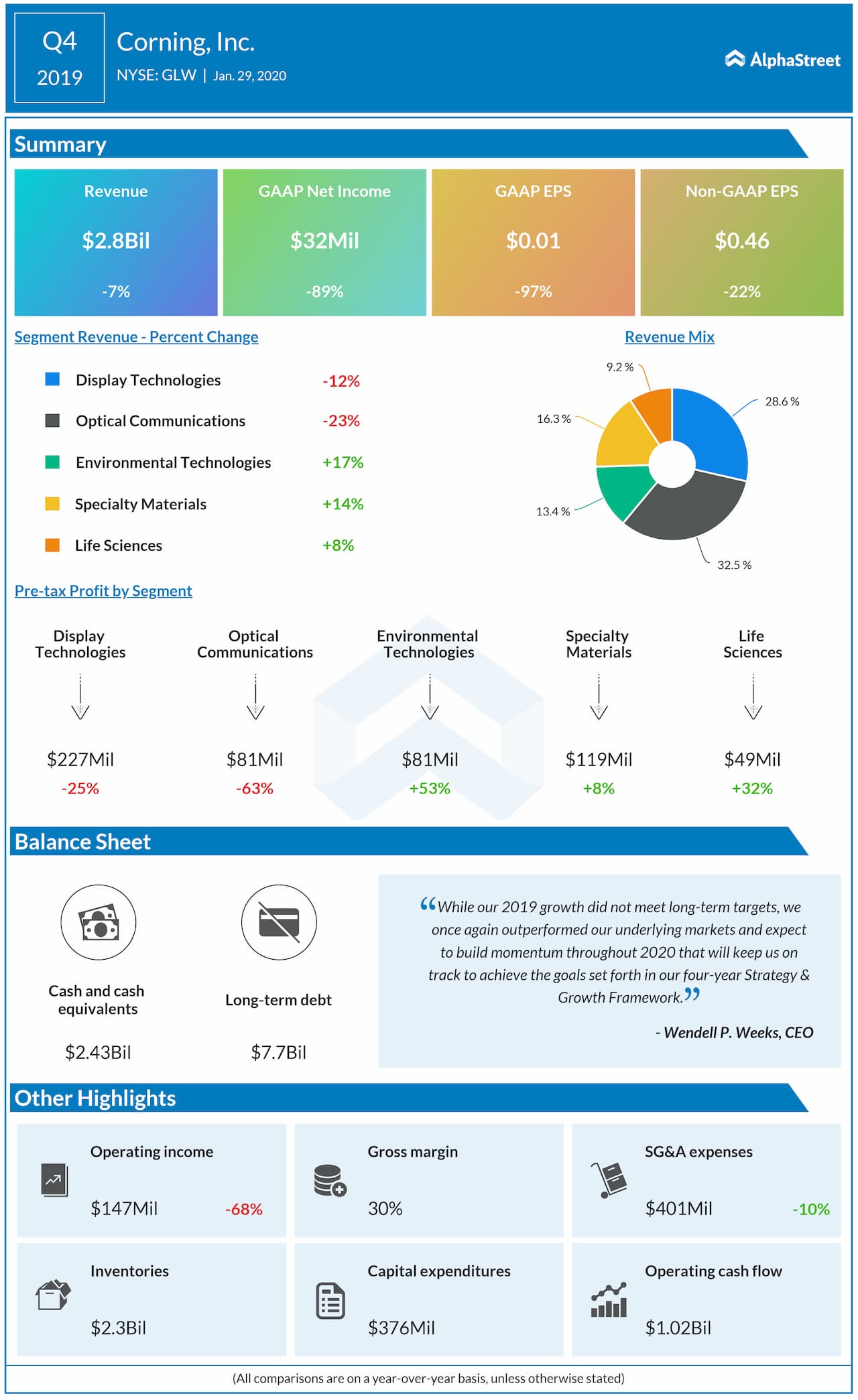

— Display Technologies sales dropped by 12% due to a decline in display glass volume and prices. Optical Communications sales fell by 23% due to lower volume and reduced production to decrease inventory.

— Environmental Technologies sales jumped by 17%. Specialty Materials sales increased by 14%. Life Sciences sales rose by 8% backed by the strength of new products for cell culture and gene therapy.

— In 2020, the company expects continued growth in Specialty Materials, Environmental Technologies, and Life Sciences.

— The company expects to return to sales and profit growth and expand margins in the second half of 2020 as the volume in Display Technologies and Optical Communications improves.

— Corning expects to add an incremental $3-4 billion in annual sales and improve profitability by the end of 2023 for delivering its strategy and growth framework goals.

— Through 2023, Corning expects to deliver 6-8% compound annual sales growth and 12-15% compound annual EPS growth while investing $10-12 billion in RD&E, capital and mergers, and acquisitions.

— Through 2023, the company plans to expand operating margin and ROIC, and deliver $8-10 billion to shareholders, including annual dividend per share increase of at least 10%.