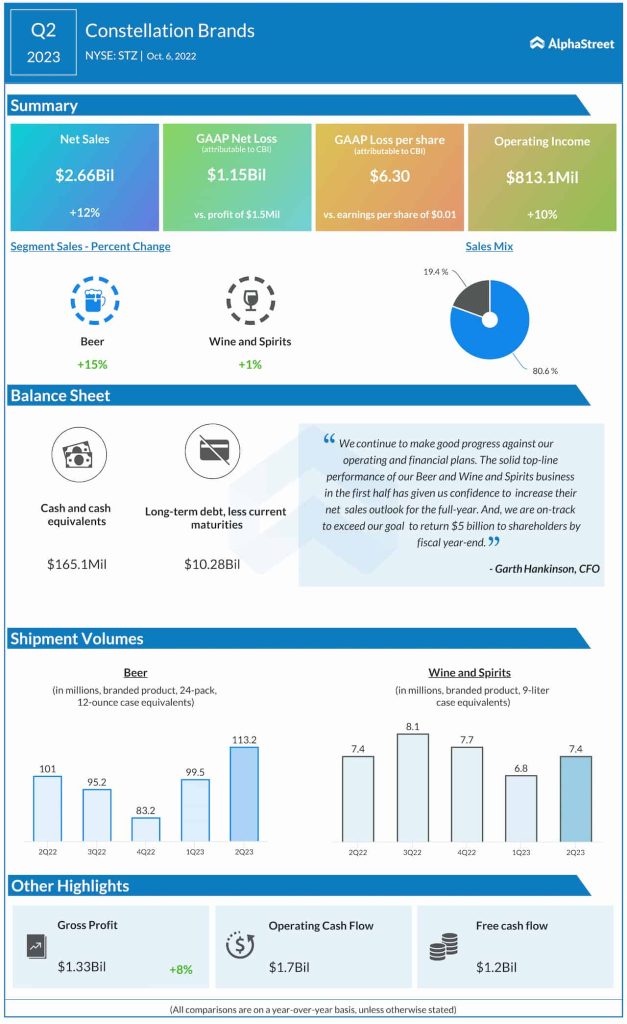

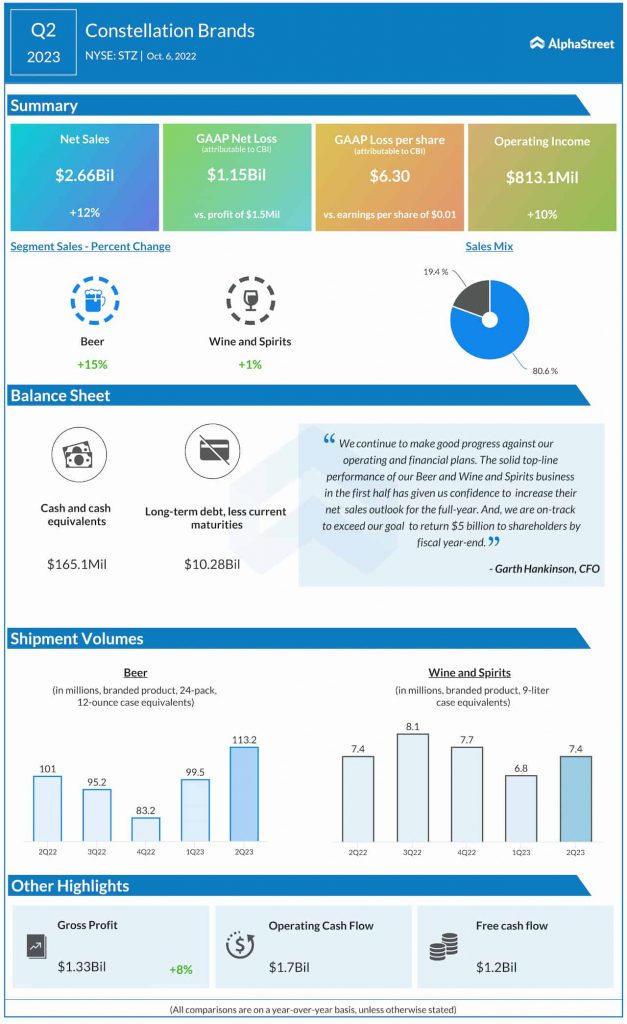

Revenue and profitability

Strong performance in beer

Constellation witnessed strong performance in its beer business, driven by solid demand for its brands. In Q2, the beer business posted depletion growth of 9%, driven by strength in Modelo Especial and Corona Extra. Modelo Especial garnered the maximum share in the entire US beer category with depletion growth of over 10%. Corona Extra delivered depletion growth of 6%. The Modelo Chelada brands delivered depletion growth of over 60% in Q2.

The strong demand for its brands helped drive a 15% growth in net sales for the beer business in Q2. Operating income for the division gained 25% in the quarter. This momentum led Constellation to increase its guidance for the beer business. The company now expects net sales to grow 8-10% and operating income to grow 3-5% in FY2023.

Wine and spirits portfolio transformation

In Q2, net sales for the wine and spirits business inched up just 1% to $515.8 million, driven by an increase in bulk sales and favorable pricing. However, depletion growth was solid for its premium wine brands like Kim Crawford, Robert Mondavi and Meiomi.

The company’s efforts in revamping its wine and spirits portfolio is paying off. It has been moving from the mainstream segment and focusing more on the higher end of the market. In Q2, its largest premium and fine wine brands and craft spirits brands delivered strong depletion growth rates. As part of its strategy to premiumize its business, it divested a portion of its mainstream wine portfolio along with a couple of select premium brands to The Wine Group.

Wine and spirits DTC net sales grew 15% in Q2 while international sales grew 10%. Constellation plans to focus on the growth of its omnichannel and international footprint as it expects these channels to make up a larger portion of its mix over time and provide an important opportunity for higher-end growth.

For FY2023, wine and spirits net sales are expected to be flat to down 2% while operating income is expected to increase 3-5%. This would imply operating margin of about 24% for the year for the segment.

Click here to read the full transcript of Constellation Brands’ Q2 2023 earnings conference call