Commenting on the management’s decision to sell 100% of outstanding membership interest in the Community Specialty Pharmacy business, Suren said, “Our core business is B2B, focusing on that vs Community Specialty Pharmacy really drives new business and we can reallocate those resources to B2B. I understand you may see a revenue drop in the first two quarters but margin will be high as B2B is tech business vs Community Specialty Pharmacy has the ‘cost of goods sold’ driving margins down.

He attributed the decline in expenses in recent quarters to a cost-cutting strategy and believes that the initiative would eventually translate into profitability in a couple of quarters. When it comes to driving long-term growth, integration with POS systems would be a key focus this year, besides partnerships, according to Suren.

On being asked how the business evolved since last year, Suren said integration is the one major change the company is witnessing from 12 months ago. According to him, the strong margin growth in fiscal 2022 was the result of the strategy to move back to core tech platform sales, which has 78% gross margins.

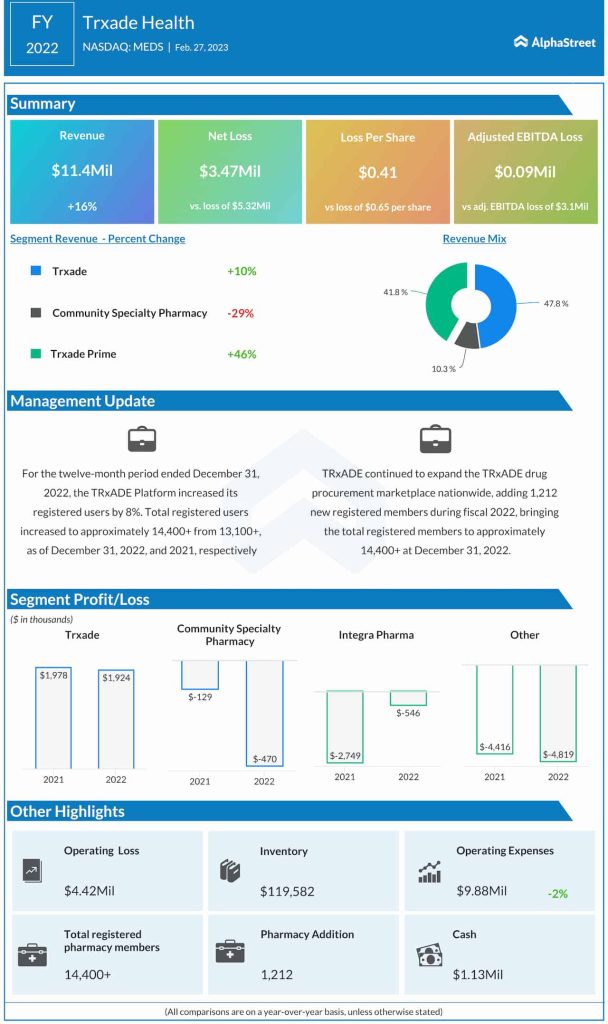

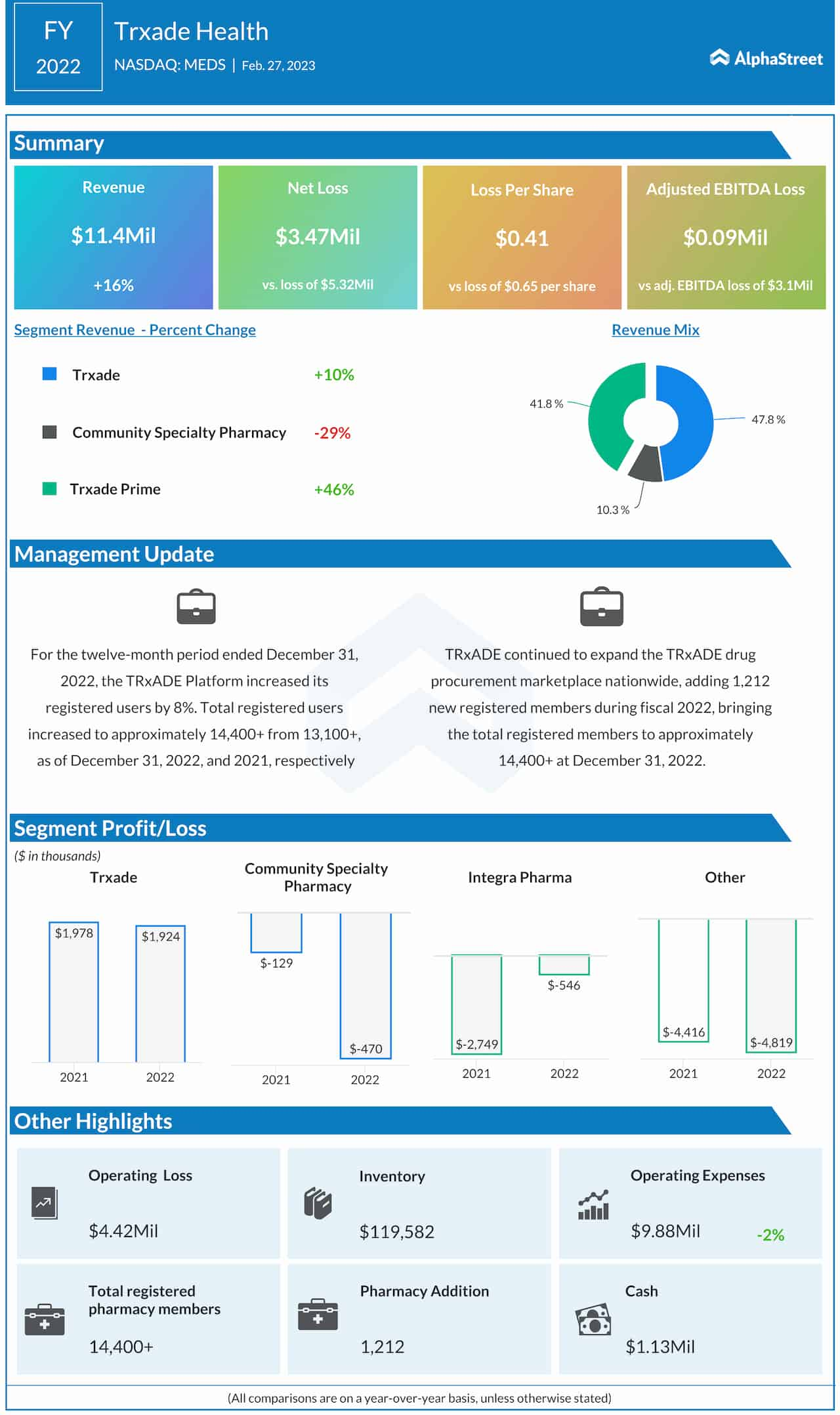

It is worth noting that total gross profit grew 15% annually in fiscal 2022, aided by a 16% increase in revenues to $11.4 million. Double-digit increase in the Trxade and Trxade Prime segments more than offset weakness in the Community Specialty Pharmacy division.

The number of registered users on the Trxade Platform increased by 8%, taking the total to more than 14,400. The company ended the year with total cash of $1.13 million. Full-year net loss narrowed to $3.47 million or $0.41 per share from $5.32 million or $0.65 per share in the prior year.

Trxade’s disruptive business model is focused on opening channels of distribution to help pharmacies and patients purchase healthcare products at reasonable prices. The company has been successful in bringing price transparency to the pharmaceutical marketplace and providing significant savings to customers. The long-term goal is to make healthcare accessible and affordable to all patients.